Last updated: July 29, 2025

Introduction

MICARDIS HCT (telmisartan/hydrochlorothiazide) symbolizes a significant therapeutic solution within the antihypertensive medication landscape. Combining an angiotensin II receptor blocker (ARB) with a thiazide diuretic, MICARDIS HCT offers synergistic blood pressure control, targeting a broad patient demographic. As hypertension remains a pervasive global health concern, understanding its market dynamics and financial trajectory reveals critical insights for pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview of MICARDIS HCT

Therapeutic Positioning and Indications

Developed by Boehringer Ingelheim, MICARDIS HCT is positioned within the global antihypertensive market, primarily reimbursed for managing hypertension and preventing consequent cardiovascular events. Its fixed-dose combination (FDC) improves patient compliance by reducing pill burden compared to separate formulations of telmisartan and hydrochlorothiazide.

Market Penetration and Prescribing Trends

Since its launch, MICARDIS HCT has gained acceptance among cardiologists and primary care physicians. Prescribing trends inform market penetration, which is influenced by:

- Efficacy and safety profile: Demonstrated in clinical trials, MICARDIS HCT shows favorable tolerability, especially for patients with resistant hypertension.

- Formulation convenience: FDCs improve adherence, which aligns with current trends favoring simplified medication regimens.

- Competitive landscape: Alternatives such as other ARB/thiazide combinations (e.g., valsartan/HCTZ, losartan/HCTZ) compete on efficacy, pricing, and marketing efforts.

Key Market Drivers

- Rising prevalence of hypertension globally, particularly in emerging markets.

- Increasing awareness and emphasis on cardiovascular risk reduction.

- Favorable reimbursement policies and continued inclusion in clinical guidelines.

- Expansion of fixed-dose combination therapies.

Market Dynamics Influencing MICARDIS HCT

Global Hypertension Burden

With over 1.2 billion adults affected globally, hypertension remains a leading cause of cardiovascular morbidity and mortality. The World Health Organization (WHO) projects that hypertension prevalence will grow to approximately 1.56 billion by 2025 [1]. This growth fuels demand for effective antihypertensive agents, including MICARDIS HCT.

Regulatory and Reimbursement Environment

Regulatory approvals, especially in emerging markets, facilitate broader access. Conversely, price governance and reimbursement constraints aim to balance affordability with innovation. In several jurisdictions, government tenders and price caps influence market volume and revenue potential.

Innovation and Formulation Developments

The pharmaceutical industry continuously explores next-generation ARB combinations with enhanced efficacy and safety profiles. While MICARDIS HCT remains a trusted option, competition from newer agents with improved pharmacokinetics or additional therapeutic benefits could impact its market share.

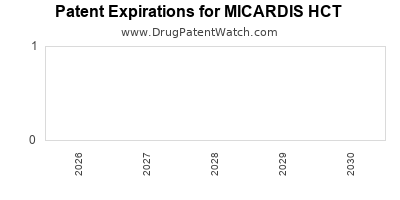

Generics and Biosimilars Impact

Patent expirations of telmisartan and hydrochlorothiazide have facilitated the entry of generics, exerting downward pressure on prices. The availability of generics impacts revenues but also broadens access, potentially expanding the overall market.

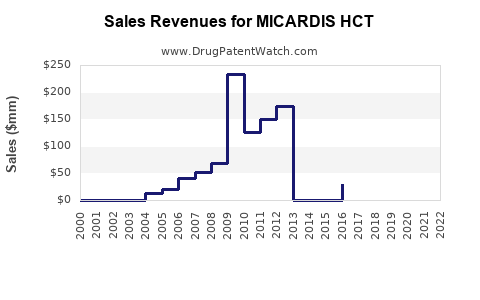

Financial Trajectory of MICARDIS HCT

Revenue Forecasts and Market Share

Boehringer Ingelheim's strategic positioning forecasts steady revenue streams from MICARDIS HCT, driven by:

- Growth in hypertension prevalence.

- Increasing adoption of fixed-dose combinations.

- Geographic expansion into emerging markets.

Global antihypertensive drug market estimates project a CAGR of approximately 4-6% over the next five years [2]. As part of this, MICARDIS HCT’s revenues are expected to grow proportionally, with potential acceleration in regions experiencing healthcare infrastructure expansion.

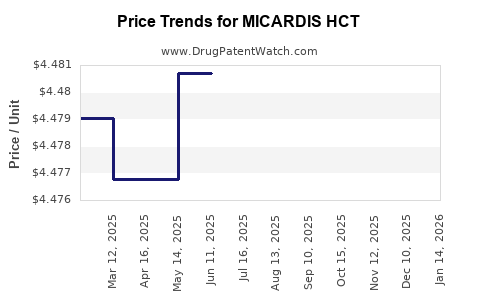

Pricing and Competitive Dynamics

Pricing strategies influence profitability. In mature markets, price erosion due to generics reduces margins, but volume increases may offset this. Premium formulations or combination therapies with additional benefits may command higher prices, although market saturation limits pricing flexibility.

Research and Development (R&D) Investiture

Investments in clinical trials comparing MICARDIS HCT to newer agents and exploring expanded indications could shape future revenue streams. However, R&D expenses also impact net margins.

Pipeline and Lifecycle Management

Booth’s ongoing lifecycle strategies, such as new formulations or unapproved indications, may extend product relevance, influencing financial outlooks favorably.

Challenges and Opportunities

Challenges

- Market saturation in developed countries due to high generic penetration.

- Price competition and reimbursement pressures reducing profit margins.

- Regulatory hurdles in new markets or for line extensions.

- Competition from novel mechanisms of action and combination therapies.

Opportunities

- Expansion into emerging markets with high hypertension prevalence.

- Formulation innovations, such as once-daily dosing or combination with other antihypertensives.

- Strategic partnerships to enhance distribution channels.

- Incorporation into combination regimens targeting resistant hypertension.

Conclusion

The financial trajectory of MICARDIS HCT hinges on global hypertension trends, regulatory factors, and competitive dynamics. While patent expirations and generic entry present challenges, expanding markets and formulation innovations maintain its fiscal viability. Stakeholders should monitor regional growth patterns, pricing strategies, and clinical advancements to optimize investment returns and ensure steady growth.

Key Takeaways

- The global rise in hypertension sustains demand for fixed-dose antihypertensives like MICARDIS HCT.

- Patent expirations and generic competition pressure pricing but can expand overall market access.

- Emerging markets with high disease prevalence offer significant growth opportunities.

- Formulation innovation and pipeline development are vital to sustaining market share.

- Strategic positioning regarding pricing, distribution, and clinical differentiation shapes long-term financial success.

FAQs

1. How does MICARDIS HCT compare to other ARB/thiazide combinations in the market?

MICARDIS HCT is distinguished by its efficacy and safety profile, along with its once-daily dosing. However, competition from generic alternatives and newer agents requires ongoing differentiation strategies.

2. What impact will patent expirations have on MICARDIS HCT’s revenue?

Patent expirations typically lead to generic entry, exerting downward pricing pressure but also expanding the accessible patient base, which can offset reduced margins through increased volume.

3. Which geographic regions represent the most promising growth opportunities?

Emerging markets across Asia, Latin America, and Africa present high-growth opportunities due to rising hypertension prevalence, improving healthcare infrastructure, and increasing affordability.

4. How might future developments in hypertension management affect MICARDIS HCT?

Advances in novel drug mechanisms, personalized medicine, and combination therapies could influence market share. However, established drugs like MICARDIS HCT will likely remain relevant through lifecycle management and expanding indications.

5. What strategic actions should stakeholders consider to capitalize on MICARDIS HCT’s market potential?

Investing in pipeline innovations, expanding into high-growth regions, fostering payer relationships, and differentiating formulations can improve market positioning and financial outcomes.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] MarketsandMarkets. (2022). Hypertension Therapeutics Market Forecast.