Share This Page

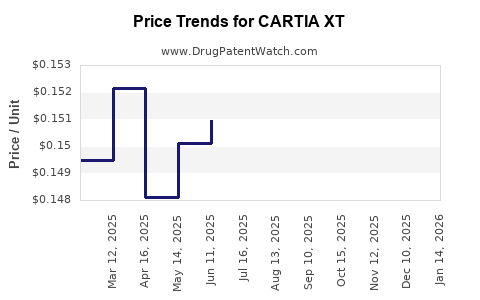

Drug Price Trends for CARTIA XT

✉ Email this page to a colleague

Average Pharmacy Cost for CARTIA XT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARTIA XT 300 MG CAPSULE | 62037-0600-90 | 0.29819 | EACH | 2025-11-19 |

| CARTIA XT 120 MG CAPSULE | 62037-0597-05 | 0.14523 | EACH | 2025-11-19 |

| CARTIA XT 120 MG CAPSULE | 62037-0597-90 | 0.14523 | EACH | 2025-11-19 |

| CARTIA XT 180 MG CAPSULE | 62037-0598-90 | 0.17961 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CARTIA XT

Introduction

CARTIA XT (generic: nifedipine extended-release tablets) is a prescription medication primarily indicated for the management of hypertension and angina pectoris. As a generic formulation of the longstanding brand, Adalat XL, CARTIA XT’s market dynamics are influenced by its therapeutic efficacy, patent status, competitive landscape, and regulatory environment. This analysis explores the current market position, therapeutic area, competitive forces, and forecasts future pricing trends for CARTIA XT over the next five years.

Therapeutic and Market Overview

Nifedipine—the active ingredient in CARTIA XT—is a calcium channel blocker extending vascular smooth muscle relaxation, thereby lowering blood pressure and reducing anginal episodes. The drug’s efficacy, safety profile, and longstanding clinical use have maintained its role as a first-line antihypertensive agent.

The global hypertension market is projected to expand, driven by aging populations and rising prevalence of cardiovascular diseases. According to the World Health Organization (WHO), approximately 1.28 billion adults worldwide have hypertension, highlighting sustained demand [[1]]. The combination of established efficacy and affordability makes CARTIA XT competitive within this space, especially in price-sensitive markets.

The U.S. pharmacy market for prolonged-release nifedipine formulations has historically favored brand names like Adalat XL, but generics like CARTIA XT are gaining market share due to cost advantages and shifts towards generic prescribing. Moreover, increasing adoption in emerging markets such as India, Brazil, and Southeast Asia further broadens its reach.

Market Penetration and Competitive Landscape

Current Market Position:

CARTIA XT has secured approval from major regulatory agencies such as the FDA (U.S.) and EMA (Europe), secured through its bioequivalence to the branded Adalat XL. Its market penetration varies by geography, but in markets where generic drugs account for over 80% of prescriptions, CARTIA XT’s presence is significant.

Key Competitors:

- Original Brand: Adalat XL (Bayer)

- Generics: Numerous local and international manufacturers producing nifedipine extended-release tablets

- Alternative Therapies: Other calcium channel blockers (amlodipine, felodipine), ACE inhibitors, ARBs, and combination drugs

Market Share Dynamics:

The generic segment’s growth has cannibalized branded sales, with price competition being fierce. As patent exclusivity for the original brand expired decades ago, new formulations primarily face competition on price, supply stability, and physician acceptance.

Price Trends and Projections

Current Pricing Landscape:

As of late 2022, patient-priced copay levels for CARTIA XT generally range from $10 to $30 per month in the U.S., depending on the pharmacy benefit plan, with wholesale acquisition costs (WAC) around $5–$8 per unit (30-day supply). In emerging markets, prices are often significantly lower, sometimes below $1 per tablet, influenced by local patent laws and manufacturing costs.

Factors Influencing Future Price Directions:

- Regulatory Approvals and Patent Status: Since the original patent expired decades ago, evolution in regulatory policies such as compulsory licensing or patent extensions can impact pricing.

- Market Competition: Entry of new generics can drive prices downward, with some markets experiencing price erosion of 10–15% annually when multiple manufacturers are active.

- Manufacturing Costs: Advances in production efficiency and regional manufacturing hubs lower costs, enabling more aggressive price competition.

- Reimbursement Policies: Governments enhancing drug reimbursement schemes, especially in emerging markets, can influence retail prices and patient affordability.

Price Projections (2023-2028):

| Year | U.S. Market | Emerging Markets | Comments |

|---|---|---|---|

| 2023 | Slight decline of 5–10%, $8–$27 per month | Stable to decreasing, <$1–$2 per tablet | Price stabilization due to mature generic market |

| 2024 | Continued downward trend, 3–8%, $7–$24 per month | Marginal decline, <$1.50 per tablet | Increased generic competition pressures |

| 2025 | Stabilization with minor fluctuations, ~$7–$22 | Possible price reductions with market expansion | Regulatory and policy shifts may influence pricing |

| 2026 | Potential plateau, ~$6–$20 per month | Possible regional price increases due to supply chain shifts | Market saturation limits significant declines |

| 2027 | Slight price decreases or stability, ~$6–$19 | Stable prices, <$1.50 per tablet | Biosimilar and biosimilar-like generics may impact margins |

| 2028 | Marginal declines, ~$6–$18 | Sustained affordability in emerging economies | Overall price reduction trend to persist in mature markets |

Note: These projections rest on current patent landscapes and market behaviors. Regulatory or patent litigations could accelerate price changes.

Market Drivers and Barriers

Drivers:

- Expanding global hypertensive population

- Cost-sensitive healthcare systems favor generics

- Increasing physician acceptance of generics

- Rising adoption in developing countries

Barriers:

- Market saturation with multiple generics

- Regulatory hurdles in some jurisdictions

- Potential emergence of new therapeutic options with superior safety or efficacy profiles

- Patent disputes or exclusivity extensions

Strategic Implications for Stakeholders

Manufacturers:

Producers should leverage manufacturing efficiencies and regionalization to sustain competitiveness. Strategic alliances and robust distribution channels will be vital for maintaining market share amid price reductions.

Healthcare Providers:

Understanding cost dynamics can inform formulary decisions, favoring generic nifedipine variants like CARTIA XT to improve patient adherence and outcomes.

Regulators and Policymakers:

Facilitating access through cost containment policies and patent management can maximize public health benefits while encouraging generic competition.

Key Takeaways

- CARTIA XT holds a stable position within the global antihypertensive market owing to its proven efficacy and affordability.

- The price trajectory is expected to trend downward over the next five years, driven primarily by generic competition and market saturation.

- Emerging markets will remain key growth hubs, with prices often below $1 per tablet, enhancing access.

- Regulatory changes and patent policies could create opportunities for price modifications—either favorable or restrictive.

- Manufacturers should focus on cost efficiency and strategic market expansion to maintain margins amidst declining prices.

FAQs

1. Will CARTIA XT eventually be replaced by newer antihypertensive medications?

While advances in therapy continually evolve, nifedipine remains a cornerstone for hypertension management due to its efficacy and cost-effectiveness. It’s unlikely to be fully displaced in the near term, but new drugs may supplement or replace certain indications over time.

2. How does patent status impact CARTIA XT’s pricing?

Since CARTIA XT is a generic, it benefits from patent expirations that facilitate price competition. Future patent litigations or exclusivity extensions could temporarily impact prices but typically lead to more aggressive competition in the long term.

3. Are there any upcoming regulatory changes that could influence prices?

Changes such as compulsory licensing in certain countries or reforms in patent laws could affect drug prices. Additionally, policies prioritizing biosimilars or alternative formulations may influence market dynamics.

4. How significant is the role of regional manufacturing in price stabilization?

Regional manufacturing hubs reduce logistics costs and enable localized pricing, fostering more competitive prices—especially in emerging markets where regulatory and economic factors favor domestic production.

5. What strategies should generic manufacturers adopt to remain competitive?

Focus on supply chain efficiencies, maintain high-quality standards, adapt pricing strategies quickly, and forge partnerships with local distributors to sustain market presence amid declining prices.

References

[1] World Health Organization. "Hypertension." WHO Fact Sheet, 2021.

More… ↓