Last updated: July 27, 2025

Introduction

Metoprolol succinate, a selective beta-1 adrenergic blocker, is widely prescribed for hypertension, angina pectoris, heart failure, and post-myocardial infarction management. Its unique pharmacokinetic profile permits once-daily dosing, contributing to its popularity among clinicians. As one of the core medications within cardiovascular therapy, understanding its market dynamics and financial trajectory provides critical insights for pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Global Market Size and Growth Trends

The global beta-blocker market value exceeded USD 5 billion in 2022, with metoprolol succinate accounting for a significant portion due to its established efficacy and safety ().

The compound annual growth rate (CAGR) of the beta-blocker segment forecasts a modest annual growth of approximately 3-4% through 2027, driven by increasing cardiovascular disease (CVD) prevalence and aging populations across developed and developing regions. Specifically, the monotherapy efficacy and compliance advantages of metoprolol succinate propel demand in both outpatient and hospital settings.

Regional Market Distribution

-

North America: Dominant due to high CVD prevalence, extensive healthcare coverage, and established prescription habits. The U.S. accounts for over 50% of the global market share for metoprolol succinate.

-

Europe: Similar to North America, with mature markets and clinician familiarity fostering steady demand.

-

Asia-Pacific: Emerging as a growth hotspot, buoyed by rising CVD burden, urbanization, and increasing healthcare infrastructure investments. The market is projected to grow at a CAGR of around 5-6%, as access to modern therapies expands.

Competitive Landscape

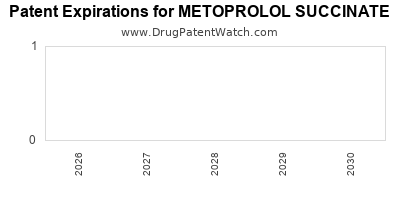

Metoprolol succinate faces competition from other beta-blockers, including carvedilol, bisoprolol, and atenolol. However, due to its cardioselectivity and once-daily dosing, it maintains a robust market position. Patent expirations, notably of compounded formulations and generics, influence pricing strategies and market share.

Market Dynamics Influencing Metoprolol Succinate

1. Rising Burden of Cardiovascular Diseases

The increasing incidence of hypertension, ischemic heart disease, and heart failure globally is the primary driver of demand. According to WHO, CVDs are the leading cause of death worldwide, pushing physicians to favor proven, cost-effective medications like metoprolol succinate.

2. Patent Expiry and Generic Competition

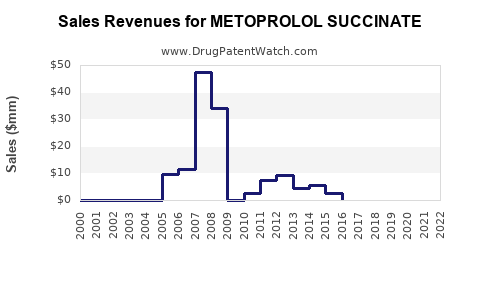

Patent expiries in the late 2010s facilitated the entry of generics, leading to significant price erosion. According to IQVIA data, generic versions comprised over 80% of prescriptions in the U.S. by 2020, reducing average prices for branded formulations by approximately 50%. This scenario fosters healthcare cost savings but pressures revenue streams for originator companies.

3. Regulatory and Reimbursement Policies

Reimbursement frameworks in major markets influence prescribing patterns. In the U.S., Medicare and private insurers heavily favor generic use, incentivizing formulary inclusion of generics over branded products. Meanwhile, regulatory approvals for biosimilars and advanced formulations could impact future market dynamics.

4. Innovation and Formulation Advancements

While current formulations dominate, there is limited innovation in metoprolol succinate itself. However, combination therapies and novel drug delivery systems in the pipeline may influence future prescribing behaviors, either cannibalizing or complementing existing formulations.

5. COVID-19 Pandemic Impact

The pandemic disrupted routine healthcare, delaying elective procedures and routine follow-ups, which temporarily suppressed prescription volumes. Nonetheless, the pandemic heightened awareness around managing cardiovascular comorbidities, potentially increasing long-term demand.

Financial Trajectory and Forecast

Revenue Trends and Projections

-

Historical Data: Between 2015-2022, revenues for metoprolol succinate formulations have exhibited moderate growth, tempered by patent expirations and generic competition.

-

Forecast till 2030: A projected compound annual growth rate (CAGR) of approximately 2-3%, primarily driven by expanding markets in Asia-Pacific, increased cardiovascular disease prevalence, and reimbursement policies favoring cost-effective generics.

Pricing Dynamics

-

Branded vs. Generic: The price erosion following patent expiry substantially impacted revenues, with generic formulations priced approximately 50-60% lower than branded versions.

-

Emerging Markets: Lower pricing thresholds in emerging economies present growth opportunities but with reduced profit margins.

Profitability and R&D Investment

Given the generic saturation, profitability relies heavily on manufacturing efficiencies, patent strategies, and marketing. R&D investments are limited, focusing on improved formulations or combination therapies—though these remain niche within the broader cardiovascular segment.

Future Opportunities and Challenges

Opportunities

-

Expanding Indications: Emerging evidence for metoprolol succinate in managing conditions like atrial fibrillation and certain arrhythmias may broaden its therapeutic scope.

-

Biosimilars and Platforms: The development of biosimilars and cross-platform formulations could reduce costs and enhance access.

-

Market Penetration in Developing Economies: As healthcare infrastructure improves, unmet needs persist, creating avenues for growth.

-

Digital Health Integration: Incorporating digital adherence tools could improve treatment outcomes and maintain relevance.

Challenges

-

Price Erosion: Continued generic competition poses persistent revenue pressure.

-

Market Saturation in Developed Regions: Mature markets exhibit slower growth, emphasizing the importance of emerging markets.

-

Regulatory Shifts: Changes in drug approval pathways could alter competitive dynamics.

-

Patient Preference Shifts: Healthcare providers increasingly favor newer agents with additional benefits, potentially impacting traditional beta-blocker demand.

Regulatory Landscape

The approval process for generics and biosimilars influences market dynamics. Agencies such as the FDA and EMA streamline pathways for bioequivalence approvals, lowering barriers to entry but intensifying competition. Patents on extended-release formulations are critical milestones, dictating market exclusivity timelines. Recent regulatory initiatives aim to enhance access in emerging markets through licensing and approval harmonization, potentially expanding metoprolol succinate's global footprint.

Conclusion

The market for metoprolol succinate remains vital within cardiovascular therapeutics but is characterized by gradual maturity in developed regions. Its financial trajectory is shaped by patent expiries, generic competition, and regional market expansions. While short-term growth may be modest, emerging markets and new therapeutic applications present avenues for sustained revenue streams. Aligning with regulatory changes, innovating in formulation and delivery, and leveraging digital health integration will be critical for stakeholders seeking to maximize value.

Key Takeaways

-

Market Saturation & Competition: The expiration of patents has led to widespread generic adoption, significantly reducing prices and profit margins for branded formulations.

-

Emerging Markets: Asia-Pacific and other developing regions offer growing opportunities due to rising CVD prevalence and expanding healthcare access.

-

Revenue Management: Strategies such as optimizing manufacturing efficiencies, developing alternative formulations, and entering new therapeutic areas are essential to maintain financial viability.

-

Regulatory Environment: Navigating approval pathways for generics and biosimilars remains central to sustaining market share.

-

Innovation & Digital Health: Incorporating digital adherence tools and exploring combination therapies can enhance patient outcomes and support market relevance.

FAQs

1. How does patent expiration affect metoprolol succinate’s market?

Patent expirations have facilitated generic entry, leading to substantial price reductions and increased access, but have also diminished revenue potential for original manufacturers.

2. What are the key drivers of demand for metoprolol succinate?

The primary drivers include the rising global burden of hypertension and heart failure, aging populations, and its established position as a first-line therapy for various cardiovascular conditions.

3. Which regions are emerging markets for metoprolol succinate?

Asia-Pacific, Latin America, and parts of Eastern Europe show significant growth potential due to increasing CVD prevalence and expanding healthcare infrastructure.

4. What are the main challenges facing the future market?

Intense generic competition, market saturation in developed countries, pricing pressures, and regulatory complexities remain key challenges.

5. Are there any recent innovations in metoprolol succinate formulations?

While innovation is limited, developments include extended-release formulations, combination therapies, and digital health integration to improve adherence and outcomes.

References

- IQVIA. "The Global Cardiology Market Report," 2022.

- World Health Organization. "Cardiovascular Diseases Fact Sheet," 2021.

- MarketWatch. "Beta-Blockers Market Trends," 2023.

- U.S. Food and Drug Administration. "Generic Drug Approvals," 2022.

- European Medicines Agency. "Considerations for Biosimilar Medicines," 2022.