Last updated: July 27, 2025

Introduction

Famciclovir stands as a prominent antiviral medication within the herpesvirus treatment landscape. Approved by regulatory agencies such as the FDA in 1994, it is predominantly indicated for herpes zoster, recurrent genital herpes, and shingles. As a prodrug of penciclovir, famciclovir offers improved bioavailability, leading to enhanced clinical efficacy. The pharmaceutical market surrounding famciclovir has experienced significant evolution driven by epidemiological trends, technological advancements, and strategic regulatory and commercial activities.

Market Overview

The global antiviral drugs market, which includes drugs like famciclovir, was valued at approximately USD 32 billion in 2022, with projections reaching USD 52 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 6.2% [1]. Famciclovir constitutes a notable segment within this landscape, driven by increasing prevalence of herpes zoster and genital herpes, populations at higher risk, and advances in antiviral formulations.

Epidemiological and Market Drivers

-

Rising Prevalence of Herpes Viruses: The global herpes zoster (shingles) incidence is escalating due to aging populations, with an estimated 1 million cases annually in the U.S. alone [2]. Similarly, genital herpes affects over 400 million people globally, emphasizing the ongoing demand for effective antiviral therapy.

-

Aging Population and Immunocompromised Patients: Aging populations and immunosuppressed individuals, notably HIV-positive patients and transplant recipients, are at increased risk, further propelling demand for famciclovir.

-

Emerging Resistance and Treatment Strategies: While resistance remains relatively low, ongoing surveillance influences prescribing patterns and the development of next-generation antivirals.

-

Vaccination Programs Impact: The introduction of herpes zoster vaccines like Shingrix has impacted the overall management landscape, but antiviral therapies, including famciclovir, remain essential for acute treatment and outbreak management.

Market Dynamics

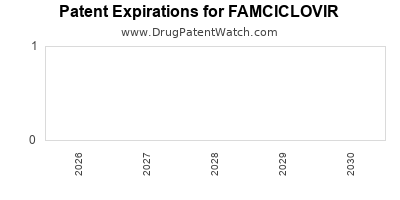

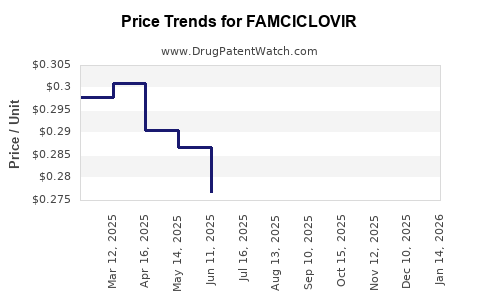

- Patent Expiration and Generic Competition

Famciclovir's patent expired in multiple jurisdictions during the late 2000s and early 2010s, leading to the entry of generic manufacturers. In markets like India and Europe, generics now dominate, significantly reducing treatment costs and expanding access [3]. While patent expiry has catalyzed price competition, it has also compressed profit margins for brand-name vendors, impacting revenue trajectories.

- Brand-Name vs. Generic Prescriptions

Despite the affordability of generics, brand-name medications maintain a niche within hospital settings and specialized markets, owing to perceived quality, brand recognition, and prescribing habits. The cost-effectiveness of generics has increased accessibility, especially in low- and middle-income regions, amplifying volume-based revenues but decreasing per-unit margins.

- Formulation Innovations

Advancements include sustained-release formulations and combination therapies designed to improve bioavailability and patient adherence. Although such innovations are limited for famciclovir, ongoing research could produce new derivatives or delivery systems, stimulating market growth.

- Regulatory and Price Policies

Countries with strict drug pricing policies, such as Australia and Germany, have impacted revenue streams. Conversely, emerging markets often have less stringent controls, presenting growth opportunities. Regulatory approvals for extended indications or combination therapies can unlock new revenue avenues.

Financial Trajectory

Historically, family-care medications like famciclovir have seen volatile revenue streams, heavily influenced by patent status and generics’ entry. Prior to patent expiry, global sales peaked; for instance, GSK's market share in the 1990s resulted in revenues exceeding USD 500 million annually [4]. Post-patent, revenues have declined but stabilized due to generics, with current estimates ranging between USD 100-200 million globally, predominantly driven by emerging markets.

Market share in specific regions is evolving:

-

North America & Europe: Predominantly generic sales with limited brand-name prescriptions. Growth is primarily through volume expansion.

-

Asia-Pacific: Rapid expansion driven by large populations, affordability of generics, and expanding healthcare infrastructure.

-

Emerging Markets: High growth potential, although penetration is moderated by price sensitivity and patent litigation.

Competitive Landscape

The competitive landscape is characterized by numerous generic producers. Major brand owners historically included GSK and Mylan. Patent litigation, alongside regulatory challenges, often delays market saturation, leading to transient revenue fluctuations.

Strategic Commercial Considerations

-

Intellectual Property: Vigilance around patent cliffs informs R&D investments and licensing strategies.

-

Pricing Strategies: Tiered pricing, volume discounts, and inclusion in national essential medicines lists influence market penetration.

-

Partnerships & Alliances: Collaborations with local manufacturers facilitate access in developing markets and ensure regulatory compliance.

-

Research & Development: Innovations in antiviral therapies and delivery systems like transdermal patches may redefine market dynamics.

Future Outlook

The outlook for famciclovir hinges on multiple factors:

-

Market Penetration in Under-Served Areas: Expanding access through affordable generics can scale revenues, especially in Africa, Asia, and Latin America.

-

Potential for Novel Indications: Ongoing research into herpes-related conditions and possible repositioning efforts may extend market lifecycle.

-

Competitive Pressure: Entry of newer antivirals with improved safety and efficacy profiles could influence the market share of famciclovir.

-

Regulatory Landscape: Policies favoring biosimilars and generics will likely sustain a competitive environment, affecting profit margins.

Conclusion

Famciclovir's market and financial trajectory reveal a classic pattern of pharmaceutical lifecycle evolution. Initial growth driven by patent protection yields to market consolidation post-patent expiry, with generics filling supply gaps and expanding access. Future growth hinges on geographic expansion, formulation innovations, and strategic positioning amidst a competitive landscape characterized by rapid commoditization and evolving regulatory frameworks.

Key Takeaways

-

The global antivirals market is growing steadily, with famciclovir positioned as a significant contributor given epidemiological trends.

-

Patent expiry has catalyzed price competition, demanding strategic adaptation from manufacturers through cost control and innovation.

-

Market expansion in emerging economies offers substantial growth opportunities, leveraging affordability and healthcare infrastructure improvements.

-

Innovations in formulation and potential new indications could extend famciclovir's revenue lifecycle.

-

Stakeholders should monitor regulatory policies, patent statuses, and competitive moves to navigate the evolving market landscape effectively.

FAQs

-

What are the primary therapeutic indications for famciclovir?

Famciclovir is primarily prescribed for herpes zoster (shingles), recurrent genital herpes, and other herpesvirus infections, leveraging its antiviral properties to reduce symptom duration and viral shedding.

-

How has patent expiration affected the market for famciclovir?

Patent expiration led to the proliferation of generic versions, significantly reducing prices and expanding access, but also decreasing revenue for brand-name manufacturers and increasing market competition.

-

What future developments could impact famciclovir’s market share?

Innovations in antiviral drug formulations, the emergence of better-tolerated or more effective medications, and expanded vaccination programs could influence famciclovir’s market positioning.

-

Are there emerging markets with untapped potential for famciclovir sales?

Yes, regions like Africa, Southeast Asia, and Latin America present substantial growth opportunities owing to increased healthcare infrastructure and affordable generics.

-

What strategic considerations should pharmaceutical companies prioritize regarding famciclovir?

Companies should focus on cost-effective manufacturing, exploring new formulation approaches, expanding into emerging markets, and maintaining regulatory compliance to sustain profitability.

References

[1] MarketResearch.com, "Global Antiviral Drugs Market," 2023.

[2] Centers for Disease Control and Prevention (CDC), "Herpes Zoster Surveillance," 2022.

[3] European Medicines Agency (EMA), "Market Approvals and Patent Data," 2023.

[4] IMS Health, "Historical Sales Data for Famciclovir," 2021.