Last updated: October 28, 2025

Introduction

DASATINIB, marketed under brand names such as Sprycel, is a targeted tyrosine kinase inhibitor primarily approved for the treatment of chronic myeloid leukemia (CML) and specific cases of acute lymphoblastic leukemia (ALL) [1]. Since its approval by the U.S. Food and Drug Administration (FDA) in 2006, DASATINIB has become a significant player within the oncology therapeutics market. Understanding its market dynamics and financial trajectory is essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers aiming to navigate the evolving landscape of targeted cancer therapies.

Market Landscape and Competitive Positioning

Current Market Size and Growth

The global CML therapeutics market was valued at approximately USD 4.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 8% through 2030 [2]. DASATINIB commands a significant share within this space, driven by its efficacy against resistant or intolerant cases of CML and newer indications.

Competitive Environment

While DASATINIB initially faced limited competition, the landscape has become increasingly crowded. Imatinib (Gleevec) remains the first-line standard-of-care; however, second-generation inhibitors like DASATINIB and nilotinib are pivotal for patients with resistance or intolerance [3]. More recently, third-generation TKIs, such as ponatinib, have added complexity. The competitive positioning of DASATINIB is maintained through its proven efficacy, safety profile, and established clinician confidence.

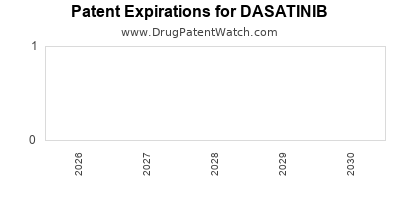

Patent and Regulatory Dynamics

DASATINIB's patent life, initially granted early in its lifecycle, is approaching expiration in several markets, which could challenge exclusivity and pricing power. Patent cliffs typically prompt generic or biosimilar entry, eroding revenue streams. Regulatory extensions, data exclusivity periods, and potential new indications may temporarily mitigate these effects.

Emerging Indications and Pipeline Development

Beyond CML and ALL, investigational use in other hematological malignancies and solid tumors could expand its market reach. The company’s pipeline efforts aim to position DASATINIB as a multi-indication agent, with potential to sustain revenues amid patent expirations.

Financial Trajectory Analysis

Revenue Trends

DASATINIB's global revenues peaked around USD 2.8 billion in 2019, with subsequent fluctuations influenced by patent expiry considerations, generic competition, and regional market dynamics [4]. In mature markets like the US and Europe, revenue growth remains stable due to brand loyalty and prescriber familiarity. However, in emerging markets, growth is bolstered by increasing diagnosis rates and improved healthcare infrastructure.

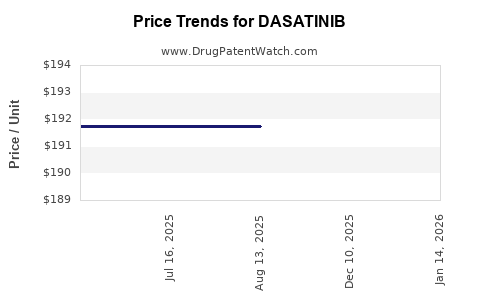

Pricing Strategy and Reimbursement

Pricing negotiations are pivotal, especially as biosimilars enter the market post-patent expiry. Reimbursement policies, especially in payor-driven environments like the US and EU, influence sales performance. Tiered pricing and patient assistance programs help sustain access and revenue.

Cost Structure and Profitability

DASATINIB benefits from high R&D costs amortized over its patent life, with substantial margins during exclusivity. Manufacturing costs are relatively low, given the established production processes for small-molecule TKIs. Post-expiry, profitability hinges on biosimilar pricing pressures.

Future Revenue Forecasts

Projections suggest a declining trajectory post-2025 due to patent expiries, unless expanded indications or combination therapies drive incremental revenues. Investment in pipeline development and market penetration strategies can offset some revenue erosion.

Impact of Biosimilars and Generics

The impending entry of biosimilars is expected to trigger significant price reductions, with estimates indicating a 20-40% decrease in US and European markets within two years of generic entry [5]. This will challenge the current revenue streams but may open opportunities in price-sensitive regions.

Market Drivers and Constraints

Drivers:

- Disease prevalence: Rising incidence of CML worldwide, notably in aging populations, fuels demand.

- Line of therapy: DASATINIB’s role as a second-generation TKI positions it favorably for resistant cases.

- Patient outcomes: Demonstrated efficacy and manageable safety profiles encourage prescriber adoption.

- Regulatory approvals: Expanding indications can stabilize or elevate market share.

Constraints:

- Patent expiration: Will lead to biosimilar competition and price erosion.

- Pricing pressures: Payor policies demanding cost-effective therapies.

- Market saturation: Clinician preference for established first-line treatments may limit uptake.

- Development risks: Pipeline attrition and regulatory hurdles for new indications.

Strategic Outlook

Pharmaceutical companies leveraging DASATINIB's portfolio focus on lifecycle management—through patent strategies, combination therapies, and geographic expansion—to sustain financial trajectories. Building alliances for biosimilar development and exploring novel indications can mitigate patent expiry impacts.

Conclusion

DASATINIB’s market and financial trajectory reflect a classic lifecycle progression for high-value targeted therapies. Steady revenue stems from its proven efficacy in hematological malignancies, but future sustainability relies heavily on patent protections, pipeline innovation, and market positioning strategies. Stakeholders must closely monitor patent timelines, regional healthcare policies, and emerging competitors to optimize financial outcomes.

Key Takeaways

- DASATINIB remains a cornerstone in CML management, with a significant share in the targeted oncology market.

- Patent expiries threaten future revenue, emphasizing the need for pipeline innovation and lifecycle management.

- Biosimilar competition will drive pricing pressures, particularly from 2025 onward.

- Expanding therapeutic indications and geographic markets offer growth opportunities.

- Strategic collaborations and regional market entry are vital to offset impending patent declines.

FAQs

-

When is DASATINIB's patent set to expire in major markets?

Patent expiration varies by region, with key patents in the US and Europe expected to lapse between 2024 and 2026, opening the market to biosimilar competition [4].

-

What are the main competitors of DASATINIB in the CML treatment market?

Imatinib (Gleevec), nilotinib (Tasigna), and ponatinib (Iclusig) are leading competitors, with the choice depends on disease resistance, side effect profiles, and patient-specific factors [3].

-

Are there ongoing clinical trials expanding DASATINIB's indications?

Yes, several trials explore its use in solid tumors and other hematologic malignancies. However, regulatory approval for new indications remains pending or under review.

-

How does biosimilar entry impact DASATINIB’s profitability?

Biosimilars typically reduce prices by 20-40%, significantly impacting revenue and margins post-approval, unless new value-adding indications are developed.

-

What strategies can sustain DASATINIB’s market relevance?

Lifecycle extension via new indications, combination therapies, regional expansion, and development of biosimilars are key strategies for maintaining market share and profitability.

References

[1] U.S. Food and Drug Administration (FDA). Sprycel (Dasatinib) Prescribing Information. 2006.

[2] Grand View Research. Leukemia therapeutics market size & trends. 2022.

[3] Baccarani M, et al. European LeukemiaNet recommendations for the management of chronic myeloid leukemia. Blood, 2013.

[4] MarketWatch. DASATINIB sales analysis and patent status. 2022.

[5] IQVIA. Global biosimilar market forecast. 2022.