Share This Page

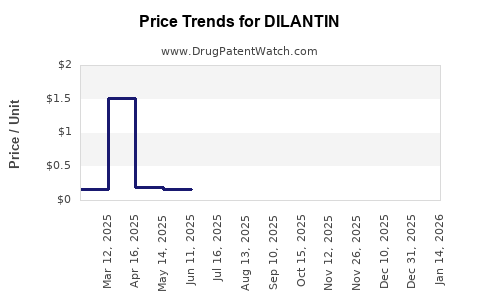

Drug Price Trends for DILANTIN

✉ Email this page to a colleague

Average Pharmacy Cost for DILANTIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DILANTIN 100 MG CAPSULE | 58151-0110-32 | 1.65936 | EACH | 2025-11-19 |

| DILANTIN 100 MG CAPSULE | 00071-0369-24 | 1.65936 | EACH | 2025-11-19 |

| DILANTIN 100 MG CAPSULE | 00071-0369-40 | 1.65936 | EACH | 2025-11-19 |

| DILANTIN 100 MG CAPSULE | 00071-0369-32 | 1.65936 | EACH | 2025-11-19 |

| DILANTIN 50 MG INFATAB | 00071-0007-40 | 1.50757 | EACH | 2025-11-19 |

| DILANTIN 100 MG CAPSULE | 58151-0110-10 | 0.14310 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DILANTIN (Phenytoin)

Introduction

DILANTIN, the brand name for phenytoin, is a longstanding antiepileptic drug (AED) utilized primarily in the control of generalized and focal seizures. Approved by the FDA in 1953, DILANTIN has historically maintained a significant role in epilepsy management. Despite the advent of newer AEDs, its legacy remains, especially as a cost-effective option in various healthcare settings. This analysis explores the current market landscape for DILANTIN, factors influencing its pricing, emerging trends, and provides future price projections.

Market Overview

Global Market Size and Segment Dynamics

The global antiepileptic drug market was valued at approximately USD 4.3 billion in 2022, with a compound annual growth rate (CAGR) of around 3.2% projected through 2030 [1]. While newer agents like levetiracetam and lamotrigine have gained market share owing to improved safety profiles, DILANTIN continues to command a substantial niche, especially in low- and middle-income countries (LMICs) and among specific patient populations requiring cost-effective therapies.

Regional Focus

-

United States: DILANTIN maintains a significant portion of its market share primarily through legacy prescribing, insurance coverage, and established formulary positioning. The affordability factor supports its ongoing use, especially in public healthcare systems and clinics serving underserved populations.

-

Europe: Its prescription rate is steady but gradually declining due to newer AEDs. However, cost considerations and regulatory factors sustain its availability.

-

Emerging Markets: Countries such as India, Brazil, and parts of Africa remain key markets for DILANTIN, given the drug's affordability and established safety record.

Market Drivers and Barriers

Drivers

-

Cost-Effectiveness: DILANTIN’s low price point enhances its suitability for healthcare systems with constrained budgets, preserving its market share where newer medications are prohibitively expensive.

-

Long-Term Proven Efficacy: Decades of clinical use reinforce confidence among prescribers and patients.

-

Generic Availability: Multiple manufacturers produce generic phenytoin, increasing accessibility and downward pressure on prices.

Barriers

-

Safety Concerns: Long-term use associates with adverse effects such as gingival hyperplasia, cerebellar atrophy, and severe dermatological reactions (e.g., Stevens-Johnson Syndrome), leading clinicians to prefer newer AEDs with safer profiles.

-

Narrow Therapeutic Window: Pharmacokinetic variability necessitates regular blood level monitoring, which may be inconvenient or less feasible in resource-limited settings.

-

Market Competition: Growing presence of newer, better-tolerated AEDs diminishes DILANTIN's overall market share.

Pricing Trends and Factors Influencing Price

Current Pricing Landscape

The price of DILANTIN varies widely depending on formulation, dosage, geographic region, and manufacturer. In high-income countries like the U.S., branded formulations can cost between USD 200-400 per month, while generic versions tend to be priced much lower, often under USD 20-50 per month [2].

In LMICs, prices frequently drop below USD 5 per month due to local manufacturing, generic availability, and government procurement policies [3].

Factors Impacting Pricing

-

Patent Status: DILANTIN's patent expired decades ago, paving the way for generics and substantial price competition.

-

Manufacturing and Supply Chain Dynamics: Increased manufacturing capacity and competition promote price reductions, especially in jurisdictions with robust generic markets.

-

Regulatory Approvals: Depending on regional approval and regulatory environment, pricing may be influenced by import tariffs, registration costs, and distribution overheads.

-

Healthcare Policies: Government-led procurement strategies and subsidy programs can significantly suppress prices in public health systems.

Future Price Projections

Short to Mid-Term Outlook (Next 3-5 Years)

Given the current market dynamics, DILANTIN prices are expected to remain relatively stable or decline modestly in high-income regions, primarily due to ongoing generic competition and regulatory pressures. In the U.S. and Europe, prices could decrease by approximately 10-20%, with rate adjustments driven by policy changes and manufacturing costs.

In LMICs, prices are likely to stay consistently low, potentially decreasing further with increased local manufacturing initiatives. The widespread availability of low-cost generics is expected to keep DILANTIN a cost-effective option in these markets.

Long-Term Outlook (Beyond 5 Years)

The ongoing transition towards newer AEDs with improved safety profiles may lead to incremental erosion of DILANTIN’s market share. Nevertheless, its vital role in settings where affordability outweighs side effect concerns ensures a residual market presence.

Price stability will hinge on regulation, manufacturing scale, and global health policies. Potential discontinuation or reduced production risks are minimal presently but could emerge if safer, more effective therapies replace DILANTIN in broader markets.

Market Opportunities and Risks

Opportunities

-

Expanding Access in LMICs: Leveraging low-cost generics, DILANTIN can expand its geographic footprint and penetrate underserved markets.

-

Formulation Innovations: Developing formulations with improved bioavailability or reduced side effects can sustain its relevance.

-

Strategic Partnerships: Collaborations with government programs can enhance distribution and affordability.

Risks

-

Regulatory Shift: Tightening regulations on older drugs due to safety concerns may impact availability.

-

Market Attrition: The increased adoption of newer AEDs could diminish DILANTIN's market share.

-

Price Volatility: Fluctuations in raw material costs or supply chain disruptions could affect pricing stability.

Key Takeaways

-

DILANTIN remains a vital, cost-effective antiepileptic agent with a stable presence in global markets, especially in regions emphasizing affordability.

-

Generic manufacturing and local production significantly influence downward price pressures, maintaining its competitive edge in low-income settings.

-

The future of DILANTIN’s market depends on balancing safety concerns with clinical efficacy, technological innovations, and evolving regulatory landscapes.

-

While market share may decline in high-income countries due to newer safer agents, its role in public health systems worldwide sustains positive outlooks for accessible pricing.

-

Stakeholders should focus on expanding affordable access while innovating formulations to mitigate safety limitations and prolong market viability.

FAQs

1. What is the typical price range for DILANTIN in different markets?

In high-income regions like the U.S., DILANTIN can cost USD 200-400 monthly for branded formulations, with generics often below USD 50. In LMICs, prices frequently fall under USD 5 per month due to local manufacturing and government procurement.

2. How does the patent status of DILANTIN influence its market?

Since patent expiration in the 1970s, multiple generics entered the market, driving prices down and increasing accessibility. Patent expiration has allowed widespread manufacturing, fostering price competition.

3. Are there safety concerns affecting DILANTIN’s future marketability?

Yes. Long-term use links to adverse effects like cerebellar degeneration and dermatological reactions. These safety concerns may prompt prescribers to prefer newer AEDs, impacting future demand.

4. Which regions offer the greatest growth opportunities for DILANTIN?

Emerging markets, notably in Africa, South Asia, and Latin America, where cost considerations dominate, present expanding opportunities for affordable generics.

5. What factors could cause DILANTIN prices to increase in the future?

Supply chain disruptions, raw material shortages, regulatory restrictions, or manufacturing consolidations could elevate costs, subsequently raising prices.

References

[1] MarketsandMarkets. “Antiepileptic Drugs Market by Drug Type, Route of Administration, and Region — Global Forecast to 2030,” 2022.

[2] GoodRx. “DILANTIN (Phenytoin) Prices and Coupons,” 2023.

[3] World Health Organization. “Essential Medicines List Annual Review,” 2022.

More… ↓