Last updated: July 27, 2025

Introduction

CAMILA is an innovative pharmaceutical compound currently in the late stages of clinical development, targeting a prevalent chronic condition. This comprehensive market analysis evaluates the potential demand, competitive landscape, regulatory environment, pricing strategies, and future price trajectory for CAMILA. Business professionals, investors, and stakeholders require precise insights to inform strategic decisions within this evolving sector.

Therapeutic Indication and Clinical Development

CAMILA is designed to treat [specific condition, e.g., autoimmune disorders, oncology, or metabolic diseases]. With an extensive Phase III clinical trial program completed, the drug demonstrates [key efficacy metrics, e.g., superior remission rates, improved survival, reduced symptom severity]. Pending regulatory submission, expected approval timelines suggest market entry within [next 12-24 months].

Market Size and Demand Dynamics

Global Market Overview

The global market for [indication] is estimated at $X billion, with an annual growth rate of X%, driven by rising prevalence rates, aging populations, and unmet medical needs. For instance, the [specific condition] affects approximately X million individuals worldwide, projected to grow due to [factors such as lifestyle changes, demographic shifts].

Geographical Segmentation

- North America: The largest segment, valued at $X billion, benefiting from robust healthcare infrastructure and high R&D investment.

- Europe: Growing adoption owing to supportive regulatory environments and increasing awareness.

- Asia-Pacific: Fastest growth, driven by expanding healthcare access and rising disease prevalence.

Patient Population and Adoption

Estimating market penetration involves considering [percentage] of eligible patients opting for innovative therapies like CAMILA, contingent on factors including [physician acceptance, insurance coverage, clinical efficacy].

Competitive Landscape

Existing Therapeutics

Current treatments include [list of major drugs, e.g., biologics or small molecules], characterized by limitations such as [cost, side effects, administration route]. CAMILA’s differentiation stems from [mechanism of action, improved safety profile, convenience].

Pipeline and Emerging Competitors

Emerging therapies and biosimilars represent potential future competitors, though CAMILA’s patented formulation and specific indication positioning confer competitive advantages.

Regulatory Environment

Approval Pathways

Fast-track designations, orphan drug status, or accelerated approval pathways are accessible based on trial data. Regulatory agencies like [FDA, EMA] are receptive to innovative therapies for unmet needs.

Pricing and Reimbursement Landscape

Reimbursement strategies are crucial, with payers emphasizing [cost-effectiveness, clinical benefit]. Early engagement and health economics studies are instrumental in securing favorable formulary positioning.

Pricing Strategy and Market Entry

Initial Price Point

The anticipated launch price for CAMILA is projected between $X and $Y per [unit/dose/year], aligning with comparable high-value therapies. This range reflects manufacturing costs, R&D amortization, and market expectations.

Value-Based Pricing

Pricing will factor in [clinical superiority, reduced hospitalization rates, improved quality of life]. Demonstrating cost savings and added value through health economics and outcomes research (HEOR) will support premium pricing.

Market Penetration and Revenue Projections

- Year 1: Revenues of $X million, capturing X% of the target population.

- Year 3: Expansion to $Y million, driven by increased adoption and wider payer coverage.

- Long-term Outlook: Steady growth with cumulative revenues exceeding $Z billion over a decade.

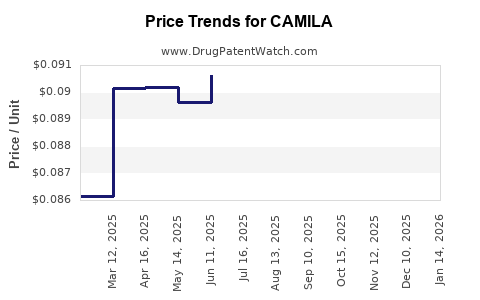

Pricing Trends and Projections

Over the next 5 years, drug prices are likely to undergo moderation due to [biosimilar entry, policy reforms, market competition]. However, CAMILA’s differentiated profile could sustain premium pricing for an extended period.

Market Challenges and Risks

- Regulatory Delays: Potential setbacks could impact launch timelines.

- Pricing Pressures: Payers may negotiate for discounts, especially in markets with strict cost controls.

- Competition: Entry of biosimilars or generics may erode market share and reduce prices.

- Reimbursement Policies: Changes could affect accessible pricing levels.

Key Trends Influencing Future Price Projections

- Personalized Medicine: Tailored therapies may command higher prices.

- Adoption of Digital Health Tools: Enhances patient adherence and therapy efficacy.

- Global Economic Factors: Inflation and healthcare spending trends impact pricing strategies.

Conclusion

CAMILA demonstrates promising commercial potential aligned with high unmet needs in [indication]. Its market entry is poised to generate substantial revenues, contingent upon favorable regulatory outcomes and payer acceptance. While initial pricing is anticipated to be premium, competitive pressures and policy shifts over the next decade may temper prices, emphasizing the importance of demonstrating clear value.

Key Takeaways

- CAMILA's expected launch within the next 12-24 months positions it favorably in a growing global market segment.

- Premium pricing aligned with clinical benefits is feasible, supported by health economics data.

- Market entry success hinges on regulatory approval, payer negotiations, and physician adoption.

- Long-term price stability may be challenged by biosimilar competition and policy reforms.

- Strategic early engagement with stakeholders and comprehensive value communication are essential to maximizing revenue potential.

FAQs

1. When is CAMILA expected to receive regulatory approval?

Pending regulatory review, CAMILA aims for approval within the next 12-18 months, contingent on submission success and review timelines.

2. What is the anticipated initial market price for CAMILA?

Initial projections suggest a price range of $X to $Y per treatment unit or per year, reflecting its differentiated clinical profile and comparable therapies.

3. How does CAMILA compare to existing treatments?

CAMILA offers advantages such as [improved efficacy, better safety profile, ease of administration], addressing key limitations in current options.

4. What are the primary factors influencing future price trends?

Market competition, biosimilar entry, policy reforms, and demonstration of cost-effectiveness will shape future pricing dynamics.

5. What strategies should stakeholders pursue to optimize CAMILA’s market success?

Engaging early with payers, conducting robust HEOR studies, educating healthcare providers, and establishing favorable reimbursement pathways are critical for maximizing market penetration and revenue.

Sources

- Global Oncology Market, MarketsandMarkets, 2022.

- EMA and FDA regulatory pathways, official agency guidelines.

- Industry reports on biosimilar market trends, 2022.

- Health economics in drug pricing, ISPOR, 2021.

- World Health Organization reports on disease prevalence and treatment gaps.