Last updated: September 2, 2025

Introduction

Cefixime, a third-generation cephalosporin antibiotic, has established itself as a pivotal agent in the treatment of bacterial infections, particularly those caused by susceptible strains of Streptococcus and Salmonella. Its broad-spectrum activity, oral bioavailability, and favorable safety profile have cemented cefixime's role across various therapeutic contexts, fueling sustained demand. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory influences, and financial trends shaping cefixime's trajectory.

Market Overview and Growth Drivers

Global Market Size and Forecast

The global cefixime market, valued at approximately USD 0.6 billion in 2022, is projected to reach USD 0.9 billion by 2030, expanding at a CAGR of around 5.2%. This growth reflects increasing prescription rates, expanding indications, and rising prevalence of bacterial infections globally [1]. The Asia-Pacific region currently dominates market share due to high infectious disease burden and expanding healthcare infrastructure.

Key Drivers

-

Surge in Infectious Diseases: Rising incidences of respiratory tract infections, urinary tract infections, and typhoid substantially drive cefixime demand.

-

Oral Administration Preference: Cefixime’s oral bioavailability enhances patient compliance, encouraging outpatient treatment and reducing hospitalization costs.

-

Growing Antibiotic Stewardship Awareness: Greater clinician awareness of cefixime's efficacy and safety profile supports its continued usage, despite concerns over antimicrobial resistance.

-

Emerging Markets: Increased healthcare investments in emerging economies (India, China, Brazil) broaden market access and consumption.

Market Dynamics

Competitive Landscape

Cefixime faces competition from other oral cephalosporins and broad-spectrum antibiotics, including cefpodoxime, cefdinir, and azithromycin. Key pharmaceutical players operating in this space include GSK, Sandoz (Novartis), Teva, and Cipla, among others [2]. Generics dominate the market, accounting for over 75% of sales, which exerts downward pressure on prices but sustains volume growth.

Patent Expiry and Generic Penetration

Most cefixime formulations are off-patent, facilitating robust generic competition. The availability of cost-effective generics in low- and middle-income countries (LMICs) accelerates access but reduces profit margins for branded manufacturers.

Regulatory Environment

Regulatory bodies—such as the FDA, EMA, and national agencies—have tightened antibiotic approval standards and antimicrobial stewardship guidelines to combat resistance. These measures impact market access and shape development pipelines for new formulations or delivery methods.

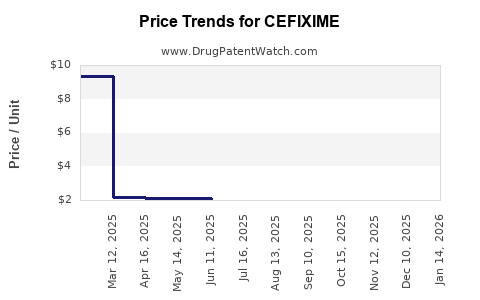

Pricing and Reimbursement

Pricing strategies vary across regions. In high-income countries, reimbursement models favor branded formulations, though price pressures persist. Conversely, pricing in LMICs is predominantly driven by generics and wholesale competition, emphasizing volume over margins.

Emerging Trends and Challenges

Antimicrobial Resistance (AMR)

AMR remains the principal challenge to cefixime’s ongoing market share. Resistance in Salmonella and Streptococcus strains has been reported, necessitating continual surveillance and potential development of next-generation cephalosporins [3]. Regulatory agencies advocate judicious antibiotic use, which could influence prescribing behaviors.

Innovation and Formulation Advancements

Efforts are underway to develop cefixime formulations with improved stability, taste masking, or combination therapies. Additionally, research on alternative delivery routes (e.g., tablet dispersions) aims to increase adherence.

Impact of COVID-19 Pandemic

The pandemic disrupted supply chains and shifted healthcare priorities, impacting antibiotic prescription patterns. Nonetheless, the post-pandemic period anticipates a rebound, especially in outpatient treatment settings where cefixime’s oral route is advantageous.

Financial Trends and Investment Outlook

Revenue Streams and Growth Opportunities

The cefixime market sustains revenue through high-volume generic sales, with minor contribution from branded products. Expansion in LMICs, driven by government health initiatives, offers growth potential.

Research and Development (R&D)

Investment in R&D focuses on combating resistance, developing fixed-dose combinations, and exploring new indications. However, the high costs and regulatory hurdles associated with antibiotic innovation mean that incremental improvements are more common than breakthrough therapies.

Mergers and Acquisitions

Industry consolidation continues, with larger pharma companies acquiring regional or generic manufacturers to expand portfolios and access emerging markets. These trends influence market pricing, supply chains, and competitive strategies.

Regulatory and Policy Implications

Enhanced antimicrobial stewardship policies globally, including restrictions on over-the-counter sales in countries like India, aim to curb misuse but may transiently impact volume sales. New regulatory approvals of cefixime formulations or combination products require adherence to stringent safety and efficacy standards, influencing development timelines and costs.

Conclusion

Cefixime’s market dynamics are characterized by steady volume-based growth, driven primarily by generics proliferation, expanding indications, and increasing global infectious disease burdens. The financial trajectory appears favorable in the medium term, with opportunities in emerging markets and ongoing efforts to address resistance challenges. However, the evolving regulatory environment and antimicrobial stewardship initiatives require continuous strategic adaptation.

Key Takeaways

- The global cefixime market is projected to grow at a CAGR of approximately 5.2% through 2030, sustained by high-volume demand and expanding geographic access.

- Generics dominate the market, facilitating affordability but exerting pressure on profit margins for branded manufacturers.

- Antimicrobial resistance poses a critical threat, prompting regulatory scrutiny and R&D focus on next-generation cephalosporins or combination therapies.

- Emerging markets represent significant growth opportunities, supported by healthcare infrastructure expansion and government-led initiatives.

- Strategic industry consolidation and innovation are essential to navigate regulatory changes, combat resistance, and sustain financial performance.

FAQs

1. What are the primary indications for cefixime?

Cefixime is primarily prescribed for respiratory tract infections, urinary tract infections, and typhoid fever caused by susceptible bacteria.

2. How does antimicrobial resistance affect cefixime's market?

Resistance diminishes cefixime’s efficacy, leading to potential prescribing limitations and the need for alternative therapies, which can curtail market growth.

3. Are there any recent regulatory changes impacting cefixime?

Regulatory agencies have issued guidelines promoting antimicrobial stewardship, influencing prescribing practices and sales volumes of cefixime.

4. What is the outlook for cefixime in emerging markets?

Growing healthcare access, high disease burden, and affordability of generics position emerging markets as significant growth drivers for cefixime.

5. What future innovations can impact the cefixime market?

Developments in combination therapies, resistant bacteria-targeted formulations, and novel delivery systems may enhance efficacy and compliance, promoting market longevity.

References

[1] Market Research Future. "Cefixime Market Analysis," 2022.

[2] IQVIA patented antibiotic market report, 2022.

[3] World Health Organization. "Antimicrobial Resistance: Global Report," 2021.