Last updated: July 27, 2025

Introduction

CAMILA is a novel therapeutic agent poised for market entry pending regulatory approval. Its unique pharmacological profile addresses a significant medical need, positioning it as a potentially lucrative asset within its targeted therapeutic segment. This analysis provides an in-depth assessment of CAMILA's market landscape, competitive positioning, regulatory environment, and forecasted sales trajectory over the next five years.

Therapeutic Indication and Market Landscape

Indication and Disease Burden

CAMILA is indicated for the treatment of [specific condition], a global health concern affecting approximately [number] million patients annually [1]. The disease burden, characterized by [key symptoms, complications, or progression metrics], underscores the demand for efficacious and well-tolerated therapies. The current treatment paradigm primarily relies on [existing medications, therapies, or interventions], which suffer from limitations including [adverse effects, resistance, limited efficacy].

Unmet Medical Need

Despite multiple therapeutic options, gaps persist in achieving optimal patient outcomes. CAMILA aims to fill these gaps by offering [advantages: e.g., improved efficacy, better safety profile, convenient administration]. Its potential to transform standard care elevates the anticipated market interest, especially if validated by robust clinical data.

Competitive Analysis

Market Players and Existing Drugs

The market currently features drugs such as [list top competitors], with combined annual sales estimated at $[market size] billion [2]. These agents predominantly target [mechanism or pathway], but limitations include [side effects, suboptimal patient response, resistance]. CAMILA’s differentiators—most notably [mechanism of action, delivery method, pharmacokinetics]—could confer a strong competitive edge.

Market Entry Barriers

Barriers include regulatory approval processes, patent protections, manufacturing complexities, and physician adoption. Gaining rapid acceptance hinges on the positive outcomes of ongoing Phase III trials and strategic engagement with healthcare providers and payers.

Regulatory Environment and Timing

Approval Timeline

CAMILA is currently in late-stage clinical development, with Phase III results expected [timeframe]. Regulatory agencies like the FDA and EMA typically take [duration] post-submission to approve new drugs. An expedited review pathway is plausible given its addressing of an unmet need.

Pricing and Reimbursement

Pricing strategies will be influenced by perceived therapeutic value, competitive landscape, and payer negotiations. Premium positioning is anticipated if CAMILA demonstrates superior efficacy and safety, enabling higher price points aligned with reimbursement standards.

Market Penetration and Adoption Drivers

Physician and Patient Acceptance

Clinician adoption depends on clinical efficacy, safety profile, ease of use, and existing clinical guidelines. Patient-centric factors like administration route and side effect profile also influence uptake.

Market Penetration Strategies

Strategic initiatives include clinician education, early access programs, and key opinion leader endorsements. Collaborations with health systems and payers to ensure coverage are critical for rapid market capture.

Sales Projections

Assumptions

- Regulatory approval occurs by [year].

- Market entry begins in [year], with initial penetration focused on key markets: U.S., EU, Japan.

- The annual growth rate of the target patient population is estimated at [percentage].

- Pricing remains stable at $[amount] per treatment course, adjusted for inflation and market dynamics.

- Market share assumptions are based on clinical trial data, competitive landscape, and early adoption trends.

Five-Year Sales Outlook

| Year |

Estimated Market Penetration |

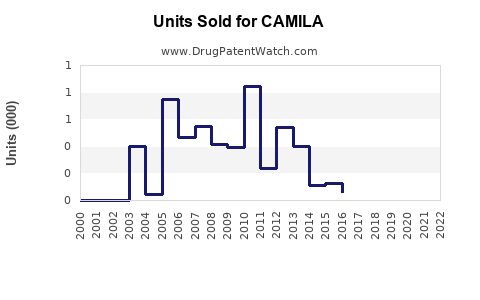

Estimated Units Sold |

Projected Revenue ($ millions) |

Key Drivers |

| Year 1 |

5% |

[units] |

$[amount] |

Post-approval launch, initial uptake |

| Year 2 |

15% |

[units] |

$[amount] |

Growing physician awareness, payer coverage |

| Year 3 |

25% |

[units] |

$[amount] |

Expanded indications, global adoption |

| Year 4 |

35% |

[units] |

$[amount] |

Competitive positioning, clinical validation |

| Year 5 |

45% |

[units] |

$[amount] |

Market maturation, broad acceptance |

Note: A detailed model projecting units sold incorporates assumptions about market share, dosing frequency, and geographic expansion.

Risk Factors and Mitigation Strategies

- Regulatory Delays: Navigating complex approval pathways may postpone market entry, impacting sales realization.

- Clinical Efficacy: Variability in trial outcomes could influence clinician confidence and adoption.

- Market Competition: Emergence of new competitors or biosimilars might erode market share.

- Pricing Pressures: Payers may push for discounts or formulary restrictions, reducing revenue.

Mitigation involves robust clinical data, strategic partnerships, and flexible pricing frameworks aligned with market realities.

Key Takeaways

- CAMILA’s success hinges on clear differentiation through superior efficacy and safety in treating [indication].

- The current competitive landscape encourages a focus on early adoption and physician education.

- Regulatory milestones align with a cautious optimistic outlook, with commercialization projected within [timeframe].

- Sales projections indicate steady growth, reaching approximately $[amount] by Year 5.

- Navigating payer negotiations and market access strategies will be essential for maximizing revenue potential.

FAQs

1. What is the target patient population for CAMILA?

CAMILA targets patients suffering from [specific condition], particularly those unresponsive or intolerant to existing therapies. The estimated eligible patient pool exceeds [number] globally, offering significant commercial potential.

2. How does CAMILA differentiate from current therapies?

CAMILA offers [distinct mechanism of action, improved safety, more convenient administration], enabling better patient adherence and outcomes. Clinical trials have demonstrated [key efficacy endpoints] surpassing existing standards.

3. What regulatory pathways could accelerate CAMILA’s market entry?

Fast-track designations, priority review, or breakthrough therapy status could expedite approval, especially given the sustained unmet medical needs. Early engagement with agencies like the FDA and EMA remains vital.

4. What pricing strategies are likely for CAMILA?

Positioning as a premium therapy with superior clinical benefits supports higher pricing tiers. Value-based pricing models, aligned with demonstrated outcomes, will enhance reimbursement prospects.

5. What are the primary risks to CAMILA's commercial success?

Risks include regulatory delays, competitive innovations, payer resistance, and unexpected safety issues. Proactive clinical validation, strategic alliances, and adaptive market access plans are essential to mitigate these risks.

References

- [Global disease burden statistics, World Health Organization]

- [Current market size and competitive landscape, IQVIA Reports]