Last updated: July 27, 2025

- Increasing prevalence of opioid and alcohol use disorders globally.

- Growing emphasis on outpatient and pharmaceutical-based addiction management.

- Expanding approval of extended-release formulations, enhancing compliance.

- Legislative shifts favoring medication-assisted treatment (MAT).

Challenges include:

- Limited awareness among some healthcare providers.

- Competition from alternative therapies, including buprenorphine and methadone.

- Regulatory hurdles in certain emerging markets.

Market Segmentation and Geographical Breakdown

1. By Formulation

- Oral Naltrexone: Traditionally used, with moderate adherence issues.

- Extended-Release Injectable Naltrexone (Vivitrol): Enhanced compliance, growing adoption in clinical settings.

2. By Application

- Alcohol Use Disorder (AUD): Accounts for approximately 70% of the utilization.

- Opioid Dependence: Remaining 30%, increasingly targeted in opioid crisis regions.

3. By Region

- North America: Dominates with nearly 50% of global sales, buoyed by high prevalence of addiction and established healthcare infrastructure.

- Europe: Significant growth driven by similar factors, with key markets including the UK, Germany, and France.

- Asia-Pacific: Rapidly expanding markets attributable to rising addiction rates and increasing mental health awareness.

Market Trends and Opportunities

- Emergence of Novel Delivery Systems: Development of implantable and biocompatible microsphere formulations promises improved compliance.

- Regulatory Approvals in New Markets: Several countries are streamlining approval pathways for addiction drugs, creating expansion opportunities.

- Rising Investment in Addiction Pharma: Notably, major pharmaceutical firms are focusing R&D efforts to develop combinatorial therapies involving Naltrexone, promising future growth.

- Telemedicine Integration: Remote prescriptions and monitoring are expanding Naltrexone's reach, particularly in underserved regions.

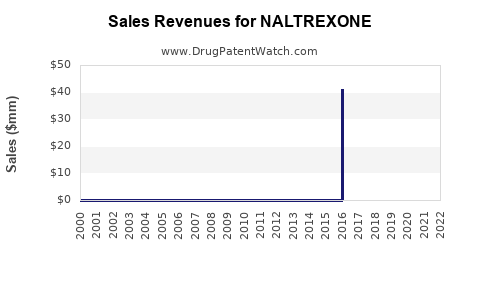

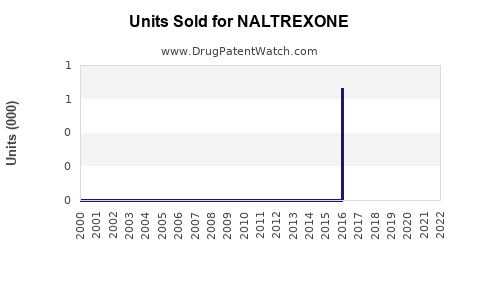

Sales Projections (2023-2028)

Based on current market dynamics, a compound annual growth rate of approximately 7-9% is forecasted for Naltrexone in the upcoming five years.

Projected revenues:

| Year |

Estimated Global Sales (USD billion) |

Growth Rate |

| 2023 |

$1.2 billion |

— |

| 2024 |

$1.3 billion |

~8.3% |

| 2025 |

$1.4 billion |

~7.7% |

| 2026 |

$1.5 billion |

~7.1% |

| 2027 |

$1.6 billion |

~6.7% |

| 2028 |

$1.7 billion |

~6.3% |

This steady growth is supported by increased adoption of extended-release formulations, expanding approval footprints, and rising prevalence of addiction disorders. The injectable form is expected to outpace oral versions in growth rate, driven by adherence advantages.

Competitive Landscape and Key Players

Major manufacturers include:

- Reysol (Janssen Pharmaceuticals): Market leader with Vivitrol.

- Mylan (Part of Viatris): Offers generic oral Naltrexone.

- Indivior: Development of novel formulations and combination therapies.

- Others: Including Sun Pharmaceutical, Lupin, and Teva.

The competitive landscape hinges on drug efficacy, delivery systems, pricing strategies, and regional regulatory approvals.

Regulatory and Patent Considerations

Patents protecting Vivitrol are set to expire around 2024-2025, opening avenues for generic competition, which could impact pricing and sales volumes. Regulatory approvals for new indications, such as impulse control disorders, could further extend market potential.

Risks and Mitigating Factors

- Regulatory bottlenecks in emerging markets.

- Payor and reimbursement issues impacting pricing strategies.

- Adherence issues with oral formulations.

Favorable factors include increased awareness, ongoing clinical trials, and supportive healthcare policies aimed at combating addiction crises.

Conclusion

The Naltrexone market is positioned for sustained growth, driven by epidemiological trends and innovations in drug delivery. The injectable formulation is poised to expand significantly, leveraging its increased compliance profile. Entering new geographical markets and pursuing novel indications represent critical opportunities for industry stakeholders aiming to capitalize on this trajectory.

Key Takeaways

- Market growth is projected at approximately 7-9% CAGR through 2028, with revenues reaching around $1.7 billion.

- Extended-release formulations will dominate future sales due to higher adherence rates.

- Geographical expansion particularly in Asia-Pacific and emerging markets presents significant upside potential.

- Patent expirations will usher in generic competition, likely reducing prices and boosting accessibility.

- Innovative delivery systems and new indications will be vital drivers for sustained growth.

FAQs

1. What factors are driving the international expansion of Naltrexone?

Rising addiction rates coupled with regulatory liberalization and increased healthcare funding are primary drivers. Additionally, the development of more efficient formulations makes expansion feasible.

2. How does the market share compare between oral and injectable Naltrexone?

Currently, oral Naltrexone holds a significant share; however, the injectable form is rapidly gaining ground owing to its superior adherence profile and longer-lasting efficacy.

3. What is the potential impact of patent expirations on Naltrexone sales?

Patent expirations in key markets around 2024-2025 may lead to increased generic competition, potentially reducing prices but also enabling wider access, thereby sustaining overall sales volume.

4. Are there any emerging indications for Naltrexone beyond addiction treatment?

Yes, exploratory clinical trials are investigating Naltrexone's efficacy in behavioral disorders, impulse control issues, and certain autoimmune conditions, which could expand its therapeutic scope.

5. How has the COVID-19 pandemic affected Naltrexone market dynamics?

The pandemic temporarily disrupted supply chains and outpatient services but accelerated telemedicine adoption, which has improved access to Naltrexone therapy and possibly stabilized sales in the longer term.

Sources:

[1] Grand View Research. (2023). "Addiction Treatment Market Size, Share & Trends Analysis."

[2] FDA. (2010). "Approval of Vivitrol for Alcohol Dependence."

[3] IQVIA. (2022). "Global Pharmaceutical Market Data."

[4] Evaluate Pharma. (2023). "Drug Pipeline and Market Forecasts."