Last updated: November 7, 2025

Introduction

Naltrexone, a long-established opioid antagonist, has historically played a significant role in addiction management, particularly for opioid and alcohol dependence. Over recent years, evolving indications, regulatory shifts, and market entry of novel formulations have influenced its market dynamics and financial prospects. This article provides a detailed examination of Naltrexone's current market landscape, key growth drivers, challenges, and future financial trajectories, enabling stakeholders to make informed decisions.

Pharmacological Profile and Approved Indications

Naltrexone is primarily utilized for:

- Opioid dependence: Prevents relapse post-detoxification.

- Alcohol dependence: Reduces cravings and consumption.

- Off-label uses: Emerging applications include impulse control disorders and behavioral addictions.

The drug's original formulations include oral tablets and an extended-release intramuscular injection (Vivitrol), approved by leading regulatory agencies such as the FDA. The prolonged-acting injectable has expanded the formulation landscape, offering improved adherence and compliance.

Market Drivers Shaping Naltrexone’s Trajectory

1. Rising Opioid and Alcohol Use Disorders (OUD and AUD)

The opioid epidemic in North America and parts of Europe has elevated the need for effective maintenance therapies. According to the CDC, approximately 10.1 million Americans aged 12 or older had a prescription opioid misuse disorder in 2020 ([2]). Naltrexone's role as an alternative to methadone or buprenorphine has gained visibility, especially among populations seeking opioid-free treatment options.

Concurrently, alcohol use disorder affects approximately 14.5 million adults in the U.S., with demand for non-addictive intervention strategies [3].

2. Preference for Non-Agonist Therapies

Patients and clinicians increasingly favor non-opioid treatments to mitigate diversion risks and dependency. Naltrexone’s opioid antagonism aligns with this preference, bolstering its clinical and market viability.

3. Regulatory Approvals and Expanded Indications

Recent approvals of novel formulations, especially long-acting injectables, have enhanced treatment adherence. For example, the FDA's approval of Vivitrol for alcohol dependence in 2014 expanded its market scope. Ongoing clinical trials exploring off-label indications could further diversify revenue streams.

4. Increasing Awareness and Integrated Treatment Models

Public health campaigns and integrated behavioral health services have promoted the utilization of Naltrexone. Digital health platforms are aiding in patient engagement, ensuring adherence and follow-up, consequently propelling growth.

Market Challenges and Constraints

1. Competition from Alternative Therapies

Methadone and buprenorphine remain dominant in opioid maintenance therapy, especially given their affordability and established efficacy ([4]). The presence of generic formulations reduces Naltrexone's market share and constrains pricing.

2. Cost and Accessibility Concerns

Vivitrol’s high price point, often exceeding $1,000 per injection, limits adoption among underserved populations. Insurance coverage variability adds to access barriers, impacting market size.

3. Limited Awareness and Stigma

Despite clinical efficacy, stigma related to addiction treatments and limited provider awareness hinder widespread utilization. Regulatory hurdles and contraindications also restrict client eligibility.

4. Off-Label and Experimental Uses’ Limited Evidence

Emerging uses for behavioral and impulse-control disorders lack robust clinical data, potentially limiting commercialization efforts.

Market Size and Financial Projections

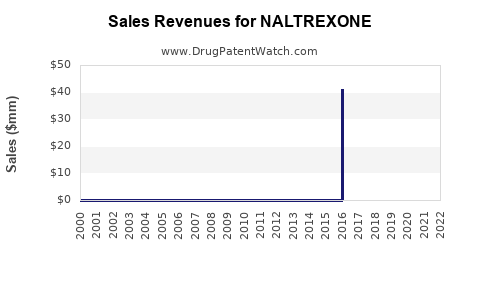

Current Market Landscape

The global Naltrexone market was valued at approximately USD 250 million in 2022 ([5]). North America dominates the landscape, accounting for over 70% of total sales, driven by the opioid crisis and healthcare infrastructure.

Projected Growth Trajectory

Market analysts forecast a compound annual growth rate (CAGR) of 6-8% over the next five years, reaching an estimated USD 400-500 million by 2028**. Key factors include increased diagnosis rates, expanded indications, and novel delivery methods.

Trends Influencing the Trajectory

- Formulation Innovations: New long-acting, implantable, and oral delivery systems aim to improve adherence and reduce costs.

- Market Penetration in Emerging Economies: Rising healthcare investments in Asia-Pacific and Latin America could unlock new revenue. However, affordability remains a challenge.

- Demographic Shifts: Aging populations in developed nations with higher prevalence of substance use disorders bolster demand.

Strategic Opportunities and Future Outlook

1. Development of Cost-Effective Formulations

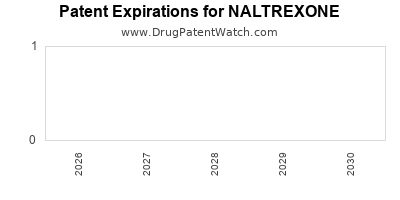

Generics and biosimilars could enhance affordability and accessibility. Patent expirations and strategic partnerships are pivotal in this domain.

2. Expansion into Off-Label Territories

Robust clinical trials may facilitate approval for additional indications, expanding revenue streams. For instance, research into Naltrexone's efficacy in gambling and other behavioral addictions presents significant opportunities.

3. Adoption of Digital Health Technologies

Mobile apps and telemedicine platforms facilitate adherence monitoring and patient engagement, potentially increasing medication utilization.

4. Policy and Reimbursement Trends

Government initiatives deploying subsidies and insurance coverage enhancements will positively influence market growth.

Regulatory and Patent Landscape

Naltrexone’s older patent portfolio has largely expired or is nearing expiration, leading to increased generic competition. Nonetheless, companies investing in novel delivery systems and combination therapies hold strategic advantages. Regulatory bodies worldwide are updating guidelines to accommodate innovative formulations, potentially extending market exclusivity.

Key Takeaways

- Market growth is driven by the opioid crisis, expanded indications, and formulation innovations, particularly long-acting injectables.

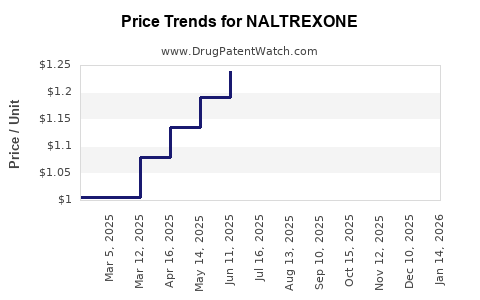

- Pricing and reimbursement are critical bottlenecks, with high costs limiting access in some regions.

- Competition from generics and alternative therapies constrains profit margins.

- Emerging markets offer opportunities for growth, contingent on affordability and local healthcare infrastructure.

- Innovative delivery methods, digital health integration, and new clinical applications will shape Naltrexone’s future financial landscape.

FAQs

Q1: What is the primary revenue driver for Naltrexone?

The extended-release injectable formulation (Vivitrol) is the main revenue driver due to improved adherence benefits and higher pricing compared to oral forms.

Q2: How does Naltrexone’s market compare to other addiction medications?

While Naltrexone has a niche role, methadone and buprenorphine dominate in opioid maintenance, partly because of lower costs and established prescribing practices. Naltrexone's market share remains modest but growing.

Q3: What factors could accelerate Naltrexone's market growth?

Innovations in delivery systems, expanded indications through clinical trials, increased awareness, and supportive policy changes are key growth catalysts.

Q4: How does pricing impact Naltrexone’s market penetration?

High costs, especially of branded formulations, limit access among low-income populations and in regions with limited insurance coverage, restraining market expansion.

Q5: Are there upcoming regulatory developments that could influence the Naltrexone market?

Yes, approvals of new formulations, off-label indications, and policy shifts favoring opioid dependence treatments could positively impact market dynamics.

Conclusion

Naltrexone's stability as a treatment option amid evolving addiction therapies underscores its strategic significance. Its financial trajectory hinges on formulation innovation, regulatory strategies, and market penetration—particularly across emerging markets. While facing challenges from cost and competition, targeted efforts in developing affordable, convenient, and effective formulations hold the key to unlocking its full commercial potential in the coming decade.

References

[2] Centers for Disease Control and Prevention (CDC). 2020 National Epidemiologic Survey on Alcohol and Related Conditions (NESARC).

[3] Substance Abuse and Mental Health Services Administration (SAMHSA). 2020 National Survey on Drug Use and Health.

[4] Mattick, R.P., et al. (2014). Buprenorphine maintenance vs. placebo or methadone maintenance for opioid dependence. Cochrane Database.

[5] Research and Markets. Global Naltrexone Market Report, 2022.