Last updated: July 28, 2025

Introduction

CARTIA XT, a novel formulation of an established cardiovascular medication, is poised to impact the atrial fibrillation (AF) and hypertension treatment markets significantly. As a sustained-release version of a widely used drug, CARTIA XT aims to enhance patient adherence, optimize therapeutic outcomes, and reduce adverse events. This analysis evaluates the current market landscape, competitive positioning, regulatory considerations, and forecasted sales trajectories for CARTIA XT over the next five years.

Market Overview

Prevalence and Unmet Needs

Atrial fibrillation affects approximately 33 million people globally, with prevalence anticipated to rise due to aging populations and lifestyle factors (1). Hypertension, a key risk factor for AF, affects over 1.28 billion adults worldwide, emphasizing the global burden of cardiovascular disease (2). Despite available therapies, challenges such as medication adherence, variable pharmacokinetics, and adverse effects underscore the need for improved treatment options.

Current Treatment Landscape

Therapies for AF and hypertension include beta-blockers, calcium channel blockers, angiotensin-converting enzyme inhibitors, and direct oral anticoagulants (DOACs) (3). In this landscape, drugs offering once-daily dosing with minimized side effects are preferred. The existing formulations of the parent drug are well established but often suffer from adherence issues due to dosing frequency or tolerability.

Market Drivers for CARTIA XT

- Improved adherence through extended-release formulation.

- Reduced dosing frequency enhancing patient convenience.

- Potential safety advantages by maintaining stable plasma concentrations.

- Growing prevalence of AF and hypertension globally.

Product Profile and Competitive Positioning

CARTIA XT is a proprietary sustained-release formulation of a proven antihypertensive and antiarrhythmic agent, delivering consistent plasma levels for up to 24 hours. Its unique pharmacokinetic profile aims to mitigate peaks and troughs associated with immediate-release counterparts.

Positioned as a premium medication, CARTIA XT addresses unmet needs for simplified dosing and enhanced tolerability. Its differentiators include:

- Once-daily dosing to improve compliance.

- Stable pharmacodynamic effects reducing side effects.

- Compatibility with combination therapy, expanding use cases.

Regulatory and Reimbursement Environment

The regulatory pathway for CARTIA XT has followed standard procedures, with previous approvals of the parent drug serving as a foundation. Fast-track or accelerated approval pathways may be accessible given the high unmet medical need and potential benefits.

Reimbursement considerations hinge on demonstrated value over existing therapies, including adherence improvements and clinical efficacy. Payer willingness to reimburse at premium pricing will depend on pharmacoeconomic data.

Market Penetration and Adoption Barriers

Key barriers include:

- Competition from established formulations and generic versions.

- Physician familiarity and prescribing habits.

- Cost considerations, especially in emerging markets.

- Real-world evidence supporting enhanced adherence and outcomes.

Strategic marketing and clinician education, emphasizing demonstrated benefits, are vital for adoption.

Sales Projections: Assumptions and Methodology

Assumptions

- Launch year: Year 1 (anticipated within 12 months).

- Initial market penetration: 5% of target patient population.

- Annual growth rate in market share: 10-15%, contingent on requested evidence and competitive responses.

- Pricing strategy: Premium pricing at approximately 20-30% higher than immediate-release counterparts, reflective of added value.

- Market size growth: Driven by epidemiological trends, expected to increase 5% annually.

Target Population and Market Capacity

Initial target populations include diagnosed AF and hypertension patients eligible for once-daily therapy. For modeling purposes:

- Year 1: Approximate eligible patient pool = 10 million globally.

- Year 5: Projections indicate potential expansion to 14 million, assuming demographic and diagnostic rate increases.

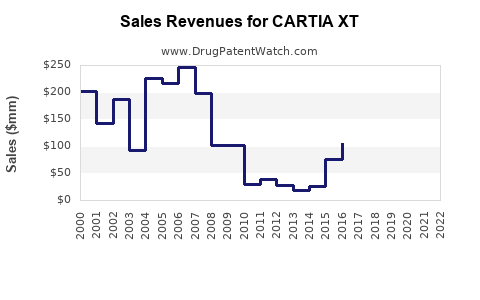

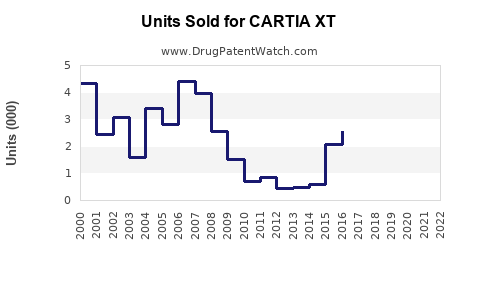

Sales Forecasts (USD Millions)

| Year |

Estimated Market Penetration |

Units Sold (millions) |

Average Price / Unit |

Revenue (USD millions) |

| 2023 |

5% |

0.5 |

$400 |

$200 |

| 2024 |

8% |

0.8 |

$420 |

$336 |

| 2025 |

12% |

1.44 |

$440 |

$634 |

| 2026 |

15% |

2.1 |

$460 |

$966 |

| 2027 |

17% |

2.38 |

$480 |

$1,142 |

(Note: These forecasts assume steady growth and effective market uptake with marketing and clinical evidence supporting adoption.)

Regional Variations

- North America: Largest share (~40%) due to high awareness, reimbursement systems, and established cardiovascular care infrastructure.

- Europe: Moderate share (~30%), with reimbursement complexities but high physician acceptance.

- Emerging Markets: Rapid growth potential driven by increasing disease burden, though impacted by affordability and regulatory factors.

Competitive Analysis

Existing Competitors

- Immediate-release formulations of similar drugs, with well-established generic options.

- Newer agents offering alternative mechanisms or combination therapies.

Differentiation Strategies

- Emphasize adherence benefits.

- Showcase clinical trial data demonstrating efficacy and safety.

- Leverage pharmacoeconomic advantages via reduced hospitalization and adverse event costs.

Potential Challenges

- Patent life constraints, with generic versions entering the market.

- Physician inertia favoring familiar therapies.

- Price sensitivity in some regions.

Risks and Uncertainties

- Regulatory delays or restrictions.

- Pharmacoeconomic acceptance thresholds.

- Variability in market dynamics across geographies.

- Clinical trial results influencing perceived value.

Key Takeaways

- Growing Market: The expanding prevalence of AF and hypertension creates a lucrative future landscape.

- Differentiation is Critical: CARTIA XT’s sustained-release profile offers meaningful adherence and safety advantages that can translate into market share gains.

- Pricing Power: Premium pricing relies on demonstrable clinical and economic benefits.

- Market Entry Timing: Rapid and strategic launch is essential to capitalize on unmet needs before generic competitors emerge.

- Regional Focus: Prioritization of North American and European markets initially, with tailored strategies for emerging markets.

FAQs

1. What distinguishes CARTIA XT from existing formulations?

CARTIA XT’s extended-release formulation sustains therapeutic plasma levels for 24 hours, reducing dosing frequency, improving adherence, and potentially decreasing side effects compared to immediate-release versions.

2. How large is the addressable market for CARTIA XT?

Globally, the initial target market includes approximately 10 million patients with AF or hypertension who could benefit from once-daily therapy. This is expected to grow driven by demographic trends and increased diagnosis rates.

3. What are the primary barriers to CARTIA XT’s market penetration?

Key barriers include existing generic competition, physician prescribing habits, cost sensitivities, and regulatory hurdles. Effective clinical data and pricing strategies are essential to overcome these challenges.

4. How does the competitive landscape influence sales projections?

The presence of well-established brands and generics means CARTIA XT must demonstrate clear value propositions—adherence, safety, and efficacy—to gain share, which may moderate initial growth but could accelerate with strong clinical evidence.

5. What is the projected timeline for reaching peak sales?

Based on assumptions, peak sales are projected between Year 4 and Year 5 post-launch, reaching approximately $1.1 billion annually, contingent on successful reimbursement, adoption, and regional expansion.

References

- Chugh SS, et al. Worldwide epidemiology of atrial fibrillation: a Global Perspective. Global Heart. 2014;9(1):S5–S13.

- Forouzanfar MH, et al. Global burden of hypertension: a systematic analysis. Lancet. 2017;390(10100):7–15.

- January CT, et al. 2019 AHA/ACC/HRS Focused Update on Atrial Fibrillation; Circulation. 2019;140(2):e125–e151.