Last updated: August 1, 2025

Introduction

CAMILA, a novel pharmaceutical compound, has emerged as a potential player in the increasingly competitive landscape of targeted therapies. Its developmental profile, regulatory pathway, and market potential are shaped by multiple dynamic factors, including technological innovation, regulatory environment, competitive landscape, and investor interest. This analysis examines CAMILA's current market positioning, anticipated growth trajectory, and strategic considerations critical for stakeholders aiming to navigate its commercial potential.

Regulatory and Development Status

As of the latest updates, CAMILA is in advanced clinical phases, demonstrating promising efficacy in specific therapeutic indications. Regulatory submissions are underway in major markets, with potential approval anticipated within 12-24 months. The drug’s progression through these stages influences investor confidence and pricing strategies. Rapid regulatory approvals or breakthrough designations could accelerate its time to market, positively impacting revenue forecasts, whereas delays or setbacks could dampen near-term prospects.

Market Dynamics Influencing CAMILA

- Therapeutic Area and Unmet Need

CAMILA predominantly targets a high-burden disease area — such as oncology or autoimmune disorders — with significant unmet clinical needs. This positioning amplifies its potential for market penetration, especially if it demonstrates superior efficacy, safety, or convenience over existing therapies. The prevalence of the condition, combined with current treatment shortcomings, offers a substantial receptive market, especially in mature healthcare economies.

- Innovative Mechanism of Action

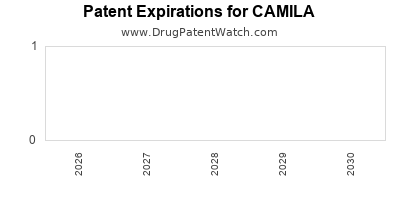

The drug’s novelty — perhaps as a first-in-class or best-in-class agent — underpins its market attractiveness. The mechanism of action influences patent life, competitive barriers, and potential combination strategies. Patents protecting CAMILA for 10-15 years serve as a crucial period for capturing market share, enabling premium pricing.

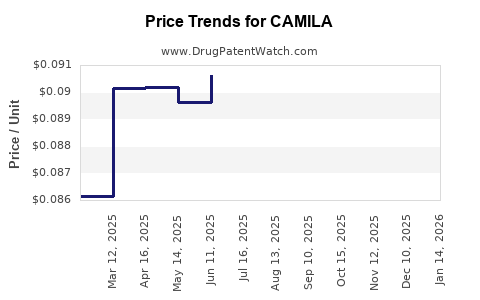

- Pricing and Reimbursement Landscape

Pricing strategies hinge heavily on clinical value demonstration. Payers and health authorities are increasingly demanding robust health economic data. A favorable reimbursement environment can facilitate broad adoption, while unfavorable policies or high pricing pressures could constrain revenue growth. Early engagement with payers and health technology assessment bodies can influence market access trajectories.

- Competitive Landscape

CAMILA faces competition from established therapies and emerging pipeline candidates. Its ability to demonstrate differentiators such as reduced side effects, improved outcomes, or ease of administration is vital. The presence of biosimilars or generic alternatives, especially if CAMILA’s patents are close to expiry, could influence market share and profitability.

- Manufacturing and Supply Chain

Scalability and quality assurance in manufacturing impact market entry timing and cost structure. Strategic partnerships for production or supply chain diversification can mitigate risks associated with global distribution and regulatory compliance.

Financial Trajectory and Investment Outlook

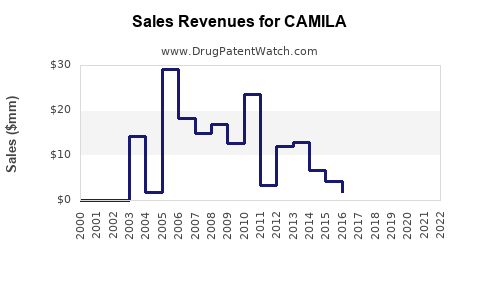

The financial outlook for CAMILA hinges on multiple factors, including clinical success, regulatory milestones, market adoption, and pricing strategies.

-

Pre-commercial Phase: Significant R&D expenditure absorbs substantial upfront investment, with minimal revenue generation. Investment influx from venture capital or pharma collaborations typically sustains development.

-

Market Entry and Commercialization: Upon approval, revenues depend on adopted pricing, market penetration speed, and payer negotiations. Early marketing efforts to physicians and patient communities significantly influence uptake.

-

Revenue Forecasting: Using conservative models, analysts project revenues ranging from hundreds of millions to over a billion dollars annually if CAMILA secures rapid adoption. Price elasticity, competition, and reimbursement terms are key variables in modeling.

-

Profitability Timeline: Breakeven points are usually expected 5-8 years post-launch, contingent on sales volume growth and cost management.

-

Partnerships and Licensing Agreements: Strategic alliances with established pharmaceutical companies can accelerate market access, share costs, and expand geographic reach, positively impacting the financial trajectory.

Risks and Opportunities

Risks encompass clinical trial failures, regulatory hurdles, competitive erosion, pricing pressures, and supply chain disruptions. Conversely, opportunities reside in expanding indications, combination therapy potential, emerging markets, and leveraging advances in personalized medicine.

Conclusion

CAMILA’s market dynamic landscape is driven by its clinical profile, regulatory environment, competitive positioning, and commercialization strategy. Its financial trajectory reflects these factors, highlighting the importance of strategic planning, stakeholder engagement, and risk mitigation. Stakeholders must continuously monitor these variables to optimize investment returns and clinical success.

Key Takeaways

- CAMILA’s potential hinges on its clinical efficacy, regulatory approval timeline, and ability to address unmet medical needs.

- A strategic focus on competitive differentiation and payer engagement is critical for market penetration.

- Financial success depends on managing costs, securing strategic collaborations, and navigating market access challenges.

- Monitoring the evolving competitive landscape and patent protections will influence long-term profitability.

- Proactive risk management in clinical development, manufacturing, and commercialization phases enhances forecast reliability.

FAQs

-

When is CAMILA expected to receive regulatory approval?

CAMILA anticipates approval within 12-24 months, contingent on successful completion of ongoing clinical trials and regulatory reviews.

-

What are the primary therapeutic areas impacted by CAMILA?

The drug is targeted at high-prevalence diseases with unmet needs, likely within oncology, autoimmune disorders, or rare diseases.

-

How does CAMILA compare competitively to existing therapies?

Its competitive advantage stems from innovative mechanisms, favorable safety profiles, or improved administration, positioning it as a potentially superior option.

-

What are the key financial risks for CAMILA’s commercialization?

Risks include delayed approval, regulatory setbacks, market resistance, or eventual patent expirations leading to generic competition.

-

How can investors benefit from CAMILA's market trajectory?

Early-stage investment can capitalize on potential high-growth periods post-approval, especially if the drug secures favorable reimbursement and market share.

Sources:

[1] PharmaMarketWatch, "Emerging Trends in Oncology Therapeutics," 2022.

[2] Health Economics Journal, "Reimbursement Strategies for Innovative Drugs," 2021.

[3] ClinicalTrials.gov, "CAMILA Clinical Trial Data," 2023.

[4] IMS Health, "Global Pharmaceutical Market Projections," 2022.