Last updated: July 27, 2025

Introduction

Norethindrone is a synthetic progestin widely used in hormonal contraceptives and hormone replacement therapy. Recognized for its efficacy and safety profile, norethindrone has carved a substantial niche within the global reproductive health market. This article explores the key market dynamics influencing norethindrone’s growth, discusses its financial trajectory, and analyzes underlying factors shaping its commercial landscape.

Overview of Norethindrone and its Therapeutic Applications

Norethindrone, marketed under various brand names such as Ortho-Novum, Micronor, and Errin, functions primarily as an oral contraceptive component. Its mechanism involves suppressing ovulation, thickening cervical mucus, and altering endometrial lining. Beyond contraception, norethindrone is deployed in hormone therapy, treatment of menstrual disorders, and management of endometriosis.

The drug’s approvals are primarily concentrated in North America and Europe, with emerging markets gradually increasing adoption due to heightened awareness of reproductive health and expanding access to contraception.

Market Dynamics

1. Growing Demand for Contraceptive Products

The global contraceptive market is projected to grow at a CAGR of approximately 6.8% between 2022 and 2030, driven by increasing awareness, urbanization, and rising female workforce participation [1]. Norethindrone’s prominence as a reliable oral contraceptive contributes significantly to this expansion, especially in countries with evolving healthcare infrastructure.

2. Aging Population and Hormone-Related Therapies

An aging demographic in developed regions elevates demand for hormone replacement therapy (HRT). Norethindrone, often combined with estrogen, plays a role in managing menopausal symptoms and osteoporosis, thereby diversifying its market applications beyond contraception.

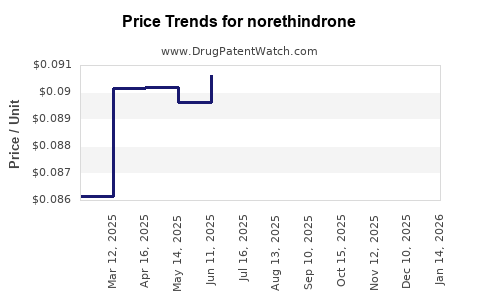

3. Patent Expirations and Generic Competition

Major pharmaceutical companies' patents for branded norethindrone formulations are nearing expiration, opening avenues for generic manufacturers. This scenario exerts downward pressure on prices, affecting revenue streams for brand-name products. The proliferation of generics is expected to bolster affordability and uptake but could compress profit margins.

4. Regulatory and Policy Environment

Changes in healthcare policies, especially related to contraceptive coverage mandates—such as the U.S. Affordable Care Act—positively influence market penetration [2]. Conversely, stringent regulatory hurdles and variations in approval processes across jurisdictions may delay new formulations’ launch, influencing overall market growth.

5. Technological Innovation and New Delivery Systems

Development of novel delivery mechanisms—like extended-release implants or transdermal systems—can enhance compliance and expand market share. While currently limited, these innovations are pivotal in reshaping future product landscapes.

6. Competitive Landscape

The market features a mix of established pharmaceutical giants (e.g., Pfizer, Bayer) and emerging biotech firms. Competition intensifies around formulation efficacy, side-effect profiles, and price competitiveness.

Financial Trajectory

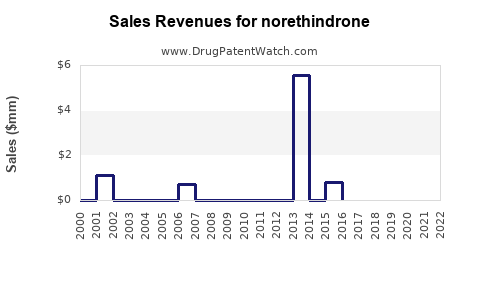

1. Market Size and Revenue Projections

The global reproductive health market, where norethindrone plays a pivotal role, was valued at approximately USD 13 billion in 2022 and is expected to reach USD 17.5 billion by 2030, growing at a CAGR of 4.3% [3]. Norethindrone, comprising approximately 15-20% of contraceptive market revenues, presents an estimated global revenue trajectory of USD 1.2 billion to USD 2 billion by 2030, depending on regional growth and generic penetration.

2. Revenue Drivers

- Price Adjustments Post-Patent Expiry: Entry of generics reduces unit prices but increases overall volume sales. Market share gains from generics can offset margin compression for manufacturers.

- Market Penetration in Emerging Economies: Improved healthcare access boosts sales. For example, India’s contraceptive market projected to expand at over 7% CAGR, presents notable growth opportunities [4].

- Portfolio Diversification: Expansion into menopause management and other hormonal therapies diversifies revenue streams, pushing financial growth.

3. Profitability and Cost Considerations

- Manufacturing Costs: High bioequivalence standards increase manufacturing expenses for generics but benefit from economies of scale.

- Regulatory Investment: Significant R&D and regulatory compliance costs are associated with new formulations or delivery systems, impacting short-term profitability.

- Pricing Strategies: Companies adopt tiered pricing reflecting regional economic capabilities, influencing profit margins.

4. Impact of Patent Expiry and Market Entry

With patent expirations happening progressively over the next 2-5 years, the influx of generics is anticipated to shift revenue dynamics. While brand-name revenue may decline, overall market expansion driven by affordability and accessibility is projected to sustain growth.

5. Future Outlook

The financial outlook for norethindrone remains cautiously optimistic. Market shifts toward combination products and innovative delivery modalities could provide premium pricing opportunities, bolstering revenues.

Key Market Drivers and Challenges

| Drivers |

Challenges |

| Increasing contraceptive demand |

Patent expirations and generic competition |

| Rising awareness of reproductive health |

Regulatory delays in new formulations |

| Expansion into emerging markets |

Price declines eroding margins |

| Advances in delivery technologies |

Market saturation in mature regions |

| Regulatory incentives |

Variability in policy support |

Conclusion

The market for norethindrone is shaped by a confluence of demographic trends, regulatory policies, technological advances, and competitive forces. While patent expirations and price competition pose challenges, expanding access and therapeutic breadth present substantial growth opportunities.

Business stakeholders should focus on innovation, strategic regional expansion, and lifecycle management to capitalize on emerging trends. Companies capable of balancing cost efficiencies with product differentiation will be well-positioned to sustain long-term profitability.

Key Takeaways

- Growth is Driven by Rising Contraceptive Needs: Increased global demand, especially in emerging markets, underpins positive growth trajectories.

- Patent Expirations Create Both Risks and Opportunities: The transition to generics reduces prices but enhances market volume, requiring strategic adaptation.

- Regulatory and Policy Environments Are Critical: Favorable healthcare policies boost adoption; regulatory hurdles can delay growth.

- Innovation Will Shape Future Revenue Streams: Development of advanced delivery systems and expanded indications can enhance profitability.

- Market Diversification Is Essential: Expanding beyond contraception into hormone therapy and menopausal management enhances resilience.

FAQs

1. What factors primarily influence the pricing of norethindrone-based contraceptives?

Pricing is influenced by patent status, manufacturing costs, regional healthcare policies, competitive pressure from generics, and demand elasticity.

2. How does the expiration of patents impact norethindrone’s market revenue?

Patent expirations lead to increased generic competition, reducing prices but expanding overall market volume. Revenues for brand-name manufacturers may decline unless offset by volume gains or new formulations.

3. What emerging therapeutic indications could expand norethindrone’s market?

Beyond contraception, uses in hormone therapy, endometriosis, abnormal uterine bleeding, and menopausal symptom management are expanding its clinical applications.

4. How do regulatory differences across countries affect norethindrone’s global market?

Divergent approval processes and labeling standards can delay product launches, influence formulation modifications, and impact market penetration rates.

5. What technological innovations could redefine norethindrone’s market trajectory?

Long-acting reversible contraceptives, transdermal systems, and novel delivery implants are potential innovations that could improve adherence and open new revenue streams.

Sources

- MarketsandMarkets. "Contraceptive Drugs Market by Type, Application, and Region." 2022.

- U.S. Department of Health & Human Services. "Contraceptive Coverage Mandate." 2021.

- Grand View Research. "Reproductive Health Market Analysis." 2022.

- India Brand Equity Foundation. "Healthcare & Life Sciences Industry Overview." 2022.