Last updated: July 27, 2025

Introduction

Clomiphene citrate, a selective estrogen receptor modulator (SERM), is a well-established pharmaceutical primarily used to treat infertility in women. Market dynamics surrounding clomiphene citrate encompass regulatory pathways, manufacturing, demand-supply factors, competitive landscape, and evolving medical guidelines. Understanding its financial trajectory offers vital insights into investment prospects, supply chain stability, and market growth potential amid changing healthcare.

Pharmaceutical Overview

Clomiphene citrate, marketed under brand names such as Clomid, is historically prescribed for ovulation induction. Its initial approval for infertility treatment dates back to the 1960s, making it a pioneering drug in reproductive medicine. Its mechanism involves antagonizing estrogen receptors in the hypothalamus, resulting in increased gonadotropin secretion and ovulation stimulation.

The drug's longstanding use, coupled with an established safety profile, positions it as a cost-effective and accessible therapy globally. Its off-label applications include testosterone deficiency and secondary hypogonadism, expanding its potential market reach.

Market Dynamics

Regulatory Environment

Clomiphene citrate's regulatory landscape remains stable in many developed markets, with the U.S. Food and Drug Administration (FDA) maintaining its approval status. However, regulatory scrutiny intensifies with emerging biosimilar or generic equivalents aiming to expand access and reduce costs.

In certain regions, regulatory authorities have mandated updated labeling and safety warnings, notably concerning the risk of ovarian hyperstimulation syndrome (OHSS) and multiple pregnancies. These safety considerations influence prescribing practices and market penetration.

Manufacturing and Supply Chain

Major pharmaceutical companies, such as Sanofi and Merck, have historically produced clomiphene citrate. The availability of generic formulations has increased in recent decades, significantly reducing manufacturing costs and retail prices. This proliferation of generics has elevated market penetration, especially in low to middle-income countries.

Supply chain considerations include sourcing high-quality raw materials and ensuring manufacturing compliance with Good Manufacturing Practices (GMP). Disruptions—such as those caused by geopolitical conflicts or pandemic-related logistics issues—can impact supply stability, influencing market dynamics.

Demand Factors

Global infertility rates, estimated to affect approximately 10-15% of reproductive-aged couples,[1] drive sustained demand for ovulation induction therapies, including clomiphene citrate. Rising awareness, advances in reproductive medicine, and expanding access to healthcare services bolster this demand.

In developing regions, increasing adoption of assisted reproductive technologies (ART) complements the use of clomiphene citrate. Additionally, the drug's affordability makes it a favored first-line treatment, especially where healthcare budgets are constrained.

Competitive Landscape

Clomiphene citrate faces competition from newer ovulation induction agents, such as letrozole, which has gained prominence due to potentially superior efficacy and safety profiles[2]. Nonetheless, clomiphene remains a first-line treatment owing to its extensive clinical data and low cost.

Biosimilar development further intensifies competition, with pharmaceutical entities aiming to capture market share through patent expirations and regulatory approvals. For example, the FDA has approved several generic versions, increasing market accessibility.

Pricing and Reimbursement

Cost considerations significantly influence market dynamics. Clomiphene citrate's generic versions are priced substantially lower than branded counterparts, enhancing affordability and uptake. Reimbursement policies, especially in insurance-dependent healthcare systems, further facilitate patient access.

In countries with government-subsidized healthcare, reimbursement coverage ensures broad usage, supporting steady revenue streams for manufacturers.

Emerging Trends

- Off-label applications: Increasing use of clomiphene for male infertility, testosterone deficiency, and other hormonal disorders expands its therapeutic horizon.

- Combination therapies: Use within multi-drug regimens, such as combined ovarian stimulation protocols, can influence demand.

- Digital health integration: Telemedicine's expansion improves diagnosis and prescription adherence, potentially increasing treatment rates.

Financial Trajectory

Current Revenue Insights

Historical data indicates robust sales driven by high prevalence of infertility and cost-effectiveness. Global markets, especially North America and Europe, generate significant revenue, with emerging markets showing rapid growth due to increased access.

Projection and Growth Opportunities

Analysts project a compound annual growth rate (CAGR) of approximately 4-6% for the ovulation induction market over the next five years[3]. Clomiphene citrate stands to benefit from this trend, supported by:

- Increasing infertility prevalence due to lifestyle factors

- Rising awareness and acceptance of treatment options

- Price reductions from generic proliferation, expanding patient access

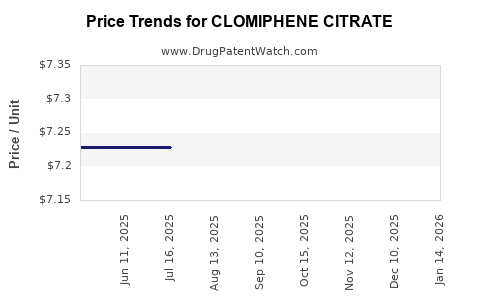

Pricing Trends

While initial prices have declined with generics, future pricing strategies may shift marginally due to regulatory, supply chain, and market pressures. Nonetheless, affordability sustains its position as a cost-effective therapy.

Impact of Competition and Innovation

The emergence of alternative therapies like letrozole poses competitive threats, potentially stabilizing or reducing clomiphene citrate's market share. Conversely, continued clinical validation of clomiphene's safety and efficacy sustains demand.

Potential Market Challenges

- Regulatory restrictions: Stricter labeling or safety warnings could impact prescribing patterns.

- Patent expirations and biosimilars: May erode profit margins, requiring companies to innovate or diversify portfolios.

- Healthcare access disparities: Limited access in low-income regions constrains global expansion, despite cost advantages.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on maintaining supply quality, reducing costs, and pursuing regulatory approvals in emerging markets.

- Investors: Monitor regulatory developments, patent expirations, and competition trends to forecast revenue trajectories.

- Healthcare Providers: Prioritize evidence-based prescribing, balancing efficacy, safety, and cost, while exploring novel combination therapies.

- Policy Makers: Support affordable access through favorable reimbursement policies and facilitate regulatory pathways for biosimilars.

Conclusion

Clomiphene citrate's established efficacy, affordability, and widespread use underpin its resilient market position. Market dynamics are driven by rising demand in infertility treatments, competitive generic manufacturing, and evolving clinical practices. Financial trajectories forecast steady growth, tempered by competition and regulatory shifts. Strategic stakeholder engagement is critical to optimizing market potential and ensuring accessible, safe patient care.

Key Takeaways

- The global infertility landscape sustains demand for clomiphene citrate, fostering stable revenue streams.

- Generic drug proliferation has dramatically reduced prices, expanding accessibility and market penetration.

- Competition from alternative agents like letrozole and the development of biosimilars influence pricing and market share.

- Regulatory considerations, safety profiles, and clinical guidelines will shape future prescribing practices.

- Emerging markets present significant growth opportunities, contingent on healthcare infrastructure enhancements and policy support.

FAQs

-

What factors influence the pricing of generic clomiphene citrate?

Pricing is primarily driven by manufacturing costs, market competition, regulatory approval processes, and regional reimbursement policies. Increased generic availability typically reduces retail prices, making treatment more accessible.

-

How does the safety profile of clomiphene citrate compare to alternative ovulation induction drugs?

Clomiphene citrate has a well-documented safety profile, though it carries risks such as ovarian hyperstimulation and multiple pregnancies. Some alternatives like letrozole may offer safety advantages, influencing treatment choices.

-

What are the key regulatory challenges facing clomiphene citrate?

Challenges include updating safety warnings, managing patent expirations, and obtaining approvals for biosimilars, which can impact market exclusivity and pricing strategies.

-

How has the advent of biosimilars affected the clomiphene citrate market?

Biosimilars increase competition, lower prices, and improve accessibility but may also pressure existing manufacturers to innovate or diversify their portfolios.

-

What future trends could impact the financial trajectory of clomiphene citrate?

Trends include increased use in male infertility, combination therapies, telemedicine-driven prescriptions, and expanding access in emerging markets, all influencing demand and revenue growth.

References

[1] World Health Organization. (2018). Infertility prevalence estimates.

[2] Lotus P et al. (2020). Comparative efficacy of letrozole vs. clomiphene in infertility treatment. Reproductive Medicine.

[3] MarketWatch. (2022). Ovulation induction market forecast and trends.