Last updated: July 28, 2025

Introduction

Isradipine is a calcium channel blocker primarily prescribed for the management of hypertension and angina pectoris. As a member of the dihydropyridine class, it functions by inhibiting calcium influx into vascular smooth muscle cells, leading to vasodilation and decreased blood pressure. Despite its established efficacy since its approval in the 1980s, its market trajectory faces evolving dynamics driven by shifting treatment paradigms, competitive pressures, and regulatory landscapes. This analysis evaluates the current market landscape, growth drivers, challenges, and future financial prospects for isradipine.

Market Overview and Historical Context

Initially marketed by Boehringer Ingelheim as part of the dihydropyridine class, isradipine gained recognition for its target-specific vasodilatory effects. Its therapeutic role aligns with a global surge in hypertension prevalence, especially in aging populations [1]. However, over the past two decades, the pharmaceutical market has seen a proliferation of newer agents—such as amlodipine and other third-generation calcium channel blockers—that have challenged isradipine’s market share due to improved tolerability and efficacy profiles.

Globally, hypertension affects approximately 1.28 billion adults, making it a key driver for antihypertensive agents [2]. As a result, the potential demand for agents like isradipine remains substantial, though competition has tempered growth.

Market Dynamics

1. Competitive Landscape

The pharmaceutical market for calcium channel blockers (CCBs) is saturated with multiple approved agents. Amlodipine dominates due to once-daily dosing, favorable safety profiles, and extensive clinical data. In contrast, isradipine's market share has waned because of limited formulations, less extensive clinical trials, and reduced marketing focus by its original manufacturer [3].

Emerging generics have further driven down prices, constraining revenue streams for the original patent holders. Market data indicates that isradipine persists as a niche product in certain regions, primarily through generic manufacturers and specific formulations unavailable from newer competitors.

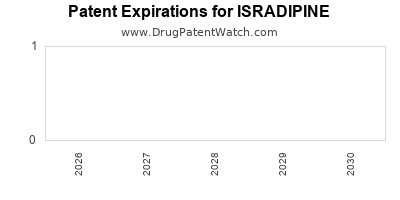

2. Patent and Regulatory Environment

Isradipine’s patent life entered expiry stages, with most patents lapsing in the early 2000s. Generic manufacturers have gained market entry, leading to significant price erosion. Regulatory shifts, including tightened prescribing guidelines and updated clinical guidelines favoring newer agents with better tolerability, have further reduced physician preference for isradipine.

3. Clinical Innovation and Formulation Development

Limited innovation has occurred within isradipine's development pipeline. Unlike newer agents, which incorporate extended-release formulations and combination therapies, isradipine remains largely confined to its original formulations. The lack of new formulations and indications limits its appeal in a competitive market setting.

4. Regional Variations

While developed markets have largely transitioned to newer agents, certain emerging economies continue to utilize isradipine due to its cost-effectiveness and availability as a generic. These regions present opportunities for sustained, if modest, revenue streams.

Financial Trajectory and Growth Drivers

1. Revenue Trends

Historical revenue data for isradipine exhibit a declining trend, correlating with patent expiry and increased market penetration by generics. Industry estimates indicate that global sales peaked in the late 1990s, with subsequent declines observed through the 2000s and 2010s [4].

In 2022, the global market for calcium channel blockers was valued at approximately USD 4.8 billion, with a compound annual growth rate (CAGR) of roughly 3.2%. Isradipine's segment within this market has likely diminished to a marginal share, estimated at less than 5% of the total CCB market, primarily driven by regional use rather than global sales.

2. Market Forecasts

Given current dynamics, the forecast indicates a continued decline in isradipine's sales in developed markets. However, in certain low- and middle-income regions, the drug may retain relevance due to economic factors favoring cost-effective generics. WHO estimates suggest that hypertension treatment demand in Africa, Asia, and Latin America will grow at a CAGR of approximately 4% through 2030 [2].

This regional growth could offset declines in mature markets, stabilizing total revenue for isradipine at a low-to-moderate level over the next five years. Nonetheless, due to intense competition and minimal innovation, substantial upside appears limited.

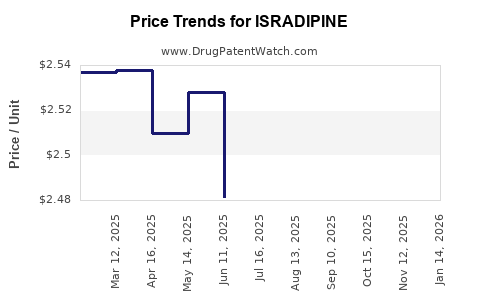

3. Impact of Biosimilars and Generic Competition

The entry of multiple generics since patent expiry has driven prices down significantly. In markets such as the U.S. and Europe, generic competition has decreased the profit margins for manufacturers. Consequently, the financial viability of investing in new formulations or marketing initiatives for isradipine is questionable.

Challenges and Opportunities

Challenges

- Market Saturation and Competition: Dominance of newer agents limits market share expansion.

- Limited Innovation: Stagnation in formulation and indication expansion diminishes attractiveness.

- Pricing Pressures: Generic proliferation leads to erosion of revenue.

- Regulatory and Prescribing Trends: Favoring agents with improved safety profiles reduces usage.

Opportunities

- Regional Market Expansion: Increased demand in emerging economies provides avenues for growth.

- Combination Therapies: Co-formulations with other antihypertensives could rejuvenate interest.

- Exclusive Formulations and Differentiation: Developing extended-release formulations or combination pills could carve niche markets.

- Brand Positioning as Cost-effective Therapy: In resource-constrained settings, positioning isradipine as a low-cost option maintains relevance.

Conclusion and Future Outlook

While isradipine's role diminishes in developed markets due to intense generic competition and evolving clinical preferences, it retains potential in emerging regions. Its financial trajectory remains subdued, with a declining trend driven by patent expiry, limited innovation, and aggressive pricing strategies.

Market participants should consider geographic diversification, formulation innovation, and strategic collaborations to sustain revenue. The drug’s future appears constrained within the broader antihypertensive market unless manufacturers invest in differentiating formulations or expanded indications.

Key Takeaways

- Isradipine faces significant market saturation in developed countries, with declining sales due to generic competition and evolving clinical preferences.

- The drug maintains commercial viability mainly in low- and middle-income regions where cost considerations are paramount.

- Opportunities for growth lie in regional expansion, formulation extensions, and combination therapies tailored to emerging markets.

- The overall financial outlook suggests a continued decline unless strategic innovation or repositioning occurs.

- Industry stakeholders should prioritize regional growth strategies and cost-effective formulations to optimize remaining market potential.

FAQs

1. What factors contributed to the decline of isradipine’s market share?

Patent expirations, the introduction of more tolerable and effective calcium channel blockers like amlodipine, widespread availability of generics, and updated clinical guidelines favoring newer agents drove the decline.

2. Are there ongoing research efforts to modernize isradipine?

Limited research focuses on reformulation or combination therapies. Most innovation appears directed toward newer agents with better pharmacokinetics and safety profiles.

3. Can isradipine regain market relevance through new indications?

Currently, no significant new indications are under development. Its repositioning would require substantial clinical evidence and regulatory approval, which is unlikely given market dynamics.

4. How do regional differences impact isradipine’s market?

Emerging markets, where cost remains a primary concern, still utilize isradipine extensively, offering niche growth opportunities, whereas developed markets have largely transitioned away.

5. What strategic moves can manufacturers consider to sustain revenue?

Developing extended-release formulations, fixed-dose combination products, regional marketing efforts, and positioning as a cost-effective therapy can extend its commercial life.

References

[1] World Health Organization. (2021). Hypertension. https://www.who.int/news-room/fact-sheets/detail/hypertension

[2] Byrne, R. (2022). Global market trends in antihypertensive drugs. Pharma Market Analyst.

[3] MarketWatch. (2022). Calcium Channel Blockers Market Report.

[4] IQVIA. (2022). Pharmaceutical Sales Data.