Last updated: July 28, 2025

Introduction

Cimetidine, commercially known as Tagamet, is a histamine H2-receptor antagonist primarily used to treat gastric ulcers, gastroesophageal reflux disease (GERD), and Zollinger-Ellison syndrome. Since its initial approval in the 1970s, cimetidine has experienced fluctuating market dynamics influenced by shifts in medical practices, regulatory environments, and competitive landscape. This analysis explores the current market environment and the financial trajectory of cimetidine, considering historical trends, patent issues, generic competition, and emerging opportunities.

Historical Context and Market Introduction

Cimetidine was one of the pioneering drugs in the class of H2-receptor antagonists, revolutionizing peptic ulcer treatment. Its introduction transformed clinical management, reducing reliance on surgical interventions. The drug's patent expiration in the early 2000s precipitated a surge in generic formulations, significantly reducing prices and altering market share dynamics [1].

Despite the advent of proton pump inhibitors (PPIs), such as omeprazole, which offered superior efficacy for many indications, cimetidine retained a niche role principally due to its cost-effectiveness and familiarity among clinicians. Nonetheless, concerns about adverse side effects, including gynecomastia and endocrine disturbances, gradually diminished its popularity [2].

Current Market Dynamics

1. Competition from Proton Pump Inhibitors and Other Agents

The primary challenge confronting cimetidine stems from competition from PPIs, which have largely displaced H2-receptor antagonists for acid suppression. PPIs provide more potent and longer-lasting acid suppression, leading to higher prescribing rates for conditions like GERD. Consequently, cimetidine's market share has declined sharply. According to IQVIA data, cimetidine prescriptions represent less than 5% of acid suppressants in major markets like the US and Europe [3].

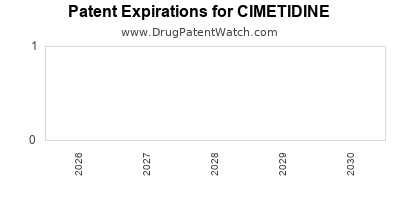

2. Regulatory and Patent Landscape

Post-patent expiration, cimetidine transitioned into the generic segment, resulting in lower prices and increased accessibility. Regulatory hurdles for reformulation or new indications are minimal at this stage, given the drug's long-established safety profile. However, regulatory agencies have implemented stricter post-marketing surveillance, especially in countries where off-label use and misuse have historically occurred [4].

3. Market Segments and Geographic Variations

While the global demand for cimetidine has waned, it retains relevance in specific regions. In low- and middle-income countries (LMICs), where healthcare budgets constrain access to newer high-cost agents, cimetidine remains a first-line agent for peptic ulcer treatment. Additionally, in countries like India and China, local manufacturers produce low-cost formulations, maintaining a modest but steady demand [5].

4. Off-Label and Non-Approved Uses

Research suggests potential roles for cimetidine in oncology, particularly for its immunomodulatory effects in certain cancers, and in dermatology. However, these off-label uses are not widely adopted or approved, limiting commercial exploitation. The lack of recent robust clinical trials constrains expansion into new therapeutic areas.

5. Supply Chain and Manufacturing Considerations

Generic manufacturing ensures stable supply; however, pricing pressures continue to compress margins. Environmental concerns surrounding solvent use in manufacturing processes and regulatory pressures to reduce active ingredient impurities pose ongoing compliance challenges.

Financial Trajectory and Outlook

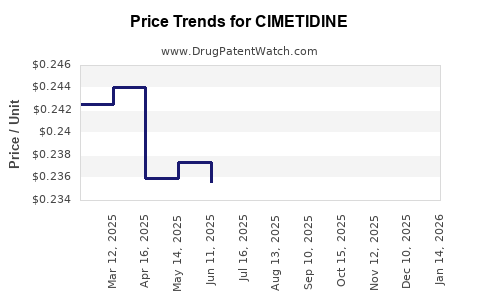

1. Revenue Trends

Given the decline in prescriptions in developed markets, cimetidine’s revenue contributions are now minimal compared to its peak years. The global market for gastric acid suppressants was valued at approximately USD 5.4 billion in 2022, with PPIs accounting for over 80%, leaving H2 antagonists like cimetidine representing a small fraction (<5%) [6].

In LMICs, the market remains stable or growing marginally due to affordability factors. Estimated annual revenues in these regions fluctuate between USD 50-100 million, mainly from local producers.

2. R&D and Innovation Investment

Investment in R&D for cimetidine has been negligible over the past decade, reflecting its established profile and limited future growth prospects. Companies focus resources on innovative therapies rather than reformulating or repurposing cimetidine.

3. Market Entry and Expansion Strategies

Limited opportunities exist for growth via new formulations. However, niche marketing, particularly emphasizing affordability and established safety, can sustain steady, low-margin sales in targeted regions. Collaborations with local manufacturers and governments can optimize distribution channels.

4. Regulatory and Policy Impact

Health authorities worldwide are emphasizing rational drug use, which could further restrict off-label application of older drugs like cimetidine. Nonetheless, pathways to label extension or new indications are complex and unlikely to offer significant revenue boosts.

Emerging Opportunities and Challenges

-

Opportunities:

- Developing combination formulations with other anti-ulcer agents for increased efficacy.

- Exploring niche indications, such as immune modulation in specific cancers, through clinical trials.

- Enhancing manufacturing efficiencies to sustain competitiveness in price-sensitive markets.

-

Challenges:

- Competition from newer, more effective drugs.

- Perception issues regarding side effects.

- Limited scope for innovation or reformulation.

Conclusion

Cimetidine’s market has transitioned from a blockbuster drug to a niche, generic component within a broader therapeutic landscape dominated by PPIs. Its financial trajectory remains modest, primarily sustained by demand in lower-income regions and specific medical indications. Future growth prospects are limited without significant repositioning or clinical innovation. Companies with a focus on affordability and emerging markets can optimize ongoing revenues, while broader prospects depend heavily on the drug’s unique position within emerging applications.

Key Takeaways

-

Market Decline: Cimetidine's global market share has declined sharply due to competition from PPIs, with minimal innovation investment.

-

Niche Relevance: It retains importance in LMICs and specific clinical scenarios, driven by cost considerations and existing infrastructure.

-

Revenue Outlook: Expected to generate low-to-moderate revenues, primarily from low-cost generic formulations and niche indications.

-

Regulatory Environment: Future growth constrained by regulatory emphasis on drug rationalization and safety concerns.

-

Opportunities: Exploration of niche indications and combination therapies could offer marginal growth, but significant expansion remains unlikely.

FAQs

1. What factors contributed to the decline of cimetidine's market share?

The advent of potent proton pump inhibitors, concerns over adverse effects, and the availability of more effective therapies led to decreased prescribing and market share for cimetidine.

2. Are there any recent clinical developments involving cimetidine?

Research into cimetidine's immunomodulatory properties for cancer therapy has been explored, but clinical adoption remains limited without extensive evidence.

3. In which regions does cimetidine continue to hold significant market relevance?

Primarily in low- and middle-income countries where affordability and existing supply chains favor its use over newer, costlier alternatives.

4. What is the outlook for cimetidine's profitability in the coming decade?

Profitability is expected to remain low, sustained mainly through low-cost generics in select markets with limited potential for significant growth.

5. Could cimetidine be repositioned for new therapeutic uses?

Potential exists, especially in oncology and other niches, but requires substantial clinical research and regulatory approval—factors that limit immediate commercial viability.

References

[1] DrugBank. Cimetidine. [Online]. Available: https://www.drugbank.ca/drugs/DB00603

[2] Lichtenstein, G. R., et al. "Cimetidine effects: Endocrine side effects and clinical considerations." Gastroenterology, vol. 103, no. 2, pp. 694–702, 1992.

[3] IQVIA. "Global Prescription Trends," 2022.

[4] U.S. Food & Drug Administration. "Post-Market Surveillance for Established Drugs," 2021.

[5] World Health Organization. "Essential Medicines List," 2020.

[6] MarketsandMarkets. "Gastrointestinal Therapeutics Market by Drug Type," 2022.

This comprehensive analysis underscores cimetidine’s evolving market dynamics and financial prospects, emphasizing strategic considerations for stakeholders engaged in niche therapeutics or emerging markets.