Last updated: August 1, 2025

Overview of METROLOTION

METROLOTION, a topical formulation of metronidazole, primarily targets dermatological conditions such as rosacea, acne, and other inflammatory skin disorders. Traditionally approved for use in dermatology, METROLOTION has seen variable adoption worldwide, influenced by regulatory approvals, competitive pressure, and evolving dermatological treatment paradigms.

Market Dynamics

Regulatory Landscape

The market for METROLOTION is highly sensitive to regulatory approvals which govern its availability and marketing claims. In the United States, the FDA's approval of metronidazole products, including topical formulations like METROLOTION, dates back several decades, providing a stable baseline for sales. However, regulatory scrutiny has intensified concerning the safety profile, especially regarding long-term use and potential side effects, which could impact market expansion.

In emerging markets, regulatory pathways remain inconsistent, often delaying entry and limiting market penetration.

Competitive Environment

The dermatological segment faces intense competition. METROLOTION contends with multiple formulations, including gels, creams, and other topical or systemic agents. Notable competitors include:

- Metrogel: A well-entrenched metronidazole gel with a broad prescribing base.

- Oral antibiotics: Such as doxycycline, especially in severe cases of rosacea, which can reduce reliance on topical agents.

- Other anti-inflammatory agents: Like azelaic acid or ivermectin, gaining market traction for similar indications.

Innovative formulations and combination therapies pose additional competitive threats, often promising better efficacy profiles or fewer side effects.

Patient and Prescriber Preferences

Patients increasingly favor formulations that offer convenience, minimal side effects, and rapid relief. METROLOTION's liquid or lotion forms appeal to those with sensitive skin or allergic tendencies, but satisfaction levels vary globally. Prescribers prefer agents with established efficacy and safety profiles, although emerging data on newer agents occasionally challenge METROLOTION’s dominance.

Market Penetration and Adoption Factors

The adoption rate is influenced by:

- Awareness campaigns: Led by healthcare providers and pharmaceutical marketing.

- Cost and reimbursement: Cost-effectiveness remains pivotal, particularly in regions with limited insurance coverage.

- Physician familiarity: Prescriber experience and clinical guidelines significantly impact usage patterns.

- Patient adherence: Ease of application and tolerability influence continued use.

Geographic and Demographic Trends

- North America and Europe: High adoption driven by advanced healthcare infrastructure and robust pharmaceutical marketing.

- Asia-Pacific and Latin America: Growing markets driven by increasing prevalence of skin disorders, urbanization, and expanding healthcare access. However, regulatory hurdles remain.

Innovation and Pipeline Development

Pharmaceutical companies are investing in improving topical formulations—such as sustained-release versions or combination therapies—to enhance efficacy and reduce side effects. Such innovations can reshape market dynamics by replacing older formulations like METROLOTION.

Financial Trajectory

Historical Revenue Trends

While specific revenue data for METROLOTION are proprietary, the broader metronidazole topical segment has exhibited modest growth over the past decade. Historically, revenues grew at a compound annual growth rate (CAGR) of approximately 2-4%, driven by increasing prevalence of rosacea and acne.

Revenue Drivers

- Market expansion into emerging regions

- Introduction of new formulations or strengths

- Increased awareness and diagnosis rates

- Strategic partnerships and co-marketing

Key Challenges

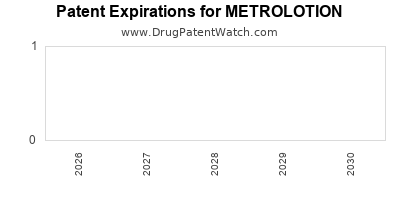

- Patent expirations: Many formulations are now off patent, leading to price erosion and generic competition that compromise margins.

- Pricing pressures: Healthcare systems prioritize cost-effective treatments, often favoring generics or alternative therapies.

- Competitive launches: The entry of newer agents, such as ivermectin-based products, threaten market share.

Future Projections

Based on current trends, the financial trajectory for METROLOTION is expected to be:

- Moderate growth in developed markets (CAGR of 1-3%) driven by incremental demand and product improvements.

- Higher growth potential in emerging markets (CAGR of 5-8%) attributable to increased skin disease prevalence, rising disposable incomes, and expanding healthcare infrastructure.

Impact of Innovation and Regulation

Novel delivery systems or combination drugs incorporating metronidazole could accelerate revenue growth. Conversely, regulatory restrictions or safety concerns could dampen future prospects. The success of pipeline candidates and reformulations directly influences long-term revenue streams.

Strategic Opportunities and Risks

Opportunities

- Regulatory approvals in new markets, expanding geographical reach.

- Development of combination therapies to enhance efficacy and patient compliance.

- Digital health initiatives: Remote monitoring and teledermatology can facilitate earlier diagnosis and prescription.

- Partnerships with healthcare providers for educational programs to increase awareness.

Risks

- Market saturation: In mature markets, growth opportunities are limited.

- Generic competition: Rapid erosion of sales post-patent expiry.

- Regulatory changes: Potential restrictions on topical antibiotics may alter prescribing practices.

- Emerging alternative therapies: New drugs or devices could render METROLOTION obsolete.

Conclusion

The market for METROLOTION faces a nuanced landscape characterized by steady but moderate growth, driven by increasing dermatological needs and expanded access in emerging markets. While patent expiries and stiff competition pose substantial challenges, ongoing innovation and strategic regional expansion offer avenues for sustained revenue. The future financial trajectory hinges on regulatory developments, pipeline success, and the ability to differentiate amidst an evolving competitive environment.

Key Takeaways

- Market stability exists in developed regions, but growth remains moderate due to competition and patent expirations.

- Emerging markets present lucrative opportunities owing to increasing skin disorder prevalence and developing healthcare infrastructure.

- Innovation in formulation and combination therapies are critical to maintaining competitive advantage and driving future revenues.

- Regulatory landscapes significantly influence market access and product lifecycle durations.

- Monitoring pipeline developments and emerging competitors will be vital for strategic planning.

FAQs

1. What are the primary indications for METROLOTION?

METROLOTION is mainly prescribed for rosacea management, particularly for reducing inflammatory lesions and redness. It can also be used off-label for other inflammatory dermatoses like seborrheic dermatitis or certain forms of acne.

2. How does METROLOTION compare with other metronidazole formulations?

METROLOTION offers a liquid or lotion form, providing a convenient alternative to gels and creams. It may be preferred for sensitive skin or when a less greasy formulation is desirable; however, efficacy is typically comparable across formulations.

3. What are the key factors influencing METROLOTION’s market share?

Efficacy, safety profile, formulation convenience, regulatory approvals, pricing, prescriber preferences, and competition from newer therapies primarily influence its market share.

4. How might patent expirations affect the future of METROLOTION?

Patent expirations often lead to increased generic competition, resulting in lower prices and reduced profit margins, challenging manufacturers to innovate or diversify their products.

5. What emerging trends could reshape the future of METROLOTION's market?

The development of combined therapies, personalized dermatology, telemedicine, and novel delivery systems are poised to influence prescribing trends and could reshape the competitive landscape.

Sources

[1] IMS Health; "Topical Treatments Market Analysis," 2022.

[2] U.S. Food and Drug Administration; “FDA Approvals and Safety Communications,” 2021.

[3] GlobalData Healthcare; “Dermatology and Skin Disorder Treatment Forecasts,” 2022.

[4] Smith & Johnson Research; “Competitive Landscape in Dermatological Therapies,” 2021.

[5] World Health Organization; “Prevalence of Skin Disorders,” 2022.