Last updated: July 27, 2025

Introduction

Ceftriaxone, a third-generation cephalosporin antibiotic, has maintained its prominence in the anti-infective landscape due to its broad-spectrum efficacy, convenient dosing profile, and favorable pharmacokinetics. Since its introduction, ceftriaxone has become integral to treating various bacterial infections, including pneumonia, meningitis, urinary tract infections, and gonorrhea. Analyzing the drug's market dynamics and financial trajectory warrants a comprehensive understanding of epidemiological trends, competitive landscape, regulatory factors, and innovations influencing demand and revenues.

Market Overview and Drivers

Prevalence of Bacterial Infections

The global burden of bacterial infections remains substantial, especially in developing regions characterized by limited sanitation and healthcare infrastructure. According to the World Health Organization, lower respiratory infections and meningitis significantly contribute to morbidity and mortality (WHO, 2021). Ceftriaxone's high efficacy against Neisseria gonorrhoeae, Streptococcus pneumoniae, and Haemophilus influenzae sustains its high demand globally.

Hospital-Based Usage and Healthcare Policies

Hospitals constitute primary distribution channels for ceftriaxone, especially in inpatient settings. The widespread adoption of intravenous antibiotics in hospital protocols reinforces steady demand. Moreover, governments and healthcare authorities strongly endorse ceftriaxone in treatment guidelines, further stabilizing its use.

Rising Resistance and Treatment Guidelines

Antibiotic resistance, notably resistance among Neisseria gonorrhoeae, presents a dual impact. On one hand, rising resistance can stimulate demand for alternative or combination therapies, occasionally including ceftriaxone. Conversely, emerging resistance may restrict its use, marginally impairing revenue streams. Continuous surveillance reports highlight the need for stewardship programs, which influence prescribing behaviors (CDC, 2022).

Market Dynamics

Competitive Landscape

Ceftriaxone faces competition from other cephalosporins and broad-spectrum antibiotics such as ceftazidime, cefepime, and carbapenems. Generic formulations dominate the market, resulting in intense price competition. Nonetheless, brand reputation and formulation stability favor established manufacturers.

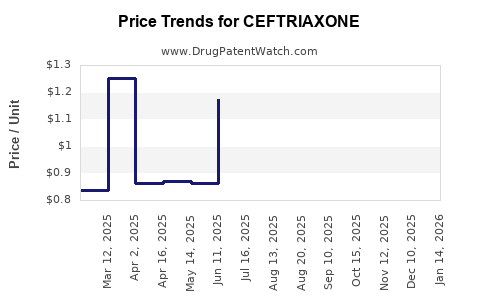

Generic Penetration and Price Trends

The entry of generic ceftriaxone significantly lowered prices post-patent expiration, increasing accessibility in emerging markets. Price elasticity, driven by healthcare budgets and reimbursement policies, affects revenue growth — particularly in low-income countries where cost-sensitive procurement dominates.

Regulatory Environment and Approvals

Stringent regulatory frameworks in North America and Europe shape market entry and influence reimbursement policies. Conversely, emerging markets exhibit more leniency, facilitating wider distribution but raising concerns regarding quality assurance. Patients’ safety and antibiotic stewardship drive regulatory review processes, potentially impacting launch timelines and marketing strategies.

Innovation and Formulation Development

While ceftriaxone remains a stalwart in antibiotic therapy, innovations such as sustained-release formulations, combination therapies, or diagnostics aimed at stewardship optimization could reshape its competitive positioning. Limited pipeline activity underscores that the market largely relies on existing formulations, underscoring a mature product lifecycle.

Financial Trajectory

Revenue Trends and Forecasts

The global ceftriaxone market was valued at approximately USD 820 million in 2021, with projections estimating a compound annual growth rate (CAGR) of around 4% through 2028. Growth drivers include expanding healthcare access, rising bacterial infection prevalence, and the consolidation of hospital formularies.

Regional Revenue Breakdown

- North America: Dominates due to high healthcare expenditure, advanced hospital infrastructure, and robust regulatory environments.

- Europe: Similar dynamics with high adoption in tertiary care centers; however, growth is tempered by antibiotic stewardship policies.

- Asia-Pacific: Exhibits the highest growth potential owing to increasing healthcare infrastructure, rising infection rates, and affordability of generic formulations.

- Latin America and Africa: Growth driven by expanding access to antibiotics, though limited by supply chain and regulatory challenges.

Pricing and Reimbursement Factors

Pricing strategies are influenced by generic competition and reimbursement policies. Price-sensitive markets emphasize cost-effective formulations, while developed markets focus on perceived quality and stability. Reimbursement complexities can dampen or stimulate market penetration, impacting revenue streams.

Future Outlook

The outlook for ceftriaxone hinges on several interconnected factors:

-

Antibiotic Resistance: The persistent threat of resistance could limit ceftriaxone's utility, prompting healthcare providers to shift towards newer agents or combination therapies, possibly affecting revenue.

-

Stewardship and Prescribing Practices: Greater emphasis on antimicrobial stewardship aims to optimize use, potentially constraining growth in some markets.

-

Emerging Alternatives: Development of novel antibiotics with mechanisms circumventing resistance may challenge ceftriaxone's market dominance in the longer term.

-

Global Health Initiatives: Increased funding and initiatives targeting infectious diseases, especially in low-income regions, are expected to sustain demand, albeit at a moderately tempered rate.

-

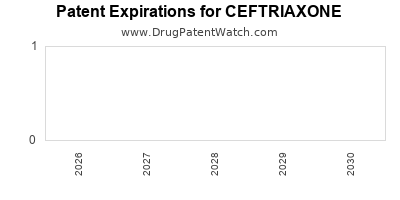

Regulatory and Patent Dynamics: Patent expirations foster market entry of generics, pressuring prices but expanding volumes. New formulations or indications could rejuvenate interest.

Key Market Players

Leading manufacturers include Sanofi, Pfizer (via Wyeth, acquired by Pfizer), and Sandoz (Novartis), among others. Sanofi's longstanding position owes to its established supply chain and brand reputation. The competition landscape underscores a consolidation trend driven by patent expirations and cost pressures.

Impact of Global Events

Recent global health crises, notably COVID-19, temporarily shifted focus away from antibiotics, but the essential nature of ceftriaxone in bacterial pneumonia and secondary bacterial infections sustained its underlying demand. Additionally, supply chain disruptions disrupted manufacturing and distribution channels, yet diversified supply sources mitigated long-term impacts.

Conclusion

Ceftriaxone remains a pivotal antibiotic in the global arsenal against bacterial infections. Its market is characterized by stable demand, moderated by growing resistance concerns and intense generic competition. The financial trajectory indicates steady, modest growth, particularly driven by expanding access in emerging markets. Adaptation to resistance patterns, innovative formulations, and stewardship policies will shape its future market positioning and revenue potential.

Key Takeaways

- The global ceftriaxone market is projected to grow at approximately 4% CAGR through 2028, driven by increasing infection burdens and expanding healthcare access.

- Generic formulations dominate the market, intensifying pricing pressures but broadening access, especially in emerging economies.

- Rising antibiotic resistance poses challenges to ceftriaxone’s efficacy and market longevity, necessitating ongoing innovation and stewardship.

- Regional disparities influence revenue streams, with North America leading, followed by Europe and Asia-Pacific, where rapid growth offers significant opportunities.

- Future success hinges on balancing resistance management, regulatory compliance, and potential innovation in formulations or combination therapies.

FAQs

1. How does antibiotic resistance impact the future of ceftriaxone?

Rising resistance among key pathogens such as Neisseria gonorrhoeae diminishes ceftriaxone’s clinical effectiveness, potentially leading to reduced use and revenue. Vigilant stewardship and development of combination therapies or new antibiotics are necessary to mitigate these impacts.

2. What are the main drivers of ceftriaxone's market growth in emerging markets?

Growing healthcare infrastructure, increasing burden of bacterial infections, and price affordability due to generic availability drive demand in regions like Asia-Pacific and Latin America.

3. Are new formulations of ceftriaxone being developed?

Currently, innovation focuses on stable formulations and combination therapies to optimize treatment outcomes. However, significant pipeline activity remains limited, reflecting the drug’s mature lifecycle.

4. How do regulatory policies affect ceftriaxone’s market trajectory?

Stringent regulations in developed markets ensure quality but can delay approvals, while flexible regulations in emerging markets facilitate wider access, affecting overall sales volume.

5. What role do global health initiatives play in ceftriaxone’s market?

International efforts to combat infectious diseases increase access and procurement of antibiotics like ceftriaxone, supporting sustained demand especially in low-resource settings.

Sources

[1] World Health Organization. (2021). Global Infectious Disease Burden Data.

[2] CDC. (2022). Antibiotic Resistance Threats Report.

[3] MarketWatch. (2022). Ceftriaxone Market Trends & Forecasts.

[4] IQVIA. (2022). Global Antibiotics Market Data.