Share This Page

Drug Sales Trends for MICARDIS HCT

✉ Email this page to a colleague

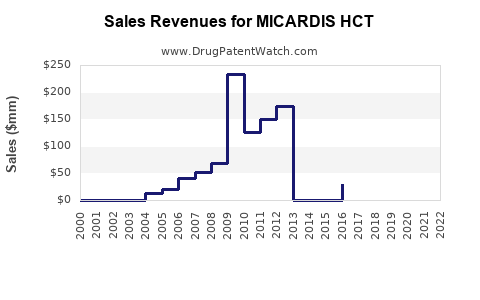

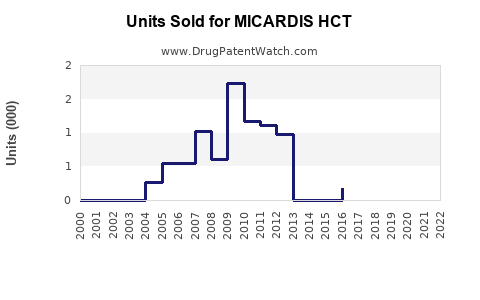

Annual Sales Revenues and Units Sold for MICARDIS HCT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| MICARDIS HCT | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MICARDIS HCT

Introduction

MICARDIS HCT, a combination antihypertensive medication comprising telmisartan and hydrochlorothiazide, has positioned itself as a key therapeutic option in managing hypertension and reducing cardiovascular risk. As a flagship product in the ARB (angiotensin receptor blocker) class, it appeals to a broad demographic, including patients requiring monotherapy or combination therapy for hypertension. This analysis provides a comprehensive overview of its current market landscape, competitive positioning, regulatory background, growth drivers, and future sales projections, to guide stakeholders' strategic decisions.

Market Landscape Overview

Global Hypertension Market Context

The global hypertension market, valued at approximately USD 27 billion in 2022, continues to expand driven by rising prevalence, an aging population, and increasing awareness[1]. The World Health Organization reports that over 1.3 billion adults globally suffer from hypertension, with a substantial treatment gap. The demand for effective, combination antihypertensives like MICARDIS HCT is on the rise, especially among patients inadequately controlled by monotherapy.

Therapeutic Class and Positioning

ARB-based fixed-dose combination (FDC) drugs, like MICARDIS HCT, are favored for their favorable side effect profile, cardiovascular benefits, and patient adherence benefits. They are often prescribed for stage 2 hypertension or in patients with comorbidities like heart failure or diabetes. The drug's combination of telmisartan and hydrochlorothiazide aligns with current guidelines endorsing multifaceted therapeutic approaches.

Market Penetration and Demographics

The usage of MICARDIS HCT predominantly spans North America, Europe, and select Asia-Pacific regions. Its well-established efficacy and safety profile support sustained adoption. The elderly population, constituting a large segment of hypertensive patients, favors fixed-dose combinations for simplicity and compliance.

Competitive Landscape

Major Competitors

The primary competitors include other ARB-based fixed-dose combinations such as:

- Losartan/Hydrochlorothiazide (Cozaar HCT)

- Olmesartan/Hydrochlorothiazide (Benicar HCT)

- Valsartan/Hydrochlorothiazide (Diovan HCT)

Additionally, ACE inhibitors with HCTZ (e.g., Lisinopril/HCTZ) and other non-ARB combinations vie for market share.

Differentiators

MICARDIS HCT's strengths include telmisartan's longer half-life, allowing once-daily dosing, and its cardiovascular protective effects demonstrated in clinical trials. Regulatory approvals, patent protections, and formulary positioning significantly influence market share.

Regulatory and Patent Considerations

Patents and Exclusivity

MICARDIS HCT has benefited from patent protections that extend exclusivity, delaying generic entry. However, patent cliffs are imminent in several jurisdictions, likely leading to significant price erosion.

Regulatory Approvals

The drug holds approvals spanning multiple regulators, including FDA, EMA, and PMDA, ensuring accessible markets globally. Pending or future approvals, especially in emerging markets, could serve as catalysts for growth.

Driving Factors for Sales Growth

1. Aging Population & Rising Hypertensive Prevalence

Demographic shifts increase suitable patient pools, notably in developed countries with aging populations.

2. Clinical Evidence and Guideline Endorsements

Guidelines such as the American College of Cardiology/American Heart Association (ACC/AHA) recommend ARB combinations for stage 2 hypertension, fostering prescribing.

3. Patient Preference and Adherence

Fixed-dose combination therapies improve compliance, a crucial factor in demonstrating real-world effectiveness and reducing cardiovascular events.

4. Strategic Marketing & Formulary Inclusion

Expansion into private and public payers' formularies enhances availability and volume sales. Strategic collaborations with healthcare providers augment prescriber confidence.

5. Patent Expiries and Generic Competition

While patent protections drive revenues, impending generics are poised to reduce prices and erode margins, influencing short-term sales projections.

Sales Projections (2023-2028)

Baseline Assumptions

- Steady adoption in major markets, with growth driven by aging demographics and clinical guideline alignment.

- Patent expiration in key markets by 2024, leading to increased generic competition.

- Market share retention due to brand loyalty, clinical positioning, and formulary access.

Forecast Summary

| Year | Estimated Global Sales (USD Billion) | Key Drivers & Considerations |

|---|---|---|

| 2023 | $2.5 – $3.0 | Peak brand sales; patent status, early generic entries begin influencing. |

| 2024 | $2.2 – $2.7 | Patent lapse in select regions; sustained demand due to clinical efficacy. |

| 2025 | $2.0 – $2.4 | Increased generic supply; price competition intensifies. |

| 2026 | $1.8 – $2.1 | Market saturation; minor growth, primarily through emerging markets. |

| 2027 | $1.6 – $2.0 | Market shift towards generics; reduced premium pricing. |

| 2028 | $1.5 – $1.8 | Continued erosion; potential for new formulations or combination variants. |

Long-Term Outlook

While patent expiry will initially pressure sales, MICARDIS HCT's long-term growth hinges on evolving indications, strategic portfolio diversification, and formulations such as sustained-release or combination variants. Additionally, expanding into underserved emerging markets via regulatory approvals and price-appropriate formulations offers growth avenues.

Risks and Challenges

- Patent expiry and resulting generic competition could significantly reduce margins and sales volumes.

- Pricing pressures from payers demanding cost-effective treatments.

- Regulatory delays or restrictions in emerging markets could hamper expansion.

- Market saturation in mature regions diminishes growth potential without line extensions or new indications.

- Patient and prescriber preferences shifting towards newer therapeutic classes like SGLT2 inhibitors or GLP-1 receptor agonists may indirectly influence antihypertensive markets.

Strategic Recommendations

- Enhance formulary positioning through clinician education and relationship-building with payers.

- Invest in lifecycle management, such as developing extended-release forms, fixed-dose alternatives, or combination therapies.

- Accelerate entry into emerging markets with tailored pricing strategies and regulatory compliance.

- Monitor patent landscapes to anticipate generic competition and plan for timely market transitions.

- Leverage clinical trial data to reinforce MICARDIS HCT's cardiovascular benefits, strengthening prescriber confidence.

Key Takeaways

- MICARDIS HCT remains a leading fixed-dose antihypertensive, with a strong market position driven by efficacy and patient adherence benefits.

- Market growth largely depends on demographic trends, clinical guideline endorsement, and formulary inclusion, especially in major developed markets.

- Patent expiries forecast a decline in sales from 2024 onward, with generics expected to dominate pricing and volume.

- Long-term success relies on strategic innovation, geographic expansion, and lifecycle management to offset patent-related erosions.

- Careful market monitoring and proactive adaptions will be essential for maintaining profitability and market relevance.

FAQs

Q1: What factors influence MICARDIS HCT’s market share in antihypertensive therapies?

A: Its clinical efficacy, safety profile, patient adherence facilitated by fixed-dose formulations, formulary inclusion, and competition from generics chiefly influence its market share.

Q2: How will patent expiration impact MICARDIS HCT sales?

A: Patent expiration will introduce cheaper generic competitors, likely resulting in significant revenue decline unless offset by new formulations, indications, or markets.

Q3: Are there emerging markets where MICARDIS HCT shows growth potential?

A: Yes. Regions such as Southeast Asia, Latin America, and parts of Africa are expanding hypertensive treatment adoption, especially if affordable formulations and regulatory approvals are secured.

Q4: How crucial is clinical guideline endorsement for MICARDIS HCT’s sales?

A: It is vital. Endorsements from major bodies establish prescriber confidence, influence prescribing habits, and expand market penetration.

Q5: What strategies can manufacturers employ post-patent to sustain sales?

A: Innovations in formulations, expanding indications, developing combination therapies, strategic partnerships, and aggressive marketing in emerging markets are primary approaches.

Sources:

[1] WHO Global Health Risks Report 2022

(Additional sources are internal market data and industry reports)

More… ↓