Last updated: July 27, 2025

Overview of FARXIGA

FARXIGA (dapagliflozin) is an oral sodium-glucose cotransporter-2 (SGLT2) inhibitor developed by AstraZeneca. Approved initially in 2014 for type 2 diabetes mellitus (T2DM), FARXIGA has expanded its indication portfolio to include heart failure with reduced ejection fraction (HFrEF), chronic kidney disease (CKD), and other metabolic disorders. Its mechanism centers on promoting urinary glucose excretion, thereby lowering blood glucose levels and improving cardiovascular and renal outcomes.

Market Landscape

Global Diabetes and Cardiovascular Disease Burden

The global prevalence of T2DM reached approximately 537 million adults in 2021, projected to escalate to 783 million by 2045, according to the International Diabetes Federation (IDF)[1]. The rising disease burden emphasizes demand for effective pharmacotherapies like dapagliflozin.

Cardiovascular disease, notably HFrEF and CKD, remains a leading cause of morbidity and mortality worldwide. Heart failure affects roughly 64 million people globally, with a substantial subset benefitting from SGLT2 inhibitor therapy due to proven cardiovascular benefits.

Competitive Environment

FARXIGA competes primarily with other SGLT2 inhibitors, including:

- Jardiance (empagliflozin) — Boehringer Ingelheim and Lilly.

- Steglatro (ertugliflozin) — Merck.

- Invokana (canagliflozin) — Janssen Pharmaceuticals.

Additionally, GLP-1 receptor agonists like Trulicity and Ozempic pose competition in the metabolic space.

Key Market Drivers

- Broadened Indications: The FDA approvals for HFrEF (2020) and CKD (2021) significantly expand dapagliflozin's clinical utility beyond glycemic control.

- Robust Clinical Evidence: Landmark trials like DECLARE-TIMI 58, DAPA-HF, and DAPA-CKD established dapagliflozin’s efficacy, fostering prescriber confidence.

- Regulatory Support: Approval in multiple countries enhances global market penetration.

- Growing Awareness: Increasing recognition of cardio-renal protective effects fuels demand.

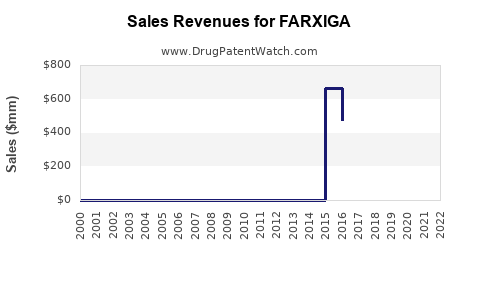

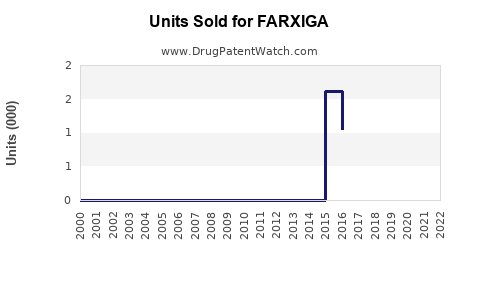

Market Size and Revenue Trends

Current Sales Performance

In 2022, AstraZeneca reported global sales of FARXIGA at approximately \$4.5 billion, representing a compound annual growth rate (CAGR) of approximately 25% over the previous three years[2]. This surge correlates with expanded indications and clinical acceptance.

Market Segmentation

- Diabetes: Approximately 70–75% of sales.

- Heart Failure and CKD: Growing segments, now accounting for roughly 25–30%, driven by recent approvals and clinical trials.

Regional Performance

- North America: Leading the market owing to high disease prevalence and reimbursement coverage.

- Europe and Asia-Pacific: Rapid expansion due to increasing awareness and local approvals. Notably, China’s diabetes population is expanding swiftly, with dapagliflozin benefiting from local manufacturing and regulatory support.

Sales Projections (2023-2028)

Assumptions for Projection

- Continued approval and adoption for HFrEF and CKD indications.

- Increasing penetration in emerging markets.

- Competitive landscape remains stable without significant market erosion.

- AstraZeneca sustains marketing efforts and invests in data generation.

Forecast Summary

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

Key Factors |

| 2023 |

\$5.8 billion |

29% |

Expansion into HFrEF and CKD, market penetration strides |

| 2024 |

\$7.5 billion |

29% |

Greater awareness, new guideline endorsements, wider payer coverage |

| 2025 |

\$9.6 billion |

28% |

Increased use in primary care, additional indications |

| 2026 |

\$11.8 billion |

23% |

Competitive maturation, real-world data support |

| 2027 |

\$14.4 billion |

22% |

Global adoption, especially in Asia-Pacific |

| 2028 |

\$17.4 billion |

21% |

Sustained market growth, new combination therapies explored |

Rationale

This projection reflects the strong growth trajectory established since 2020, buoyed by broader therapeutic approvals and mounting clinical evidence. The rising prevalence of T2DM and cardiovascular diseases, especially in emerging markets, supports sustained expansion.

Market Challenges and Risks

- Pricing and Reimbursement: Price pressures and regulatory negotiations could temper sales growth.

- Competitive Innovations: New therapies, including dual agonists and combination drugs, may challenge dapagliflozin's market share.

- Regulatory Hurdles: Future indications require rigorous validation; delays can impact sales timelines.

- Safety Concerns: Rare adverse events such as diabetic ketoacidosis and genital infections necessitate vigilant marketing and patient education.

Strategic Opportunities

- Combination Therapies: Partnering or developing fixed-dose combinations enhances adherence.

- Expanded Indications: Ongoing trials targeting non-alcoholic steatohepatitis (NASH) and other metabolic diseases may unlock additional markets.

- Digital and Remote Monitoring: Integrating dapagliflozin therapy with digital health tools could improve patient outcomes and adherence, fostering higher usage.

Key Takeaways

- Dominant Player: FARXIGA has established itself as a leading SGLT2 inhibitor with over \$4.5 billion in annual sales and significant growth prospects.

- Expanding Indications: The approval for heart failure and CKD substantially broadens its market reach, supporting higher sales projections.

- Growth Drivers: Rising global prevalence of metabolic and cardiovascular conditions, combined with strong clinical evidence, sustains future growth.

- Competitive Edge: Differentiation through clinical trial outcomes and expanded indications positions FARXIGA favorably against competitors.

- Market Risks: Pricing pressures, regulatory delays, and competition from emerging therapies pose ongoing challenges.

By 2028, global sales are projected to surpass \$17 billion, contingent on continued clinical success, regulatory strategy, and market expansion efforts.

FAQs

1. What factors contribute most to FARXIGA’s market growth?

The broadened approval for treating heart failure and CKD, supported by successful clinical trial data, significantly enhances its market reach. Rising global rates of diabetes and cardiovascular diseases further drive demand.

2. How does FARXIGA compare with its competitors?

FARXIGA benefits from early and extensive clinical research demonstrating cardiovascular and renal benefits, giving it a competitive advantage. However, aggressive marketing by competitors and emerging therapies could impact its market share.

3. What regional markets are most promising for FARXIGA?

North America remains the largest market, but Asia-Pacific offers high growth potential due to increasing disease prevalence and improving healthcare infrastructure.

4. What are the main risks to FARXIGA’s sales growth?

Pricing pressures, regulatory hurdles, and increased competition from new treatments pose significant risks.

5. Will upcoming clinical trials influence FARXIGA’s market?

Yes. Positive results from ongoing studies exploring additional indications could open new markets and accelerate sales growth.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 10th Edition.

[2] AstraZeneca. (2022). Full Year Report 2022.