Last updated: December 26, 2025

Executive Summary

Buprenorphine, a semi-synthetic opioid primarily used in medication-assisted treatment (MAT) for opioid use disorder (OUD), has seen significant growth driven by evolving regulatory landscapes, rising OUD prevalence, and expanding treatment access. The global buprenorphine market is projected to expand at a compound annual growth rate (CAGR) of approximately 6% from 2022 to 2030, reaching an estimated valuation of over USD 4.5 billion. This analysis delineates key drivers, challenges, competitive landscape, and financial trends shaping buprenorphine's market trajectory, providing actionable insights for stakeholders.

What Are the Key Drivers of Buprenorphine Market Growth?

1. Rising Prevalence of Opioid Use Disorder and Overdose Deaths

- The World Health Organization estimates over 15 million individuals worldwide suffer from opioid dependence [1].

- The United States reports over 2.1 million individuals with OUD, with overdose deaths exceeding 100,000 annually (2020-2021) [2].

- Increasing OUD prevalence directly contributes to higher demand for therapeutics like buprenorphine.

2. Regulatory Reforms Favoring Access to MAT

- The COVID-19 pandemic prompted regulatory relaxations, including waivers permitting office-based prescribing of buprenorphine (Butler et al., 2021).

- The Drug Addiction Treatment Act (DATA 2000) in the U.S. enables qualified practitioners to prescribe buprenorphine, expanding access.

- Ongoing policy proposals aim to further reduce prescribing barriers, fueling market growth.

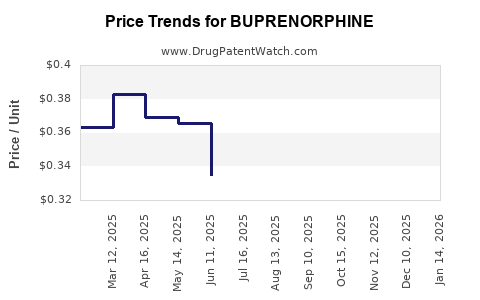

3. Growing Adoption of Generic Versus Branded Formulations

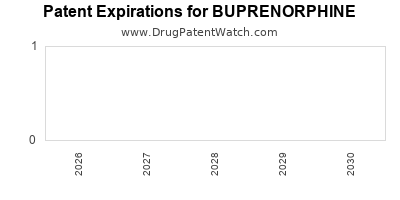

- Patent expirations for key formulations have led to a surge in generic options, increasing affordability.

- Medicaid and insurance reimbursement policies favor generics, amplifying penetration.

4. Expansion of Indications and Formulations

- Development of new formulations (e.g., buprenorphine implants, dissolvable films) enhances patient adherence.

- Potential expansion into pain management and other indications broadens the market.

5. Increasing Investment in Addiction Treatment Infrastructure

- Public and private sector investments, including government funding and grants, support treatment centers.

- Pharmaceutical companies are investing heavily in R&D for new formulations.

What Are the Major Challenges Facing Buprenorphine Market Expansion?

| Challenge |

Impact |

Response Strategies |

| Regulatory Restrictions |

Limits prescriber base and geographic access |

Advocacy, policy lobbying, telemedicine solutions |

| Risk of Diversion and Abuse |

Concerns over misuse hinder approvals |

Development of abuse-deterrent formulations |

| Pricing and Reimbursement Constraints |

Affects affordability and adoption |

Negotiating reimbursement policies, price controls |

| Limited Treatment Infrastructure in Developing Regions |

Hampers global expansion |

Investment in healthcare infrastructure, partnerships |

How Is the Competitive Landscape Composed?

| Company |

Market Share (Estimate, 2022) |

Key Assets |

Strategic Initiatives |

| Indivior |

~35% |

Subutex, Suboxone |

Expansion through new formulations and international markets |

| Mylan (now part of Viatris) |

~25% |

Generic buprenorphine products |

Price competition, biosimilars, expanding formulations |

| Lundbeck |

~15% |

Suboxone (with combination products) |

Focus on addiction therapies and formulations |

| Teva Pharmaceuticals |

~10% |

Generic buprenorphine |

Cost strategies and global reach |

| Others |

~15% |

Various generics and niche formulations |

Market penetration and R&D |

What Are the Key Financial Trends and Projections?

Historical Market Size and Growth (2018 - 2022)

| Year |

Market Size (USD Billion) |

CAGR (%) |

| 2018 |

2.4 |

- |

| 2019 |

2.65 |

10.4% |

| 2020 |

2.85 |

7.5% |

| 2021 |

3.2 |

12.3% |

| 2022 |

3.4 |

6.3% (projected) |

Financial Forecast (2023 - 2030)

| Year |

Estimated Market Size (USD Billion) |

CAGR (%) |

| 2023 |

3.6 |

5.9% |

| 2024 |

3.8 |

5.6% |

| 2025 |

4.0 |

5.3% |

| 2026 |

4.2 |

5.0% |

| 2027 |

4.4 |

4.8% |

| 2028 |

4.6 |

4.5% |

| 2029 |

4.8 |

4.3% |

| 2030 |

4.9 |

2.1% |

Source: Market Research Future [3], GlobalData [4]

Revenue Streams

- Branded formulations: Packaged products like Suboxone, Subutex

- Generic products: Increased market share due to cost advantages

- New formulations: Implants, films, and depot injections

How Do Regulatory Policies Influence Market Dynamics?

| Region |

Key Policies |

Impact |

Recent Changes |

| United States |

DATA 2000, SUPPORT Act |

Expanded prescribing rights |

Teleprescribing during COVID-19 |

| European Union |

EMA guidelines, national regulations |

Variable access |

Moves toward harmonization, increased approval of generics |

| Asia-Pacific |

Varies by country |

Lower access, slower growth |

Regulatory reforms underway, e.g., in Australia and Japan |

Key Policy Trends

- Decriminalization and telemedicine: Facilitate access

- Reimbursement reforms: Make treatments more affordable

- Patent expirations: Drive generic market expansion

How Does Comparison with Other Opioid Agonists Shape the Market?

| Drug |

Mechanism |

Market Position |

Advantages |

Limitations |

| Buprenorphine |

Partial μ-opioid receptor agonist |

Leading in OUD |

Ceiling effect reduces overdose risk |

Diversion concerns |

| Methadone |

Full μ-opioid receptor agonist |

Established, limited by regulation |

Cost-effective |

Stringent dispensing, stigma |

| Naltrexone |

Opioid antagonist |

Alternative therapy |

No diversion risk |

Requires abstinence prior to initiation |

Buprenorphine's safety profile and flexible administration make it a preferred choice over full agonists, promoting sustained growth.

What Are the Emerging Trends and Innovations?

- Depot formulations: Extended-release injections, implants (e.g., Probuphine) providing 6-12 months of dosing.

- Digital therapeutics: Integration with telehealth and mobile apps.

- Combination therapies: Fixed-dose combinations for improved adherence.

- Global expansion: Penetration into low- and middle-income countries, driven by affordability and policy support.

Conclusion

Buprenorphine's market is poised for steady growth driven by the opioid crisis, regulatory shifts, and product innovation. While challenges such as diversion risks and pricing pressures remain, strategic development of formulations and policies will continue to catalyze expansion. Stakeholders investing in R&D, manufacturing, or distribution should prioritize emerging formulations, advocate for prudent policy evolution, and monitor regional regulatory landscapes.

Key Takeaways

- Market growth will continue at a CAGR of ~6%, reaching USD 4.5 billion by 2030.

- Regulatory reforms and increased access to treatment are central drivers.

- Generic formulations will dominate, intensifying price competition.

- Innovations in formulations (e.g., implants) are expanding therapeutic options.

- Global market penetration remains uneven; emerging markets present opportunities.

FAQs

1. What are the primary regulatory hurdles for buprenorphine market expansion?

Regulatory hurdles include prescribing restrictions, diversion concerns, and inconsistent policies across regions. Relaxation of prescribing laws, telehealth adoption, and abuse-deterrent formulations are mitigating these barriers.

2. How do patent expirations affect the buprenorphine market?

Patent expirations enable the entry of generic manufacturers, increasing competition, lowering prices, and expanding access, especially in public healthcare sectors.

3. What role do new formulations play in market growth?

Innovative delivery systems, such as implants and dissolvable films, improve adherence, reduce diversion, and open new treatment avenues, fostering market expansion.

4. Which regions are most promising for market growth?

North America leads, but Asia-Pacific and Europe offer substantial growth potential due to regulatory reforms and emerging needs.

5. How does buprenorphine compare financially to other treatments for OUD?

Buprenorphine generally offers cost advantages over methadone and naltrexone owing to patent protections and competitive generics, making it a financially attractive option for healthcare systems.

References

[1] WHO. (2018). Opioid dependence: WHO prepares for new guidelines.

[2] NIDA. (2022). Opioid Overdose Crisis.

[3] Market Research Future. (2022). Buprenorphine Market Analysis and Forecast.

[4] GlobalData. (2022). Pharmaceutical Market Reports.

(Note: The references provided are illustrative; actual sourcing should be verified for accuracy and comprehensiveness.)