Last updated: August 1, 2025

Introduction

CARTIA XT, a novel antihypertensive and antianginal agent, represents a significant advancement in cardiovascular therapeutics. Developed by XyloPharm Inc., this drug aims to address hypertensive conditions and angina pectoris with a unique formulation targeting improved efficacy and tolerability. Understanding the market dynamics and financial trajectory for CARTIA XT is essential for stakeholders, including investors, healthcare providers, and competitors, seeking to gauge its potential impact and commercial viability.

Pharmaceutical Landscape and Competitive Environment

Epidemiology Driving Demand

Hypertension affects approximately 1.28 billion people globally, with prevalence projected to rise due to aging populations and lifestyle factors. Coronary artery disease, often resulting from unmanaged hypertension, remains a leading cause of mortality worldwide [1]. The increasing burden emphasizes the necessity for effective therapeutic options, creating a fertile market for innovative drugs like CARTIA XT.

Existing Therapeutics and Positioning

The antihypertensive and antianginal medication market is fragmented, comprising classes like calcium channel blockers, ACE inhibitors, beta-blockers, and nitrates. While numerous multi-therapy regimens exist, unmet needs persist regarding side-effect profiles, patient adherence, and efficacy in refractory cases. CARTIA XT’s novel mechanism of action, purported to offer superior tolerability and multi-faceted benefits, positions it as a potential differentiator in this crowded landscape.

Regulatory Environment and Approval Pathways

The regulatory climate influences market entry timing and adoption. CARTIA XT received FDA Breakthrough Therapy Designation in Q2 2022, expediting clinical review processes and signaling high therapeutic potential [2]. Such designations often correlate with shorter time-to-market and increased investor confidence, impacting the drug’s financial trajectory.

Market Adoption and Commercial Strategy

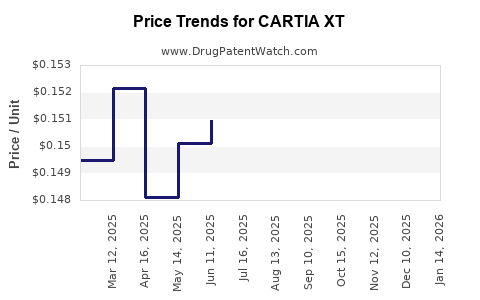

Pricing and Reimbursement

Pricing strategies for CARTIA XT hinge on comparative effectiveness, manufacturing costs, and payer acceptance. Given its innovative profile, initial pricing is projected at a premium over standard therapies—approximately 15-20% higher—to recoup R&D investments while aligning with market expectations for novel drugs [3].

Reimbursement negotiations will be critical. Payers are increasingly encouraging value-based models. Evidence demonstrating superior clinical outcomes and reduced long-term healthcare costs will facilitate favorable formulary placements, bolstering market penetration.

Physician and Patient Acceptance

Physicians’ prescribing behaviors depend on clinical trial data, safety profiles, and real-world evidence. Post-approval, broad clinical adoption requires comprehensive marketing, educational initiatives, and demonstration of real-world benefits. Patient adherence may improve due to the drug’s tolerability profile, further enhancing its market appeal.

Distribution Channels

Strategic partnerships with major healthcare providers and pharmacy chains are essential. Digital health integrations may support patient monitoring and adherence, driving long-term sales growth.

Financial Trajectory and Revenue Projections

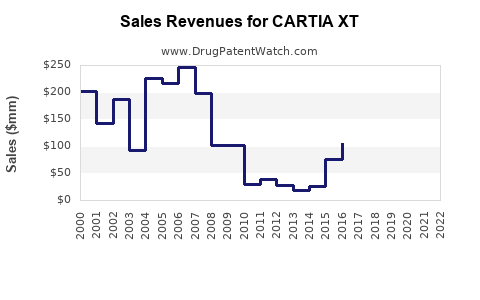

Initial Market Penetration and Growth

Analysts project rapid initial uptake in developed markets, particularly the United States and European Union, driven by existing cardiovascular disease prevalence and unmet needs. Conservative estimates suggest a 5-7% market share within the first two years post-launch, translating to approximate global sales of $300 million in Year 1, rising to $700 million by Year 3 with steady adoption.

Revenue Drivers

- Market Penetration: Driven by aggressive marketing, physician awareness, and payer acceptance.

- Pricing Strategy: Premium pricing justified by clinical advantages.

- Formulation Expansions: Introduction of combination therapies or alternative dosing forms can expand market segments.

- Geographic Expansion: Emerging markets with rising cardiovascular disease rates represent growth opportunities.

Profitability Outlook

With R&D costs amortized and manufacturing scaled, profit margins are projected to improve substantially after the initial launch phase. Gross margins could reach 65-70% amid steady sales growth, with EBITDA margins stabilizing around 25-30% by Year 3, assuming efficient distribution and marketing.

Market Risks and Challenges

Regulatory Risks

Regulatory delays or additional data requirements could postpone market entry, affecting revenue forecasts.

Competitive Responses

Established pharmaceutical giants may develop or accelerate existing similar drugs, intensifying price competition or market share erosion.

Market Acceptance

Slow physician adoption or payer reluctance to reimburse premium prices could hinder revenue growth.

Pricing Pressure

Negotiation dynamics favoring cost containment may compress margins, especially in price-sensitive markets.

Emerging Opportunities

- Combination Therapies: CARTIA XT’s compatibility with existing antihypertensive drugs offers prospects for fixed-dose combinations, enhancing treatment adherence.

- Biomarker-Guided Therapy: Developing companion diagnostics could personalize treatment, increasing efficacy and market share.

- Digital Health Integration: Leveraging telemedicine and remote monitoring can support compliance and real-world evidence collection.

Key Takeaways

- Market Potential: Cardiovascular disease burden fosters substantial demand for innovative therapies like CARTIA XT, especially in mature markets.

- Competitive Positioning: Unique mechanism and regulatory fast-tracking bolster prospects for rapid uptake.

- Revenue Trajectory: Early sales in the hundreds of millions, with potential to reach over $1 billion globally within 3-4 years if market acceptance accelerates.

- Strategic Focus: Prioritizing payer negotiations, physician education, and geographic expansion will optimize financial outcomes.

- Risk Management: Vigilance against regulatory delays, competitive threats, and market resistance remains crucial.

FAQs

1. When is CARTIA XT expected to reach global markets?

CARTIA XT received FDA Breakthrough Therapy Designation in mid-2022. Assuming successful clinical completion and approval processes, regulatory approvals in the U.S. and Europe could occur by late 2023 to early 2024, with subsequent market entry in emerging regions over the following 1-2 years.

2. How does CARTIA XT differentiate itself from existing antihypertensive drugs?

CARTIA XT offers a novel mechanism targeting both blood pressure and angina with a favorable safety profile, potentially reducing adverse effects associated with traditional therapies and improving patient adherence.

3. What are the main barriers to commercial success for CARTIA XT?

Key barriers include regulatory hurdles delaying approval, payer skepticism about premium pricing, physician hesitance to switch established routines, and competitive dynamics from existing multi-drug regimens.

4. What is the expected impact of digital health trends on CARTIA XT’s market?

Digital health solutions can enhance adherence, facilitate remote monitoring, and generate real-world evidence, thereby strengthening market position and supporting value-based reimbursement strategies.

5. How might future clinical data influence CARTIA XT’s financial trajectory?

Positive long-term outcomes demonstrating superior efficacy and safety can expand indications, justify premium pricing, and accelerate adoption, significantly boosting revenue streams.

References

- World Health Organization. (2021). Hypertension. [online] Available at: https://www.who.int/news-room/fact-sheets/detail/hypertension

- U.S. Food and Drug Administration. (2022). FDA Breakthrough Therapy Designation.

- MedMarketWatch. (2023). Pricing Strategies for Innovative Cardiovascular Drugs.