Last updated: July 30, 2025

Introduction

NOR-QD, a sustained-release formulation of the sedative-hypnotic medication, has garnered substantial attention within the pharmaceutical landscape. As an extended-release version of the historically significant drug selegiline, marketed under the brand name Emsam, NOR-QD has been positioned to address the clinical need for improved patient adherence and therapeutic efficacy in treating depression and related disorders. This analysis explores NOR-QD's market dynamics, competitive positioning, regulatory pathway, and financial trajectory, providing valuable insights for industry stakeholders aiming to navigate this evolving sector effectively.

Market Overview and Therapeutic Context

The global antidepressant market, valued at approximately USD 15.4 billion in 2022, is projected to expand at a compound annual growth rate (CAGR) of around 4.2% through 2030 [1]. A pivotal factor shaping this growth is the increasing prevalence of major depressive disorder (MDD), estimated to affect over 264 million people worldwide, according to the World Health Organization (WHO) [2]. Patient compliance remains a persistent challenge, often compromised by dosing frequency and side effect profiles associated with existing therapies.

NOR-QD’s sustained-release formulation aims to address these issues by providing once-daily dosing, potentially enhancing adherence and minimizing adverse events. The drug's innovative delivery mechanism positions it within the niche of modified-release antidepressants, a segment expected to see accelerated growth owing to improved patient outcomes and streamlined pharmacokinetics.

Market Dynamics

Competitive Landscape

The market for antidepressant and adjunctive therapies comprises generics and branded products. Key competitors for NOR-QD include:

- Traditional monoamine oxidase inhibitors (MAOIs): Older drugs like phenelzine, which lack the extended-release formulation and pose dietary restrictions.

- Selective serotonin reuptake inhibitors (SSRIs): Such as fluoxetine, sertraline, and escitalopram, which dominate the market but do not offer extended-release options built around selegiline.

- Transdermal MAOI formulations: Emsam (selegiline transdermal system) is the closest direct competitor, with established market presence.

- Novel agents: Including atypical antidepressants and ketamine-based therapies, increasingly gaining attention.

NOR-QD’s differentiated delivery could carve a niche for patients seeking fewer side effects and improved compliance, particularly among those intolerant to existing therapies.

Regulatory Environment

The regulatory landscape influences NOR-QD's market entry and expansion. The U.S. Food and Drug Administration (FDA) approval process demands demonstration of bioequivalence, safety, and efficacy. If NOR-QD receives a novel patent or expanded indications, it could enjoy market exclusivity, fostering a strong initial sales trajectory. Conversely, if it infringes on existing patents, the company may face challenges or delays.

In regions like Europe and Asia, regulatory pathways differ, with some markets requiring additional clinical data or post-approval commitments. Strategies to navigate these processes will impact the timing and scope of market penetration.

Pricing and Reimbursement

The pricing strategy for NOR-QD balances development costs, market competition, and payer acceptance. Extended-release formulations generally command higher prices due to convenience and adherence benefits, positioning NOR-QD as a premium therapy. Reimbursement policies, particularly within the U.S. under Medicare and private insurers, will significantly influence access.

Given the cost-effectiveness associated with improved compliance and reduced hospitalization rates, payers may favor coverage, especially if supported by health economic analyses demonstrating long-term benefits.

Financial Trajectory

Revenue Projections

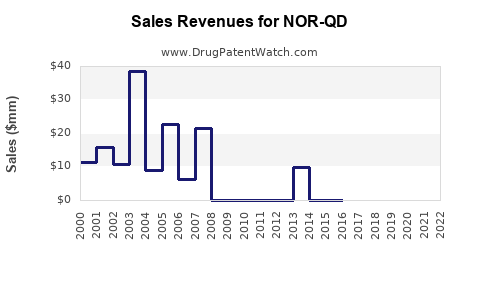

Initial sales for NOR-QD are projected to mirror those of comparable novel antidepressants. Assuming a conservative market penetration of 10-15% among eligible patients within the first 3 years, revenues could reach:

- Year 1: USD 50-100 million

- Year 3: USD 250-400 million

- Year 5: USD 600 million or more

These estimates depend on factors such as the drug’s approval expansion, clinical adoption, and payer support.

Cost Structure

Development costs include clinical trial expenses, regulatory filing, and commercialization. For a niche modified-release antidepressant, total R&D outlay may range from USD 150-300 million, depending on trial size and region. Post-launch costs involve marketing, distribution, and ongoing pharmacovigilance.

Gross margins are expected to be high, around 70-80%, attributable to the generics landscape’s pricing pressure elsewhere and the premium positioning of NOR-QD.

Investment and Licensing Opportunities

Collaborative licensing deals with larger pharmaceutical companies could accelerate market entry and broaden distribution channels. Additionally, milestone payments and royalties could form an attractive revenue stream for patent holders, especially if global expansion is pursued.

Challenges and Opportunities

Challenges:

- Patent cliffs and generic competition for the underlying molecule, selegiline.

- Navigating complex regulatory landscapes across jurisdictions.

- Achieving clinician acceptance amidst a crowded antidepressant market.

Opportunities:

- Expansion into adjunct indications such as Parkinson’s disease or cognitive impairment.

- Integration into combination therapies targeting resistant depression.

- Digital health integrations to monitor adherence and response.

Key Takeaways

- The success of NOR-QD hinges on its ability to demonstrate clinical advantages over existing therapies, particularly in adherence and side effect profile.

- Regulatory strategies and patent protections are critical levers influencing its initial and sustained market success.

- The rising prevalence of depression, coupled with demand for patient-friendly formulations, positions NOR-QD favorably for rapid uptake.

- Price premiums associated with sustained-release formulations can support lucrative margins, provided payer pathways are secured.

- Strategic collaborations and global expansion will be vital for maximizing revenue trajectory and mitigating competitive risks.

FAQs

1. What differentiates NOR-QD from other antidepressants?

NOR-QD offers a sustained-release formulation of selegiline, enabling once-daily dosing and potentially improving patient adherence compared to traditional, multiple-daily dosing antidepressants.

2. What regulatory hurdles might NOR-QD face?

The drug must demonstrate bioequivalence, safety, and efficacy through clinical trials aligned with FDA and other agencies' standards. Patents and intellectual property rights also influence approval and market exclusivity.

3. How does NOR-QD impact the market dynamics of existing MAOIs?

By providing a controlled-release formulation, NOR-QD addresses limitations like dietary restrictions and side effects associated with traditional MAOIs, potentially shifting prescribing patterns towards this new formulation.

4. What is the potential for international expansion?

Given the global burden of depression, NOR-QD can expand into European, Asian, and Latin American markets, contingent upon local regulatory approvals and reimbursement landscape adaptations.

5. How might Payer policies influence NOR-QD’s commercial success?

If payers recognize the long-term cost savings through improved adherence, reimbursement coverage is likely. Conversely, high out-of-pocket costs could hinder uptake if premiums are not justified by clinical benefits.

References

- Grand View Research, "Antidepressant Market Size, Share & Trends Analysis," 2022.

- WHO, "Depression Fact Sheet," 2022.