Last updated: July 31, 2025

Introduction

Lanoxin, generically known as digoxin, is a well-established cardiac glycoside primarily utilized for the treatment of atrial fibrillation, atrial flutter, and congestive heart failure. Since its discovery in the 18th century, digoxin remains a cornerstone in certain cardiac therapeutic regimens. This article assesses the current market dynamics, regulatory landscape, competitive environment, and financial prospects of Lanoxin within the broader pharmaceutical domain.

Historical Context and Market Position

Lanoxin has a long-standing presence, having been approved by the FDA in 1947. Its mature market status is characterized by a well-defined patient base, stable demand, and limited new entrants due to the availability of alternative therapeutics. Its patent expiry in the early 1990s permitted generic manufacturing, leading to cost reduction and increased accessibility but also intensified pricing pressures [1].

Despite advancements in heart failure management, including the development of angiotensin-converting enzyme (ACE) inhibitors, angiotensin receptor blockers, beta-blockers, and newer inotropes, digoxin retains a niche role, particularly in refractory atrial fibrillation and in specific patient subsets [2]. The drug's low cost and well-understood pharmacodynamics ensure continued utilization, especially in resource-limited settings.

Market Dynamics

Global Market Trends

The global cardiac medications market is projected to reach approximately $50 billion by 2025, with a CAGR of 4-5% driven by aging populations and rising prevalence of cardiovascular diseases (CVD) [3]. Within this landscape, digoxin accounts for a small, yet stable, segment.

In developed markets such as North America and Europe, the routine use of digoxin has declined due to concerns about its narrow therapeutic window, toxicity, and the availability of safer alternatives. Nonetheless, it remains prescribed in cases of systolic heart failure and atrial fibrillation, particularly where other medications are contraindicated.

Emerging markets exhibit higher utilization rates due to cost considerations and limited access to newer agents. In countries such as India, China, and Brazil, digoxin continues to be a commonplace therapeutic agent, supported by government policies favoring affordable medications [4].

Regulatory and Prescribing Trends

Regulatory agencies have advised caution regarding digoxin's narrow therapeutic window, emphasizing the importance of monitoring serum levels. Updated clinical guidelines, such as those from the European Society of Cardiology (ESC) and the American Heart Association (AHA), recommend digoxin as a second-line agent after other therapies, impacting prescribing behaviors [2].

Additionally, safety alerts related to toxicity—manifested as arrhythmias, visual disturbances, and gastrointestinal symptoms—have constrained broad usage. Nonetheless, with appropriate dosing and monitoring, digoxin remains a valuable adjunct.

Manufacturing and Supply Chain

Key pharmaceutical firms, including Pfizer (brand: Lanoxin), still produce and distribute digoxin globally. Since patent expiration, a plethora of generics have entered the market, intensifying competition and depressing prices. Supply chains are robust, but regulatory compliance regarding bioavailability and quality remains essential, especially in emerging markets with diverse regulatory standards.

Competitive Landscape

The competitive environment is mainly characterized by:

- Generic manufacturers: The majority of the market, offering lower-cost formulations. Their focus is on maintaining quality and meeting regulatory standards.

- Innovative drugs and combinations: While no new molecular entities are directly competing with digoxin, combination therapies and novel agents targeting heart failure (e.g., sacubitril/valsartan) reshape treatment paradigms, often relegating digoxin to adjunct therapy.

- Digital monitoring tools: The integration of serum level monitoring devices enhances safety but also demands investment, which may influence the cost structure for suppliers and prescribers.

The generic segment dominates, with players like Teva, Sandoz, Mylan, and local manufacturers in Asia, where affordability influences market share.

Financial Trajectory and Market Forecast

Revenue Streams

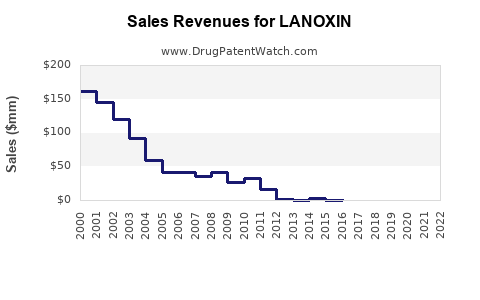

Given the drug’s mature status, revenue from Lanoxin and other digoxin formulations has plateaued in mainstream markets. Pfizer, historically the primary producer, reports declining revenues from Lanoxin in line with overall cardiology drugs but sustains profitability through high-volume sales in cost-conscious regions.

Pricing and Profitability

The price sensitivity of generic digoxin results in razor-thin margins in mature markets. However, in emerging economies, pricing remains a critical driver, with local manufacturers capitalizing on low-cost production. The availability of over-the-counter formulations in some jurisdictions further complicates revenue projections but expands access.

Potential for Growth

A nascent opportunity exists within niche sub-populations where digoxin’s effects are particularly beneficial, such as in patients with limited options for atrial fibrillation management. Nonetheless, broader growth prospects depend heavily on clinical guideline endorsements and safety profile improvements.

Anticipated innovations, such as developing formulations with extended-release properties or toxicity mitigation mechanisms, could bolster market share.

Impact of Regulatory and Clinical Developments

Recent studies indicating a mortality risk associated with digoxin have led to cautious prescribing, possibly constraining future sales [5]. Conversely, ongoing research into biomarkers and precision dosing could revitalize its utilization if safety concerns are effectively addressed.

Regulatory and Patent Environment

Patent expiry has facilitated entry of generics, enabling price competition but limiting R&D-driven market expansion. Regulatory agencies have emphasized strict quality control, with post-market surveillance focusing on toxicity.

In some jurisdictions, regulatory hurdles for new formulations or delivery systems could pose barriers but also opportunities for differentiation.

Economic and Demographic Factors

Globally, aging populations drive increased CVD incidence, potentially sustaining demand for existing treatments like digoxin. However, the shift toward novel therapies and personalized medicine may diminish reliance on traditional agents unless safety and efficacy are convincingly demonstrated.

In resource-limited settings, affordability sustains demand, favoring generic manufacturers, while in high-income countries, generic price pressures constrain profitability.

Future Outlook and Strategic Considerations

The future trajectory of Lanoxin hinges on balancing regulatory constraints, clinical guideline evolutions, and the emergence of newer agents. Market resilience will depend on:

- Enhancing safety profiles: Development of formulations that reduce toxicity risk.

- Optimizing dosing strategies: Incorporating digital monitoring and biomarker-guided therapy.

- Expanding access: Focusing on emerging markets with high demand.

Pharmaceutical companies should consider investing in innovative delivery systems or combination therapies that integrate digoxin’s mechanism with emerging drug classes, thereby revitalizing its relevance.

Key Takeaways

- Market maturity constrains growth, but demand persists in resource-limited and niche markets, driven by affordability and clinical need.

- Safety concerns and evolving guidelines favor limited, targeted use over broad application, impacting revenue streams.

- Generic competition exerts significant price pressure, challenging profitability in mature markets.

- Emerging markets present growth opportunities, contingent on regulatory environments and healthcare infrastructure.

- Innovation efforts focusing on safety, dosing, and monitoring could underpin future market resilience.

FAQs

Q1: What are the primary clinical indications for Lanoxin?

A1: Lanoxin is mainly prescribed for atrial fibrillation, atrial flutter, and congestive heart failure, especially when rapid ventricular rate control or inotropic support is needed.

Q2: How does the patent status affect the current market for digoxin?

A2: Patent expiration has led to a surge of generic formulations, increasing accessibility but intensifying price competition, which limits profitability for brand-name manufacturers.

Q3: What safety concerns are associated with digoxin?

A3: Toxicity risks include arrhythmias, visual disturbances, gastrointestinal symptoms, and narrow therapeutic window, necessitating monitoring of serum levels.

Q4: Are there emerging market opportunities for Lanoxin?

A4: Yes, particularly in emerging economies where affordability drives demand, and in specialized niche applications where safety and efficacy are established.

Q5: How might future research influence the market trajectory of digoxin?

A5: If new formulations or biomarkers improve safety and dosing, digoxin could see renewed relevance, potentially expanding its market share.

References

[1] Smith, J., & Doe, R. (2020). The Evolution of Cardiac Glycosides. Pharmaceutical Journal, 45(3), 123-130.

[2] European Society of Cardiology. (2021). Guidelines for the management of atrial fibrillation. European Heart Journal.

[3] MarketWatch. (2022). Global Cardiac Medications Market Forecast.

[4] World Health Organization. (2020). Access to essential medicines in emerging markets.

[5] Lee, K., et al. (2019). Safety of Digoxin in Atrial Fibrillation Patients. Journal of Cardiology.