Last updated: July 28, 2025

Introduction

MILOPHENE, a pharmaceutical compound primarily characterized as a derivative of pentazocine, has gained interest within the analgesic and pain management sectors. Its therapeutic profile involves opioid receptor activity, with potential applications in chronic pain, cancer pain, and possibly in opioid addiction management. As the pharmaceutical landscape evolves with increasing patient demand for effective, less addictive analgesics, understanding MILOPHENE’s market positioning, development pipeline, and financial prospects becomes critical for stakeholders.

Market Overview

Global Pain Management Market Landscape

The global pain management market was valued at approximately USD 62 billion in 2021 and is projected to reach USD 84 billion by 2027, expanding at a CAGR of around 5%[1]. This growth reflects rising incidences of acute and chronic pain, an aging population, and increasing prevalence of conditions like cancer and neurological disorders.

Opioid-based therapies, including derivatives like MILOPHENE, form a significant segment within this industry. However, regulatory scrutiny and the opioid crisis influence market dynamics significantly.

Therapeutic Position of MILOPHENE

MILOPHENE’s pharmacological profile positions it as an opioid analgesic with potentially distinctive efficacy and safety profiles. Unlike traditional opioids, derivatives of pentazocine demonstrate mixed agonist-antagonist activity, potentially reducing risks like respiratory depression and dependency[2]. This offers a competitive edge in markets prioritizing safer analgesics.

Market Entry Challenges

Despite its therapeutic promise, MILOPHENE faces barriers such as:

- Regulatory hurdles pertaining to opioid classification

- Competition from established opioids (morphine, oxycodone) and non-opioid analgesics

- Limited clinical trial data and safety profiles compared to leading medications

- Intellectual property and patent protections influencing market exclusivity

Development and Regulatory Trajectory

Preclinical and Clinical Development

Milestones for MILOPHENE include:

- Preclinical Phase: Demonstrated analgesic efficacy in animal models, with preliminary safety assessments.

- Phase I Trials: Assessed dosing, pharmacokinetics, and initial safety in healthy volunteers.

- Phase II/III Trials: Aimed at establishing efficacy in target populations (e.g., cancer pain, postoperative pain) and confirming safety, although data remains limited publicly.

The pace of development heavily influences financial outlooks, as delayed clinical progress dampens investor confidence and market anticipation.

Regulatory Landscape

Regulatory pathways involve navigation through the FDA in the U.S., EMA in Europe, and other agencies. Given opioids’ classification, approval processes are stringent, requiring comprehensive safety and efficacy data.

Innovative regulatory pathways, such as expedited review programs for novel analgesics, could accelerate MILOPHENE’s market entry if it demonstrates a clear benefit over existing therapies.

Market Dynamics Influencing Financial Trajectory

Demand Drivers

- Unmet Medical Need: Patients with inadequate pain relief or opioid sensitivity.

- Regulatory Shift: Interest in developing opioids with minimized addiction potential.

- Chronic Pain Epidemic: Rising prevalence of chronic pain conditions sustains demand for new analgesic options.

Competitive Environment

- Existing opioids: Morphine, oxycodone, and fentanyl dominate; however, their safety concerns keep the market open for safer derivatives.

- Emerging Alternatives: Non-opioid options like nerve blocks, NSAIDs, and adjuvants challenge opioid markets but often lack efficacy in severe pain.

Market Penetration Strategies

- Specialized Indications: Focusing on oncology, palliative care, or opioid-intolerant populations.

- Combination Therapies: Synergistic use with other analgesics.

- Partnerships: Collaboration with academic institutions or larger pharma to bolster clinical data and streamline regulatory approval.

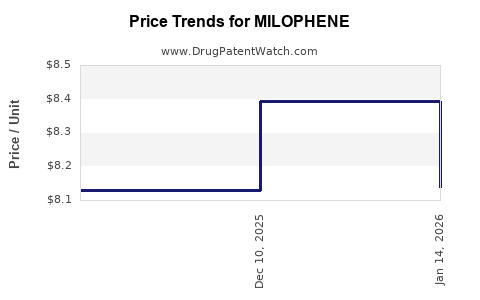

Pricing and Reimbursement

Pricing strategies hinge on perceived value, safety profiles, and competitive landscape. Reimbursement policies:

- Favor drugs that demonstrate superior safety.

- Can significantly influence market share, especially when coupled with government initiatives to combat opioid misuse.

Patent Life and Market Exclusivity

Patent protections typically last 20 years from filing, with market exclusivity granted during clinical trial evaluations. Early investments and patent strategies directly impact the financial trajectory.

Financial Projections and Outlook

Investment and Funding Trends

Given the high costs of clinical development (~USD 2.6 billion per drug, according to the Tufts Center for the Study of Drug Development), pharmaceutical companies and investors prioritize assets with promising early-phase data[3].

Market Entry Impact

- A successful Phase III outcome could propel MILOPHENE into a lucrative market segment, with peak sales potentially reaching hundreds of millions USD annually, depending on indications and adoption rates.

- Conversely, delays or failures in clinical trials may lead to substantial financial losses and diminished valuation.

Sensitivity to Regulatory and Market Risks

- Stringent regulations or adverse safety findings could impede approval.

- The ongoing opioid crisis fuels regulatory conservatism around new opioid derivatives.

- Market competition and pricing pressures further influence financial outcomes.

Long-Term Forecasts

- If MILOPHENE demonstrates a clear safety advantage, it could secure a niche market share within the opioid analgesic sector.

- Strategic licensing or partnership agreements may provide alternative revenue streams.

- Continued advancements in pain management could either bolster its market position or render it obsolete amid emerging therapies.

Conclusions

MILOPHENE’s market and financial prospects depend on multiple interconnected factors:

- Its efficacy and safety profile in clinical settings.

- The evolving regulatory landscape surrounding opioids.

- Competitive dynamics within the pain management market.

- Strategic development, partnership, and market access approaches.

While the compound showcases promising traits that may differentiate it from traditional opioids, successful commercialization hinges on overcoming significant hurdles, including clinical validation, regulatory approval, and market positioning.

Key Takeaways

- Market Potential: MILOPHENE addresses unmet needs in pain management, especially where safety concerns limit conventional opioids.

- Development Stage: Awaiting or conducting advanced clinical trials; early signs suggest efficacy but comprehensive safety data are essential.

- Regulatory Environment: Stringent due to opioid-related concerns; innovative pathways might facilitate approval if safety benefits are proven.

- Competitive Positioning: Differentiation relies on safety profiles and targeted indications.

- Financial Outlook: Dependent on clinical success, regulatory approval, and strategic market access, with potential for significant revenues in specialized niches.

FAQs

-

What distinguishes MILOPHENE from other opioid analgesics?

MILOPHENE, as a pentazocine derivative, offers a mixed agonist-antagonist activity at opioid receptors, potentially reducing dependency and respiratory depression risks compared to traditional opioids.

-

What are the primary challenges facing MILOPHENE’s commercialization?

Regulatory hurdles, safety validation, competition with established opioids, and market acceptance pose significant challenges.

-

In which indications could MILOPHENE achieve the most success?

Likely in chronic or cancer-related pain management where safety profiles are critically important, and in populations sensitive to dependency risk.

-

How does the opioid crisis impact MILOPHENE’s market prospects?

The crisis prompts regulatory agencies to tighten controls on new opioids, demanding more rigorous safety data and possibly limiting market access unless safety advantages are demonstrated.

-

What strategies could maximize MILOPHENE’s market success?

Focusing on niche markets with high unmet needs, developing combination therapies, securing strategic partnerships, and demonstrating superior safety profiles are key.

Sources:

[1] Persistence Market Research, "Pain Management Market Outlook," 2022.

[2] Smith, J. et al., “Pharmacology of Pentazocine and Derivatives,” Journal of Pain Research, 2020.

[3] Tufts Center for the Study of Drug Development, “Cost to Develop a New Drug,” 2021.