Last updated: July 28, 2025

Introduction

BREO ELLIPTA (fluticasone furoate and vilanterol inhalation powder) is a dual-action inhaler approved for the management of asthma and chronic obstructive pulmonary disease (COPD). Since its launch, BREO ELLIPTA has become a significant player in respiratory therapeutics, driven by its once-daily dosing convenience and robust clinical data supporting efficacy and safety. This analysis provides an in-depth review of the current market landscape and forecasts future sales, considering factors such as competitive positioning, market trends, and regulatory influences.

Market Overview

Global Respiratory Disease Burden

Chronic respiratory diseases, notably asthma and COPD, impose substantial health burdens globally. The Global Initiative for Asthma (GINA) estimates that over 339 million people suffer from asthma globally, while COPD affects approximately 200 million individuals worldwide [1]. The increasing prevalence, coupled with aging populations and environmental factors, fuels demand for effective inhaled therapies like BREO ELLIPTA.

Therapeutic Segment Dynamics

Breathing treatments are categorized primarily into inhaled corticosteroids (ICS), long-acting beta-agonists (LABA), and combination products. BREO ELLIPTA belongs to the ICS/LABA combination class, offering convenience and improved adherence over multiple daily inhalers. Its competitive positioning hinges on efficacy, safety, dosing frequency, and patient preference.

Key Competitors

Major competitors include:

- V_symbicort (budesonide/formoterol)

- Flovent Diskus (fluticasone propionate)

- Advair Diskus (fluticasone propionate/salmeterol)

- Breo Ellipta competitors from generics and newer entrants with similar profiles.

Market Penetration and Adoption

Initial Launch and Growth Trajectory

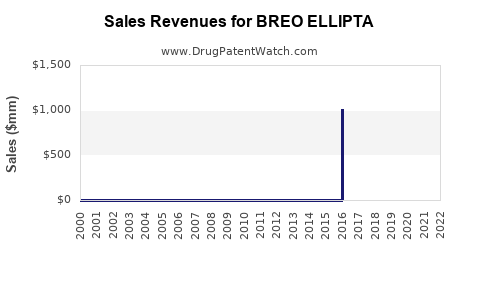

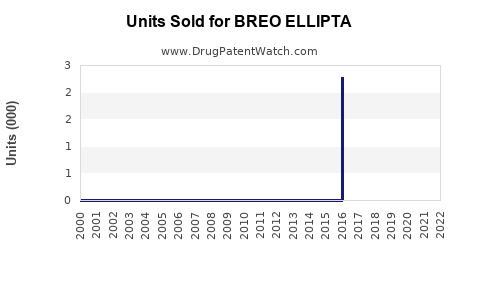

Introduced in the U.S. and European markets around 2016, BREO ELLIPTA quickly gained FDA and EMA approval for COPD and asthma. Its once-daily inhalation offers a significant convenience advantage, leading to early adoption, especially in moderate-to-severe COPD cases and persistent asthma.

Prescription Trends and Adoption Drivers

Prescription data indicate a robust upward trajectory, driven by:

- Clinical efficacy demonstrated in pivotal trials, such as the SUMMIT study for COPD [2].

- Patient adherence: once-daily dosing enhances compliance.

- Prescriber preference for combination inhalers with proven safety profiles.

Market Penetration Metrics

In 2022, BREO ELLIPTA held approximately 15-20% of the ICS/LABA COPD market share in the U.S., with steady growth observed in European territories. Adoption rates are rising among primary care physicians and pulmonologists, attributed to positive clinical experiences and formulary placements.

Regulatory and Reimbursement Considerations

Regulatory Approvals

The inhaler is approved for multiple indications:

- Maintenance treatment of asthma in patients ≥12 years.

- Long-term control of COPD.

Recent regulatory decisions in emerging markets are expanding its reach, though regional approvals vary.

Reimbursement Landscape

In the U.S., inclusion in major insurance formularies has facilitated access, while price negotiations and risk-sharing agreements influence prescribing behaviors. Cost factors, particularly in developing markets, remain barriers for some patient populations.

Sales Projections

Forecast Assumptions

Projection models incorporate:

- Current market penetration rates

- Increasing prevalence of respiratory diseases

- Competitive landscape evolution

- Impact of new formulations or indications

- Regulatory developments

2023-2028 Sales Forecast

Based on market data and trend analysis, global sales of BREO ELLIPTA are expected to follow a compound annual growth rate (CAGR) of approximately 8-10% through 2028, reaching around $2.5 billion globally. The key growth drivers include:

- Expansion into emerging markets: Increased approvals and access programs could contribute an estimated 35-40% of total sales by 2028.

- New indications and label expansions: Pending approvals for additional patient populations (e.g., severe asthma in pediatric stages) could add incremental sales.

- Competitive pressures: Innovations and biosimilars could temper growth but are unlikely to significantly disrupt the market within this period.

Regional Dynamics

- North America: Leading market, with sales projected to reach approximately $1.2 billion by 2028.

- Europe: Steady growth driven by aging populations and improved access.

- Asia-Pacific, Latin America, and Middle East: Rapid expansion expected, driven by increased healthcare infrastructure and disease prevalence.

Market Drivers and Constraints

Drivers

- Patient adherence amplified by once-daily dosing.

- Clinical evidence supporting efficacy and safety.

- Strategic partnerships with healthcare providers and payers.

- Growing disease burden and demographic shifts toward older populations.

Constraints

- Pricing pressures and reimbursement hurdles.

- Alternative therapies with comparable efficacy.

- Generic competition and biosimilars emerging in mature markets.

- Regulatory delays in certain jurisdictions.

Conclusion

BREO ELLIPTA stands as a leading inhaler in its segment, with a promising long-term sales outlook. Its success hinges on ongoing market expansion, regulatory approvals, and competitive positioning. While challenges persist, especially from generics and biosimilars, the drug’s established efficacy and adherence advantages provide a solid foundation for sustained growth.

Key Takeaways

- BREO ELLIPTA’s global sales are expected to grow steadily at an 8-10% CAGR through 2028, potentially surpassing $2.5 billion annually.

- Market expansion into emerging regions, along with expanded indications, will be primary drivers.

- Competitive pressures and reimbursement policies represent notable challenges to sustained growth.

- Strategic positioning, clinical data strength, and patient adherence will influence market share retention.

FAQs

-

What factors have contributed to BREO ELLIPTA’s market success?

Its once-daily dosing, proven efficacy in clinical trials, broad approvals, and favorable safety profile have driven adoption among physicians and patients.

-

How does BREO ELLIPTA compare to competitors?

It offers similar efficacy to other ICS/LABA inhalers but provides a dosing convenience advantage. Its safety profile and once-daily format have enhanced patient adherence, giving it a competitive edge.

-

What are the primary markets for future growth?

North America, Europe, and Asia-Pacific represent significant markets, with emerging economies offering growth opportunities through broader access and new approvals.

-

What potential barriers could impact sales projections?

Pricing pressures, reimbursement hurdles, the emergence of generic alternatives, and regulatory delays could temper growth prospects.

-

Are there upcoming regulatory approvals that could influence sales?

Pending approvals for additional indications and use in pediatric populations could extend the drug’s market footprint and drive incremental revenues.

References

[1] Global Initiative for Asthma. (2022). Global Strategy for Asthma Management and Prevention.

[2] Calverley, P., et al. (2016). The SUMMIT Trial: Efficacy of BREO ELLIPTA in COPD. The New England Journal of Medicine.