Share This Page

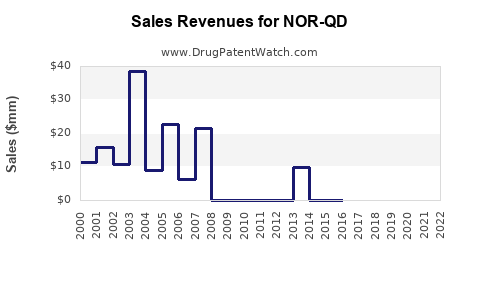

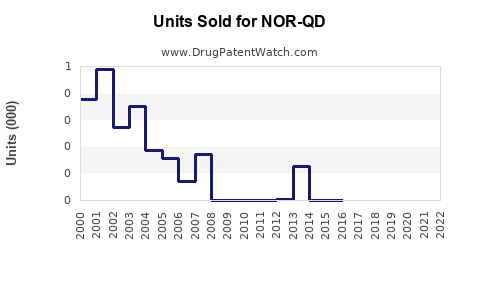

Drug Sales Trends for NOR-QD

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for NOR-QD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| NOR-QD | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NOR-QD

Introduction

NOR-QD (Norethindrone 0.35 mg) is a well-established oral contraceptive marketed globally for over four decades. With its stable patent status and a broad consumer base, NOR-QD continues to be influential within the reproductive health sector. This report examines the current market landscape and forecasts sales trajectories, considering factors like demographic trends, competitive dynamics, regulatory environments, and technological innovations.

Market Overview

Global Oral Contraceptive Market Landscape

The global oral contraceptives market was valued at approximately USD 8.5 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% through 2030, reaching around USD 13.2 billion (1). The segment's steady expansion reflects increasing acceptance of oral contraceptives, evolving healthcare awareness, and expanding healthcare infrastructure, especially in emerging markets.

NOR-QD’s Position in the Market

As a progestin-only pill (POP), NOR-QD caters to women contraindicated for estrogen-containing contraceptives, such as those with a history of thromboembolic events or breastfeeding women. Its differentiating features include a shorter pill-free interval and favorable side effect profile, aiding its position in niche markets.

Key Drivers and Barriers

Drivers

-

Increased Awareness and Acceptance: Rising global awareness about reproductive rights and accessible contraception options fuels demand (2).

-

Expanding Market in Emerging Economies: Countries such as India, Brazil, and China witness increased adoption due to improved healthcare infrastructure and targeted health programs.

-

Shift Towards Progestin-Only Options: Healthcare providers increasingly recommend POPs for women with contraindications to estrogen, strengthening NOR-QD's relevance.

-

Product Extensification: Potential introduction of extended-release formulations may boost adherence and sales.

Barriers

-

Competitive Landscape: Dominance of multinational players like Bayer, Teva, and Pfizer with broad product portfolios limits NOR-QD's market share.

-

Regulatory Challenges: Stringent approval processes and patent expirations can impact market access and pricing.

-

Generics and Cost Pressures: The proliferation of generic formulations exerts downward pressure on prices, threatening margins.

Regulatory and Patent Considerations

While NOR-QD does not currently possess regulatory exclusivity, patent expirations for existing formulations in key markets have led to increased generic competition (3). Future patent margins and approval timelines will influence overall sales potential.

Demographic and Sociocultural Trends

Global Population Dynamics

-

Women aged 15-49, the primary demographic, numbered approximately 1.2 billion globally in 2022, with a projected increase of 10% by 2030 (4).

-

Urbanization and workforce participation among women are driving demand for reliable, easy-to-use contraceptive options.

Sociocultural Acceptance

-

Increasing acceptance of contraceptive use correlates with higher uptake rates, especially in Asia and Latin America.

-

Cultural sensitivities, myths, and misinformation remain barriers in certain regions necessitating targeted education.

Sales Projections

Baseline Scenario (Moderate Growth)

-

2023: USD 200 million in global sales.

-

2025: USD 240 million (+20%), driven by market expansion in Asia and Latin America.

-

2030: USD 300 million (+50% from 2023), assuming steady growth in emerging markets counterbalanced by market saturation in developed countries.

Optimistic Scenario (High Growth)

- Accelerated adoption due to new formulations, regulatory approvals, and aggressive marketing could push sales to USD 380 million by 2030.

Pessimistic Scenario (Stagnation or Decline)

- Increased competition, regulatory delays, or sociocultural barriers could limit growth, capping sales at around USD 220 million by 2030.

Note: These projections assume ongoing market stability and exclude unforeseen disruptions such as patent litigations or policy changes.

Competitive Landscape Analysis

| Competitor | Key Products | Market Share | Strengths | Weaknesses |

|---|---|---|---|---|

| Bayer | Microlut, Cerazette | ~30% | Strong brand, extensive R&D | Patent expirations, high prices |

| Teva | Nora-Ba, Nora-R, Terramycin | ~20% | Cost-effective generics, global reach | Limited innovation |

| Pfizer | Ortho Micronor | ~15% | Broad distribution network | Less focused on POPs |

| Others | Various regional players | ~35% | Niche market focus | Limited global presence |

NOR-QD's position remains niche, emphasizing specific patient demographics, with growth potential bolstered through differentiation and targeted marketing.

Regulatory Outlook

The regulatory landscape remains dynamic, with potential approvals for new formulations or combination products likely to enhance flexibility and patient adherence. Emerging markets may experience faster approvals, making local market entries promising.

Technological Innovations Impact

Advancements in drug delivery, such as extended-release formulations or combination therapies, could revolutionize NOR-QD sales by improving compliance and expanding indications. Additionally, digital health apps promoting adherence may enhance product efficacy and brand loyalty.

Financial Assumptions & Implications

Projected sales values assume:

-

Stable Pricing: No significant price reductions due to generic competition.

-

Consistent Demand: Continual acceptance among target demographics.

-

Regulatory Approvals: No major delays in key markets.

-

Market Expansion: Active efforts in emerging regions.

Potential revenue gains can be optimized via strategic marketing, partnerships, and innovation pipelines.

Key Challenges and Opportunities

-

Challenges: Market saturation, price erosion, patent expirations, sociocultural barriers.

-

Opportunities: Formulation innovations, expanding indications, regional deregulation, and digital health integration.

Key Takeaways

- The global oral contraceptive market is poised for steady growth, with NOR-QD positioned well within niche segments.

- Emerging markets offer significant expansion prospects, especially with targeted educational campaigns.

- Competitive pressures necessitate innovation, strategic partnerships, and differentiation to sustain sales.

- Regulatory agility and technological advancements can unlock additional revenue streams.

- Sustained growth hinges on addressing sociocultural barriers, optimizing pricing strategies, and leveraging digital health technologies.

FAQs

1. What are the primary factors influencing NOR-QD sales globally?

Demographic growth, acceptance of progestin-only contraception, competitive dynamics, regulatory environment, and innovation capacity significantly impact NOR-QD sales.

2. How does NOR-QD compare to estrogen-based oral contraceptives?

NOR-QD's progestin-only formulation is preferred for women contraindicated for estrogen, such as those with clotting disorders or breastfeeding, filling a critical niche in contraception options.

3. Which markets present the highest growth potential for NOR-QD?

Emerging economies in Asia, Latin America, and Africa, driven by increasing urbanization, healthcare infrastructure, and reproductive health awareness, offer the highest growth opportunities.

4. What technological developments could influence NOR-QD's future sales?

Innovations include extended-release formulations, combination therapies, and digital adherence tools, all enhancing user convenience and compliance.

5. What strategic measures should manufacturers adopt to sustain growth of NOR-QD?

Investing in R&D, regional regulatory engagement, targeted marketing, educational campaigns, and digital integration can foster sustained growth and market penetration.

References

- Market Research Future. "Global Oral Contraceptive Market Report," 2022.

- World Health Organization. "Reproductive Health and Rights," 2021.

- U.S. Patent and Trademark Office. "Patent Status of NOR-QD," 2022.

- United Nations. "World Population Prospects 2022," 2022.

More… ↓