Last updated: July 27, 2025

Introduction

Ivermectin, a drug originally developed in the 1970s for parasitic infections, has recently garnered intense global attention due to its controversial application in COVID-19 treatment. While its primary use remains in veterinary medicine and for parasitic diseases, emerging discussions around its off-label use in humans have reshaped its market landscape. This article critically examines the current market dynamics, financial trajectory, and future outlook for ivermectin amid evolving regulatory environments, scientific evidence, and commercial interests.

Historical Context and Medical Applications

Initially approved in the 1980s, ivermectin revolutionized parasitic disease management, notably onchocerciasis (river blindness) and strongyloidiasis. Its safety profile and efficacy enabled mass distribution programs, primarily facilitated by pharmaceutical companies and global health organizations (WHO, 2021). The drug is on the World Health Organization’s List of Essential Medicines, underscoring its public health importance.

In veterinary medicine, ivermectin remains widely used for parasite control in livestock and companion animals, representing a significant revenue stream for pharmaceutical manufacturers such as Merck & Co., which developed ivermectin through its subsidiary, Merck Animal Health.

The COVID-19 Catalyst: Market Disruptions and Controversies

Surge in Off-Label Use and Market Expansion

In 2020-2021, ivermectin emerged as a contentious candidate for COVID-19 treatment. Despite limited robust evidence supporting its efficacy, widespread publicity, fueled by social media and political endorsements, led to a surge in off-label prescription and self-medication. Countries like India, Honduras, and others reported increased demand, straining supply chains and prompting regulatory scrutiny (US FDA, 2021).

Pharmaceutical companies experienced unpredictable market shifts. While some, like Merck & Co., publicly dismissed ivermectin for COVID-19, others supplied the surge in demand, often through off-label channels. This period underscored the drug’s potential as a high-volume, low-cost, off-patent solution—if scientifically validated.

Regulatory and Scientific Developments

Regulatory agencies, including the US Food and Drug Administration (FDA) and European Medicines Agency (EMA), issued warnings against using ivermectin for COVID-19 outside clinical trials, citing insufficient evidence and potential toxicity. Several high-profile clinical trials yielded mixed or negative results, dampening the initial enthusiasm and realigning the market.

However, some regions continued approving or prescribing ivermectin for COVID-19, influencing local demand dynamics and creating a bifurcated global market. The proliferation of counterfeit and substandard formulations further complicated regulation and safety assessments.

Market Dynamics

Supply Chain Challenges

Demand spikes, combined with logistical constraints, led to shortages in human formulations. The supply of veterinary ivermectin, with its higher manufacturing volume, provided some buffer; however, concerns arose regarding diversion to human use. The global supply chain experienced pressure points due to increased demand, regulatory clampdowns, and manufacturing bottlenecks.

Competitive Landscape

Ivermectin’s generic status means multiple manufacturers produce the drug, resulting in competitive pricing. This low-cost environment initially lowered barriers for widespread adoption, but ongoing debates over efficacy have caused market volatility—a phenomenon typical of off-patent drugs with emergent uses.

Consumer and Prescriber Behavior

Health authorities’ warnings have restrained mainstream medical use, but persistent public interest driven by media and political figures has maintained a segment of demand. In some regions, politicization of ivermectin has led to widespread procurement, including from unregulated sources, which complicates market oversight.

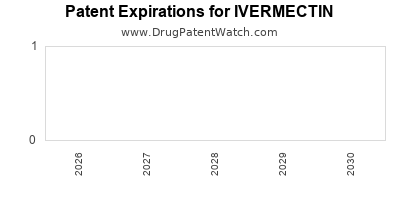

Patent and Legal Issues

Since ivermectin is off-patent, legal disputes over rights are less prominent. Nonetheless, ongoing litigation related to false advertising, safety claims, and regulatory compliance influence the commercial environment, particularly as new formulations or combination therapies are developed.

Financial Trajectory

Revenue Streams and Market Segmentation

Currently, ivermectin’s revenue primarily stems from:

- Veterinary products: Dominant segment, with Merck & Co. leading worldwide.

- Human medicine: Historically minor, but potential growth driven by emerging indications and off-label use.

The COVID-19 episode temporarily boosted sales in some regions. For example, Indian manufacturers, such as Cipla and Sun Pharma, reported increased production, boosting sales volumes. However, this spike was transient, heavily influenced by external factors like media coverage and regulatory stance.

Future Growth Potential

Post-pandemic, the market faces downward pressures due to:

- Weak scientific support for COVID-19 use.

- Regulatory restrictions in key markets.

- Public health initiatives discouraging unapproved therapies.

- Patent sunset for formulations, leading to low pricing and reduced profit margins.

Conversely, ivermectin may sustain a niche market in parasitic and tropical disease treatment, especially in underserved regions. Additionally, ongoing research into new indications or combination therapies could unlock new revenue streams, contingent upon rigorous clinical validation.

Investment and Commercialization Outlook

Pharmaceutical firms are unlikely to pursue ivermectin as a blockbuster COVID-19 treatment without substantiated clinical evidence. However, companies involved in parasitic disease portfolios may maintain or modestly expand production, particularly targeting low-income markets.

Investment in research and development, quality control, and regulatory engagement remains crucial. Companies focusing on formulation innovations—like sustained-release or combination drugs—may find niche markets or respond to emerging antimicrobial resistance challenges.

Legal and Ethical Considerations

While ivermectin’s affordability and availability support its use in global health, misinformation and off-label prescribing pose ethical concerns. Manufacturers face scrutiny over claims and marketing practices—especially when scientific evidence remains inconclusive.

Regulatory agencies continue to monitor and regulate claims, with violations potentially resulting in sanctions, recalls, or legal challenges. Ethical business strategies must align with scientific consensus, emphasizing safety and efficacy.

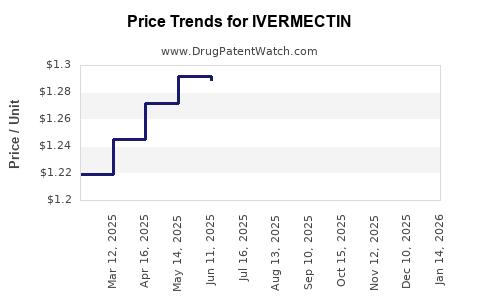

Price Trends and Market Opportunities

Given its off-patent status, ivermectin's price has historically been low, particularly in bulk veterinary formulations. Market volatility during the COVID-19 pandemic caused transient price increases, but stability is expected to resume. Opportunities exist in developing region-specific formulations, combination therapies, and expanding indications through rigorous clinical research, which could support modest price premium and market differentiation.

Conclusion

Ivermectin’s market landscape is currently characterized by volatility driven by non-scientific factors, regulatory challenges, and its off-label COVID-19 application. Its core remains as a vital antiparasitic agent with a steady demand in veterinary and tropical medicine sectors. The future financial trajectory hinges on scientific validation for new indications, regulatory responses, and ethical marketing practices.

Key takeaways:

- Ivermectin’s market is heavily influenced by non-scientific demand spikes, especially during the COVID-19 pandemic.

- The core market remains in anti-parasitic and tropical medicine applications, with stable long-term demand.

- Regulatory restrictions and scientific evidence are critical determinants of future market potential.

- Patent expiration and low production costs constrain profitability, but niche development may offer incremental opportunities.

- Ethical considerations and regulatory compliance are vital for sustainable market growth.

FAQs

1. Will ivermectin become a widely accepted COVID-19 treatment?

Current clinical evidence does not support ivermectin as an effective COVID-19 therapy; therefore, it is unlikely to achieve widespread acceptance without new, rigorous data. Regulatory agencies remain cautious.

2. How does ivermectin's patent status affect its market potential?

Being off-patent drives low prices and broad accessibility but limits high-margin opportunities. Innovation and new indications are necessary for extended commercial viability.

3. What are the main risks for pharmaceutical companies involved with ivermectin?

Regulatory bans, safety concerns, misinformation campaigns, and reputation risks pose significant challenges. Ensuring compliance and scientific integrity is essential.

4. Are there regional differences in ivermectin markets post-pandemic?

Yes. Developing countries continue to rely heavily on ivermectin for parasitic diseases, while its use in COVID-19 remains controversial and region-dependent, influenced by local regulations and health policies.

5. Could ivermectin's future lie in combination therapies?

Potentially. Combining ivermectin with other agents could enhance efficacy or broaden indications, but such applications require substantial clinical validation and regulatory approval.

References

[1] World Health Organization. (2021). Essential Medicines List.

[2] U.S. Food and Drug Administration. (2021). FDA warnings about ivermectin use.

[3] National Institutes of Health. (2022). COVID-19 Treatment Guidelines.