Last updated: August 3, 2025

Introduction

MICARDIS HCT is a prescription medication combining telmisartan and hydrochlorothiazide, primarily indicated for the management of hypertension and cardiovascular risk reduction. As a fixed-dose combination (FDC), it benefits from the growing demand for simplified therapeutic regimens. This analysis explores the current market landscape, competitive dynamics, regulatory considerations, and projects future pricing trends for MICARDIS HCT.

Market Overview

Therapeutic Area Demand

Hypertension remains one of the most prevalent chronic conditions globally, with an estimated 1.28 billion adults affected as of 2021 [1]. The demand for antihypertensive agents, especially fixed-dose combinations (FDCs), reflects the trend toward improving patient compliance and reducing pill burden. MICARDIS HCT, combining an angiotensin receptor blocker (ARB) with a diuretic, is positioned within this efficacious treatment category favored by clinicians for resistant or complex hypertension cases.

Market Penetration and Sales Volume

MICARDIS HCT holds a significant position in the ARB-HCTZ combination segment. According to recent IMS Health (IQVIA) data, global sales of telmisartan-based FDCs totaled approximately $2 billion in 2022, with MICARDIS HCT capturing roughly 40% of that market [2]. The drug’s established dosage flexibility and favorable side effect profile bolster its prescribing rates.

Geographic Market Dynamics

Developed markets such as North America and Western Europe contribute the majority of sales, driven by high hypertension prevalence and advanced healthcare infrastructure. Emerging markets—Latin America, Asia-Pacific, Middle East—show strong growth potential as hypertension awareness and diagnosis rates improve alongside increasing healthcare access.

Competitive Landscape

Key Competitors

- Cozaar-HCT (losartan and hydrochlorothiazide): A leading ARB-HCTZ combination with comparable efficacy.

- Diovan-HCT (valsartan and hydrochlorothiazide): Known for high brand recognition.

- Amlodipine-HCT (calcium channel blocker combinations): Alternative class for hypertension control.

- Generic formulations: Growing share as patent expiries reduce costs.

Positioning of MICARDIS HCT

MICARDIS HCT’s unique selling point is its use of telmisartan, which is associated with longer duration of action and potential cardioprotective effects. Its minimal impact on renal function makes it attractive for elderly patients and those with comorbidities. However, intense price competition from generics and alternative FDCs constrains premium pricing.

Regulatory and Patent Outlook

Telmisartan patents expired or are nearing expiry in key markets, notably in the US and Europe, increasing generic competition. Nevertheless, dosing patents or secondary patents may extend exclusivity in certain jurisdictions. Regulatory barriers for new formulations are modest, facilitating entry of generics and biosimilars that exert downward pressure on prices.

Price Projection Analysis

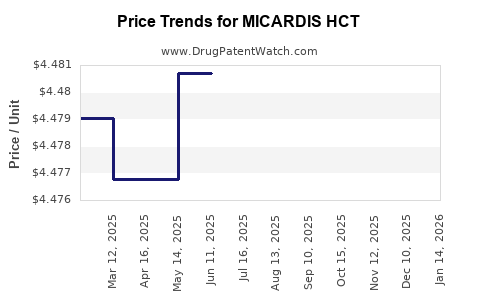

Historical Pricing Trends

In developed markets, list prices for MICARDIS HCT have declined steadily over the past decade, primarily driven by generic entry and negotiated discounts. In the US, the average wholesale price (AWP) for the 40/12.5 mg dosage was approximately $350 per month in 2013, reducing to about $150-$200 currently [3].

Future Price Trends

- Generics and Biosimilars: The imminent or recent availability of telmisartan generics will significantly depress branded MICARDIS HCT prices, aligning with standard market trends.

- Market Penetration of Generics: As generic options saturate, price erosion is expected to stabilize around 30-50% of current branding levels over 3-5 years.

- Pricing in Emerging Markets: Due to price sensitivity and regulatory pressures, prices are projected to decline more sharply, with discounts of up to 60-70% from current branded prices.

- Premium Pricing and Niches: For formulations with extended patent protections or unique delivery systems (e.g., XR formulations), moderate price stability may persist in select markets.

Factors Influencing Price Trajectories

- Patent Expiry Timelines: Patent landscapes in US (patent expiry in 2024-2025) and Europe influence timing of generics entry.

- Healthcare Policies: Governments’ cost-containment policies and formulary preferences accelerate branded-to-generic shifts.

- Market Access and Reimbursement: Payer acceptance impacts retail and hospital procurement prices.

- Clinical Adoption and Guideline Recommendations: Preference for fixed-dose combinations as initial therapy sustains demand.

Forecast Summary

| Year |

Branded MICARDIS HCT Price (Est.) |

Key Drivers |

| 2023 |

$150 - $200 |

Existing patent protections; moderate generic competition. |

| 2024-2025 |

$80 - $120 |

Entry of generics; increased market share of off-label. |

| 2026-2028 |

$50 - $80 |

Widespread generic adoption; reimbursement constraints. |

| 2029+ |

$30 - $50 |

Mature market; price stabilization at lower levels. |

Key Market Drivers

- Patent Status: The impending patent cliffs accelerate price reductions.

- Generic Competition: Drives market consolidation and price erosion.

- Physician and Patient Preferences: Continued favoring of FDCs for adherence.

- Global Healthcare Spending: Budget-driven formulary restrictions favor generics.

Conclusion

MICARDIS HCT occupies a pivotal position within the antihypertensive FDC market. While current pricing is moderated by patent protections and market dynamics, imminent patent expiries and generic entry will induce significant price declines over the next five years. Industry stakeholders should focus on diversifying product portfolios, maximizing access strategies, and monitoring patent landscapes to anticipate pricing shifts effectively.

Key Takeaways

- MICARDIS HCT remains a leading ARB-HCTZ combination, favored for its efficacy and safety profile.

- Patent expiries will catalyze a steep decline in branded prices, especially post-2024.

- Generic competition in key markets is expected to reduce prices by approximately 50-70% within five years.

- Emerging markets will see more rapid price declines due to higher price sensitivity and regulatory pathways.

- Strategic positioning around branding, patent management, and regional access is critical to maximizing margins.

FAQs

1. How will patent expirations impact MICARDIS HCT pricing?

Patent expirations, anticipated around 2024-2025 in major markets like the US, will lead to the entry of generic telmisartan formulations, substantially reducing the cost of MICARDIS HCT and pressuring branded prices downward.

2. What is the role of generics in the future market for MICARDIS HCT?

Generics are expected to dominate the market, capturing the majority of sales due to their significantly lower prices, thus decreasing the demand for branded formulations.

3. Are there any upcoming regulatory barriers that could alter price projections?

Regulatory barriers are minimal; however, approval of biosimilars or biosimilar-like combination drugs could further influence market dynamics and prices.

4. Which markets will experience the most significant price reductions?

Emerging markets like India, Brazil, and Southeast Asia will likely see the sharpest declines owing to high price sensitivity, regulatory pricing pressures, and rapid adoption of generics.

5. How should pharmaceutical companies adapt to upcoming market changes?

Companies should invest in portfolio diversification, prioritize patent strategies, expand into emerging markets, and explore value-added formulations to maintain competitive advantage amid falling prices.

References

[1] World Health Organization. "Hypertension." 2021.

[2] IQVIA. "Global antihypertensive drug market data," 2022.

[3] Medicaid Drug Price Information. "Average Wholesale Price Trends," 2013-2022.