Last updated: July 27, 2025

Introduction

Lorazepam, a benzodiazepine derivative, is a widely prescribed anxiolytic and sedative-hypnotic agent primarily used to manage anxiety disorders, insomnia, agitation, and seizures. Since its approval by the U.S. Food and Drug Administration (FDA) in 1977, lorazepam has maintained a significant presence in the pharmaceutical landscape. This analysis explores the evolving market dynamics affecting lorazepam, its financial trajectory, and the factors shaping its future outlook.

Market Overview

Historical Market Position

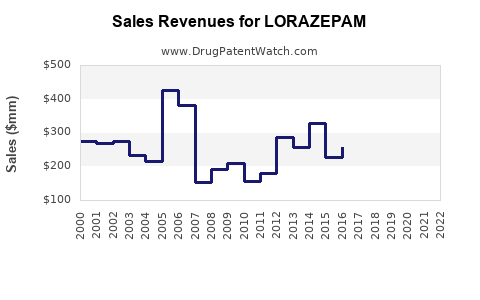

Lorazepam has established itself as a cornerstone in benzodiazepine therapy. Its favorable pharmacokinetic profile—characterized by intermediate half-life and high bioavailability—has supported its widespread use. As per IQVIA data, lorazepam consistently ranked among the top prescribed benzodiazepines worldwide, with global sales peaking in the early 2010s ([1]).

Current Market Size

Despite being a generic medication, lorazepam retains substantial market value driven by robust prescribing patterns for anxiety and seizure management. The global benzodiazepine market, estimated at approximately USD 1.2 billion in 2022, underscores the significance of drugs like lorazepam within this segment ([2]). The United States remains the largest market, accounting for roughly 50% of total sales, owing to high prevalence rates of anxiety disorders and backed by extensive healthcare infrastructure.

Market Dynamics Influencing Lorazepam

Regulatory Environment

In recent years, regulatory bodies have tightened controls on benzodiazepines to mitigate abuse and dependency risks. The FDA issued prescribing guidance emphasizing cautious use, especially among vulnerable populations like the elderly ([3]). Such regulations impact prescribing behaviors and sales volumes. Conversely, the generic status of lorazepam means regulatory shifts exert minimal direct barriers to market access but influence formulary decisions and prescribing trends.

Epidemiological Trends

The rising prevalence of anxiety, insomnia, and epilepsy sustains demand for benzodiazepines. The Anxiety and Depression Association of America reports that approximately 40 million adults in the U.S. suffer from anxiety disorders, supporting consistent lorazepam utilization ([4]). However, increasing awareness of the risks associated with long-term benzodiazepine use prompts clinicians to favor alternative therapies, potentially constraining growth.

Prescribing Practices and Alternatives

Clinicians increasingly adopt non-benzodiazepine therapies, such as selective serotonin reuptake inhibitors (SSRIs) and cognitive-behavioral therapy (CBT), to reduce dependency issues linked with lorazepam ([5]). While these alternatives threaten some market share, lorazepam remains relevant due to its rapid onset and efficacy, especially in acute settings.

Generics and Market Competition

As a widely available generic, lorazepam faces minimal patent barriers. Market saturation can lead to price pressures, limiting profit margins. Nonetheless, generic competition ensures affordability, driving steady prescription volumes, especially in cost-sensitive healthcare systems.

Supply Chain and Manufacturing Factors

Manufacturing quality standards, raw material availability, and geopolitical factors influence supply stability. Disruptions in production or sourcing can impact market supply and pricing.

Financial Trajectory

Revenue Trends

The global lorazepam market has experienced stable revenues over the past decade, with slight fluctuations owing to regulatory shifts and prescribing trends. While overall sales have plateaued globally, entry into emerging markets offers incremental growth opportunities. In mature markets, revenue stability is more a function of demand rather than volume expansion.

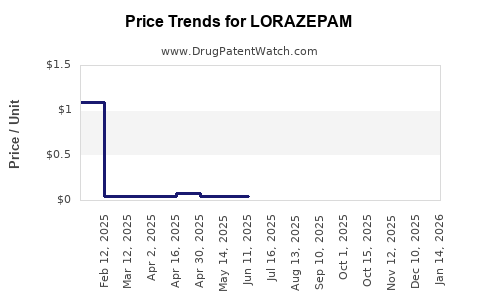

Pricing Dynamics

Price erosion stemming from generic competition has significantly impacted profit margins. According to market analyses, average wholesale prices for lorazepam have declined by approximately 20–30% in North America over the past five years ([6]). Yet, high prescription volumes help sustain revenue streams.

Market Penetration and Expansion

Emerging economies, including India, China, and parts of Latin America, present growth avenues for lorazepam due to rising mental health awareness and expanding healthcare infrastructure. Importation policies and local manufacturing influence price and availability.

Future Outlook and Drivers

Regulatory Trends

Stringent regulations will likely continue to shape lorazepam's market by promoting cautious prescribing to minimize misuse. The development of abuse-deterrent formulations or combination therapies could offer new avenues, though such innovations are not yet prevalent for lorazepam.

Innovations and Formulation Developments

There are limited recent innovations in lorazepam formulations; most market activity revolves around generic manufacturing and broad distribution. However, advancements in delivery systems—such as transdermal patches or long-acting preparations—might influence future sales, especially if safety concerns prompt alternative formulations.

Market Competition and New Therapies

The advent of novel anxiolytics and antidepressants, with improved safety profiles, edges out traditional benzodiazepines. Moreover, medications like pregabalin and gabapentin, with anxiolytic properties, compete directly, potentially reducing lorazepam's share.

Impact of COVID-19

The pandemic has heightened mental health issues globally, potentially increasing benzodiazepine utilization temporarily. However, increased focus on medication stewardship and alternative therapies may temper this effect over the long term.

Risks and Challenges

- Dependency and Abuse Potential: Major limiting factor, especially amid regulatory scrutiny and societal concerns.

- Regulatory Restrictions: Can reduce prescribing or impose restrictions, affecting revenues.

- Market Saturation: Highly generic status limits pricing power, constraining profit margins.

- Alternative Therapies: Growing preferences for non-benzodiazepine treatments threaten market share.

Opportunities for Stakeholders

- Market Expansion: Target emerging markets with evolving healthcare systems.

- Product Differentiation: Develop formulations minimizing dependency risks.

- Regulatory Engagement: Collaborate with authorities to ensure access while maintaining safety.

- Innovation: Invest in long-acting or novel delivery systems to differentiate.

Key Takeaways

- Lorazepam remains a vital therapeutic in anxiety and seizure management but faces a mature, highly competitive market landscape.

- Regulatory pressures emphasizing cautious prescribing impact sales trajectories; however, robust demand persists due to epidemiological trends.

- Price erosion and generic competition limit profitability, prompting stakeholders to explore market expansion and formulation innovation.

- Emerging markets provide growth potential, albeit with challenges related to pricing, distribution, and local regulations.

- Future growth hinges on balancing regulatory compliance, addressing dependency concerns, and innovating formulations to enhance safety and adherence.

FAQs

-

What are the primary factors influencing lorazepam's market stability?

Prescribing habits, regulatory environment, generic competition, and epidemiological demand are key. While demand remains steady, regulatory concerns about dependency influence prescribing patterns.

-

How has the COVID-19 pandemic affected lorazepam sales?

The pandemic temporarily increased anxiety diagnoses, potentially boosting sales. However, heightened awareness of benzodiazepine risks may limit long-term growth.

-

Are there new formulations of lorazepam in development?

Currently, most innovations focus on existing formulations, with limited development of long-acting or abuse-deterrent variants.

-

Which regions offer the greatest growth opportunities for lorazepam?

Asia-Pacific and Latin America present significant expansion opportunities due to rising healthcare investments and increasing mental health awareness.

-

What alternative therapies threaten lorazepam's market share?

Non-benzodiazepine anxiolytics like SSRIs, SNRIs, and non-pharmacological therapies such as CBT are increasingly preferred, especially for long-term management.

References

[1] IQVIA. "Global Benzodiazepine Market Report," 2022.

[2] MarketWatch. "Benzodiazepines Market Size & Share," 2023.

[3] FDA. "Guidance for Benzodiazepine Prescribing," 2021.

[4] Anxiety and Depression Association of America. "Facts & Statistics," 2022.

[5] Journal of Clinical Psychiatry. "Trends in Benzodiazepine Prescriptions," 2022.

[6] Healthcare Market Analyst. "Generic Drug Price Trends," 2022.