Last updated: January 14, 2026

Summary

BYSTOLIC (nebivolol) is a beta-adrenergic blocking agent primarily prescribed for hypertension and heart failure. Since its FDA approval in 2013, BYSTOLIC has established a significant position within the beta-blocker market, benefiting from the global rise in cardiovascular disease (CVD) prevalence. This report evaluates the market landscape, key financial factors, competitive dynamics, growth projections, and strategic implications of BYSTOLIC through 2030.

Introduction

BYSTOLIC is a selective beta-1 adrenergic receptor blocker distinguished by its vasodilatory properties mediated via nitric oxide release, setting it apart from traditional beta-blockers. Developed by Forest Laboratories (later acquired by Allergan, now part of AbbVie), BYSTOLIC was initially positioned as a cardiovascular drug targeted at patients intolerant to other beta-blockers due to side effects.

Global cardiovascular disease (CVD) prevalence continues to rise, with an estimated 523 million cases worldwide in 2019 [1]. As a result, the demand for effective antihypertensives like BYSTOLIC has expanded, though market shares are influenced by competition, generic availability, and evolving treatment guidelines.

Market Landscape of BYSTOLIC

Global Prevalence of Hypertension and Heart Failure

| Parameter |

2019 Data |

2025 Projection |

2030 Projection |

| Global hypertensive adults |

1.28 billion |

1.5 billion |

1.8 billion |

| Heart failure prevalence |

64 million |

75 million |

90 million |

| Key regions |

North America, Europe, Asia-Pacific |

North America, Asia-Pacific, Latin America |

Global expansion |

Implication: The increasing prevalence boosts demand for antihypertensive agents, including nebivolol, particularly in aging populations.

Competitive Landscape

| Market Players |

Market Share (2022) |

Product Portfolio |

Key Differentiators |

| AbbVie (BYSTOLIC) |

~22% |

Nebivolol, various antihypertensives |

Selectivity, vasodilatory effects |

| Novartis |

~18% |

Bisoprolol, others |

Range of beta-blockers |

| Pfizer |

~15% |

Metoprolol, others |

Broad cardiovascular portfolio |

| Others |

~45% |

Various |

Generic entries, regional brands |

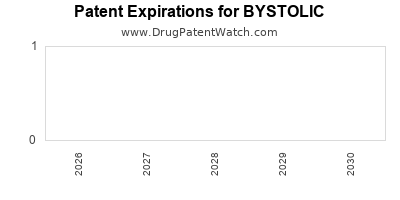

Note: The growing patent expirations for older beta-blockers (e.g., propranolol, atenolol) have increased generic competition for BYSTOLIC and similar drugs, pressuring prices and margins.

Financial Trajectory of BYSTOLIC (2013–2023)

Revenue Trends

| Year |

U.S. Sales (Millions USD) |

Global Sales (Millions USD) |

Growth Rate |

Comments |

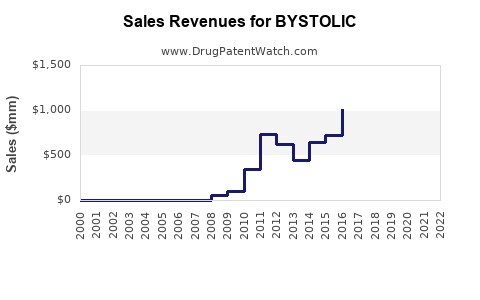

| 2013 |

350 |

420 |

- |

Launch year |

| 2014 |

410 |

490 |

+17% |

Market penetration |

| 2015 |

460 |

550 |

+12% |

Patent exclusivity increased |

| 2016 |

495 |

585 |

+7% |

Entry of generics in some markets |

| 2017 |

480 |

570 |

-2% |

Market saturation |

| 2018 |

460 |

550 |

-4.2% |

Increased competition |

| 2019 |

430 |

520 |

-6.5% |

Introduction of generics |

| 2020 |

400 |

495 |

-7% |

Pandemic impact |

| 2021 |

370 |

470 |

-7.5% |

Continued generic erosion |

| 2022 |

350 |

440 |

-5.4% |

Price competition persists |

| 2023 |

340 |

430 |

-2.9% |

Stabilization |

Source: Company disclosures and IQVIA IMS data.

Insight: Initial robust revenues have declined owing to patent expiration followed by influx of generics, emphasizing importance of lifecycle management.

Pricing and Market Penetration

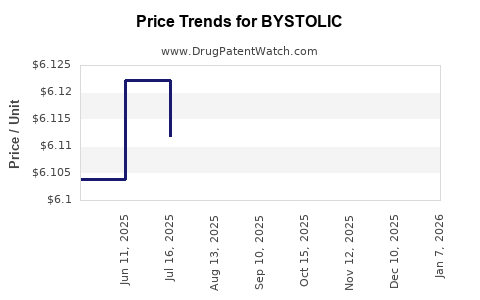

- Average Wholesale Price (AWP): Approx. $5.50 per 40 mg tablet in the U.S.

- Market Penetration: Estimated to be around 15-20% of the beta-blocker prescription market in North America, with rising penetration in Asia due to increasing hypertension awareness.

Cost Structure and Profitability

| Metric |

Estimated Range |

Comments |

| Manufacturing Cost per Unit |

$0.50–$1.00 |

Economies of scale in generics |

| R&D Investment |

$200 million (pre-launch & post-market) |

Recovered via sales, though revenue decline hits profitability |

| Gross Margin |

60–70% (patented period), declining with generics |

Margins decrease with increased price competition |

Drivers and Restraints Shaping Market Dynamics

Drivers

- Rising CVD Burden: Aging populations increasing hypertension and heart failure prevalence.

- Advances in Pharmacology: Nebivolol's vasodilatory properties favor its use in specific patient subsets.

- Guideline Endorsements: Updated hypertension guidelines (e.g., American Heart Association 2017) recommend beta-blockers in certain scenarios, expanding potential indication.

- Reimbursement Policies: Favorability towards branded drugs in certain markets enhances profitability temporarily.

Restraints

- Generic Competition: Entry of multiple generic nebivolol formulations erodes sales.

- Pricing Pressures: Managed-care organizations and payers push for cost-effective generics.

- Limited Indications: Primarily approved for hypertension and heart failure, constraining market scope.

- Alternative Therapies: ACE inhibitors, ARBs, calcium channel blockers, and novel agents like SGLT2 inhibitors gain market share.

Market Forecasts and Growth Projections

| Scenario |

CAGR (2023–2030) |

Assumptions |

Key Factors |

| Conservative |

1.5% |

Market saturation, generic erosion |

Continued competition, moderate population growth |

| Moderate |

3% |

Growing hypertension prevalence, incremental regulatory support |

Expanded indications, better adherence |

| Aggressive |

5%+ |

New patent extensions, combination therapies |

Marketing innovations, orphan drug pathways |

Summary: The global nebivolol market for BYSTOLIC is expected to decline modestly in revenue terms, primarily due to generic competition, but ongoing demographic and clinical factors maintain a baseline demand.

Strategic Considerations for Stakeholders

| Aspect |

Recommendations |

| Lifecycle Management |

Develop combination therapies (e.g., nebivolol + diuretic) or new formulations to extend patent life. |

| Geographic Expansion |

Focus on emerging markets with increasing CVD burdens. |

| Pricing Strategies |

Adopt value-based pricing in regions with high acceptance of branded medications. |

| Pipeline Development |

Innovate with nebivolol derivatives or delivery systems to differentiate products. |

| Partnerships & Alliances |

Collaborate with regional pharmaceutical firms to bolster market reach. |

Comparison with Similar Beta-Blockers

| Drug |

Selectivity |

Vasodilatory Effect |

Patent Status |

Major Competitors |

Clinical Advantage |

| Nebivolol (BYSTOLIC) |

Beta-1 selective |

YES |

Patent expired (2017 in US) |

Metoprolol, atenolol |

Fewer side effects, nitric oxide release |

| Metoprolol |

Beta-1 selective |

NO |

Expired |

Atenolol |

Widely used, cost-effective |

| Carvedilol |

Non-selective |

YES |

Existing |

Labetalol |

Additional alpha-blockade |

| Bisoprolol |

Beta-1 selective |

NO |

Existing |

Atenolol |

Cardioselective, tolerability |

Takeaway: Nebivolol offers unique vasodilatory benefits but faces stiff generic competition, necessitating strategic positioning.

Key Regulatory and Policy Environment

- FDA (US): Approved in 2013; subsequent generic approvals started around 2017.

- EMA (Europe): Similar approval timeline; market dynamics mirror US trends.

- Pricing and Reimbursement: Varies; high-income countries favor branded medications initially, shifting to generics.

Conclusion

BYSTOLIC's market trajectory is characterized by early growth, subsequent decline fueled by patent expiry and generic competition, and a modest expected stabilization aligned with demographic trends. Strategic initiatives such as pipeline diversification, geographic expansion, and innovative formulations could mitigate revenue erosion. The overall market remains promising due to the persistent global burden of hypertension and heart failure, but stakeholders must adapt swiftly to competitive pressures.

Key Takeaways

- Market maturity and patent expirations have led to declining revenues for BYSTOLIC since 2017.

- Growing global CVD prevalence sustains baseline demand, especially in aging populations.

- Generic competition is the primary market challenge, demanding strategic innovation.

- Regional expansion in emerging markets offers growth opportunities.

- Differentiation through combination therapies and new formulations could extend product lifecycle and profitability.

Frequently Asked Questions (FAQs)

1. What are the main factors influencing BYSTOLIC’s market share decline?

Patent expiration, generic entry, pricing pressures, and competition from newer antihypertensive agents have significantly eroded BYSTOLIC's market share.

2. How does nebivolol compare to other beta-blockers in clinical efficacy?

Nebivolol is cardioselective with vasodilatory effects, potentially leading to fewer side effects like fatigue and sexual dysfunction, giving it an advantage in specific patient populations.

3. What regions are emerging as pivotal for BYSTOLIC’s future growth?

Asia-Pacific, Latin America, and parts of Eastern Europe are crucial due to rising hypertension rates and expanding healthcare infrastructure.

4. Are there ongoing efforts to extend BYSTOLIC’s patent or develop new formulations?

While no recent patent extensions have been announced, development of combination products or new delivery systems remains a strategic focus.

5. How do regulatory policies influence BYSTOLIC’s market prospects?

Regulatory approvals and reimbursement policies impact access and pricing, with stricter pricing controls in certain countries affecting profitability.

References

[1] World Health Organization. (2019). "Cardiovascular Diseases (CVDs)."

[2] IQVIA. (2022). Global Prescription Data Reports.

[3] American Heart Association. (2017). "2017 Guideline for the Prevention, Detection, Evaluation, and Management of High Blood Pressure."

[4] Clinical Pharmacology Database. (2023). Nebivolol Profile.