Last updated: August 1, 2025

Introduction

DILANTIN, the brand name for phenytoin, remains a cornerstone in the management of epilepsy and certain neurological disorders. Since its introduction in the 1930s, DILANTIN has established itself as a pivotal anticonvulsant with a longstanding clinical profile. Its commercial and market dynamics are influenced by evolving medical guidelines, competitive innovations, regulatory policies, and generational shifts in therapy paradigms. This article explores the complex factors shaping DILANTIN's market, prognosis of its financial trajectory, and strategic considerations for stakeholders.

Market Landscape Overview

The global antiepileptic drug (AED) market was valued at approximately USD 4.8 billion in 2021, with phenytoin representing a significant, albeit decreasing, segment. Despite the advent of newer agents offering improved safety profiles, DILANTIN maintains a niche due to its extensive clinical experience, cost-effectiveness, and affordability, particularly in emerging markets.

Historical Significance and Clinical Utility

DILANTIN's efficacy in controlling partial and generalized seizures has cemented its role in epilepsy management over decades. Its pharmacokinetic profile, characterized by zero-order kinetics at higher doses, necessitates careful therapeutic drug monitoring (TDM). Although newer AEDs such as levetiracetam, lamotrigine, and topiramate offer better side-effect profiles, DILANTIN remains indispensable in resource-limited settings and specific patient populations, including those with complex epilepsy.

Regulatory Environment and Patent Status

DILANTIN's patent expired in the late 20th century, transitioning the market largely to generic manufacturers. The broad availability of generic phenytoin has driven pricing pressures, reducing revenue for brand-name formulations like DILANTIN. Regulatory frameworks now prioritize safety and quality standards, influencing formulation and manufacturing practices, and impacting market entry strategies for competitors.

Market Dynamics Influencing DILANTIN

1. Competitive Landscape

The transition from branded to generic phenytoin has intensified competition, impacting revenue streams. Generic manufacturers benefit from lower production costs, enabling aggressive pricing and market penetration, especially in low- and middle-income countries (LMICs). However, brand formulations such as DILANTIN differentiate through formulations that address stability issues of generic versions, such as DILANTIN CR (controlled-release), which is preferred by some clinicians.

2. Evolving Clinical Guidelines

Recent guidelines tend to favor newer AEDs with better safety profiles, reduced drug interactions, and simplified dosing. This shift gradually diminishes DILANTIN’s prescribing frequency, primarily relegating it to salvage therapy or cases with specific contraindications to newer agents. Consequently, demand in developed markets is expected to decline, exerting pressure on revenue.

3. Patent and Exclusivity Impact

While DILANTIN lost patent protection long ago, the development of specialized formulations and delivery systems can offer semi-exclusive market niches. As companies seek to sustain sales, reformulations with improved pharmacokinetics, bioavailability, or reduced toxicity signify opportunities, albeit typically with smaller market shares.

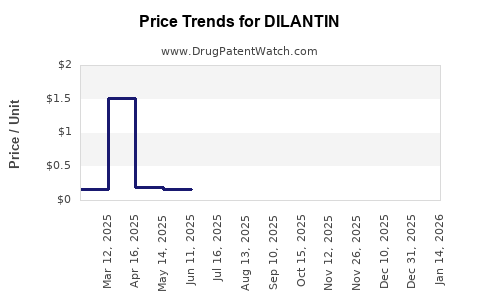

4. Manufacturing and Cost Dynamics

Cost reductions due to high competition among generics have kept prices low, especially in LMICs. While this supports access, it suppresses margins for manufacturers. Conversely, quality control concerns with generics—particularly regarding stability and bioequivalence—advocate for branded formulations, influencing market positioning.

Financial Trajectory Projections

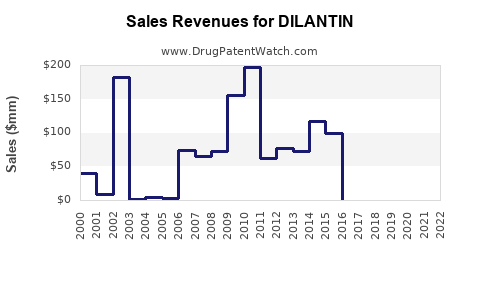

Short-Term Outlook (1-3 years)

The immediate future suggests a contraction in DILANTIN’s revenue base in high-income markets owing to increased adoption of newer AEDs. Sales are likely to stabilize or decline marginally, driven primarily by legacy prescriptions and hospital formularies in settings constrained by formulary policies. However, steady demand persists in LMICs where affordability and clinician familiarity sustain sales.

Medium to Long-Term Outlook (3-10 years)

Predictive modeling indicates a continued downward trend in developed countries, driven by clinical preference shifts and evolving treatment algorithms. Nonetheless, niche markets—like specific patient populations with drug-resistant epilepsy or with contraindications to newer AEDs—may sustain some revenue streams.

Emerging markets, accounting for over 50% of global epilepsy treatment, will likely retain steady demand, albeit with pricing pressures. The introduction or reformulation of DILANTIN with enhanced delivery properties could marginally stabilize or mobilize revenues through targeted marketing efforts.

Impact of Regulatory Innovations

Regulatory agencies increasingly mandate comprehensive post-marketing surveillance and bioequivalence standards, which could influence manufacturing costs and product consistency. Companies investing in quality assurance may command premium pricing, offsetting declining volume trends.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on specialty formulations or combination therapies incorporating DILANTIN to extend lifecycle value.

- Investors: Evaluate emerging markets' growth potential, considering regulatory, competitive, and epidemiological factors.

- Healthcare Providers: Balance the clinical economics of older versus newer AEDs, aligning formulary decisions with patient-specific needs and safety considerations.

- Regulatory Bodies: Ensure standards uphold product quality, fostering confidence amidst generics proliferation.

Key Market Drivers & Constraints

| Drivers |

Constraints |

| Cost-effectiveness and access in LMICs |

Preference for newer AEDs with better safety profiles |

| Long-term clinical familiarity |

Regulatory challenges related to generic drug bioequivalence |

| Specific clinical indications requiring older agents |

Stringent quality standards impacting production costs |

| Development of novel formulations |

Market saturation in developed countries |

Conclusion

DILANTIN's market trajectory manifests a typical lifecycle pattern for a mature, off-patent pharmaceutical. Though demand diminishes in affluent markets, it remains vital in LMICs, becoming a balancing act of sustaining legacy sales while adapting to emerging therapeutic paradigms. Strategic innovation, formulation improvements, and geographic expansion are pivotal for stakeholders seeking to optimize profitability. Overall, DILANTIN’s future hinges on responding dynamically to medical, regulatory, and market evolutions.

Key Takeaways

- Market positioning: DILANTIN retains a niche in global epilepsy treatment, chiefly in resource-constrained regions.

- Revenue outlook: Anticipate steady decline in high-income markets, with persistent demand elsewhere.

- Competitive edge: Differentiation through formulations addressing stability and safety concerns can prolong viability.

- Regulatory influences: Compliance with evolving standards affects manufacturing costs and market access.

- Strategic focus: Diversify portfolio offerings, optimize formulations, and explore new therapeutic niches to safeguard financial performance.

FAQs

-

Why is DILANTIN still relevant despite newer antiepileptic drugs?

DILANTIN’s cost-effectiveness, extensive clinical history, and established safety profile make it essential, especially in low-income regions or in cases where newer AEDs are contraindicated or unavailable.

-

How do generic versions impact DILANTIN's market?

Generics precipitated significant price competition, reducing profitability for brand-name DILANTIN. However, brand formulations can differentiate through quality improvements and specialized delivery systems.

-

What are the primary challenges facing DILANTIN's market?

The shift towards newer AEDs with better safety profiles, regulatory requirements, and pricing competition from generics constrain its growth.

-

Can reformulated DILANTIN formulations extend its market life?

Yes, innovative formulations offering enhanced stability, reduced toxicity, or tailored delivery can create niche markets and prolong product relevance.

-

What role does DILANTIN play in emerging markets?

It remains vital as an affordable, effective option for epilepsy treatment, with demand driven by economic factors and healthcare infrastructure constraints.

Sources:

[1] MarketWatch, Global AED Market Analysis, 2021

[2] U.S. Food and Drug Administration, Antiepileptic Drug Regulatory Standards, 2022

[3] IMS Health, Pharmaceutical Market Trends, 2022

[4] WHO Model List of Essential Medicines, 2021