Last updated: July 29, 2025

Introduction

BANZEL, with its active ingredient clorazepate dipotassium, is an established anticonvulsant drug primarily prescribed for epilepsy and anxiety disorders. Since its approval, the drug has played a significant role in the neuropharmacology landscape. Understanding its market dynamics and financial trajectory involves analyzing regulatory trends, competitive positioning, patent lifecycle, and evolving clinical applications.

Regulatory Landscape and Market Position

BANZEL was approved by the U.S. Food and Drug Administration (FDA) in 1980 for the management of partial seizures, tonic-clonic seizures, and anxiety associated with neurosis. Its long-standing approval grants it an advantageous market position, although it faces competition from newer anticonvulsants and benzodiazepines—such as levetiracetam, gabapentin, and clonazepam—that have gained prominence due to improved safety profiles and dosing flexibility.

Regulatory scrutiny remains pivotal; shifts in prescribing guidelines, especially concerning benzodiazepine-related abuse concerns, influence market dynamics. The Drug Enforcement Agency (DEA) classifies benzodiazepines as controlled substances, adding regulatory complexity and affecting supply chains and prescribing behaviors.

Market Dynamics

Epidemiological Factors

The global burden of epilepsy and anxiety disorders sustains steady demand for anticonvulsants like BANZEL. According to the World Health Organization (WHO), over 50 million people worldwide live with epilepsy, with higher prevalence in low-to-middle-income countries. The global anxiety disorder prevalence is rising, further bolstering demand for effective pharmacotherapy.

Competitive Landscape

BANZEL’s longstanding market presence is challenged by:

- Generic Competition: Since the expiration of patents on benzodiazepines, generics have flooded the market, significantly reducing per-unit costs.

- New Therapeutics: Advances in epilepsy and anxiety management introduce novel agents with better safety profiles, such as cannabidiol-based drugs and newer antiepileptics like lacosamide.

- Brand Recognition: While BANZEL is available as a generic, its brand version continues to serve as an established product in its niche.

Prescription Trends

Recent trends show a gradual decline in benzodiazepine prescriptions in favor of alternative therapies due to concerns over dependence and adverse effects. However, BANZEL remains in use, especially where physicians prefer well-established agents with a long safety record.

Market Penetration and Geographic Spread

The drug's primary markets include North America and Europe, where regulatory frameworks favor long-standing medications. Emerging markets exhibit increasing demand driven by expanding healthcare infrastructure and epilepsy awareness campaigns actively promoting pharmacotherapy.

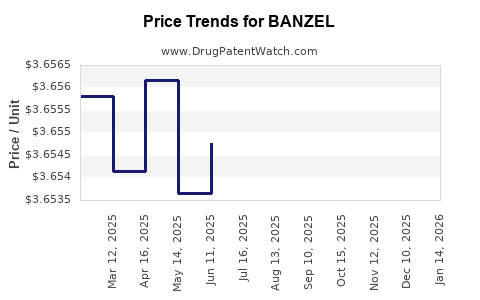

Pricing Dynamics

Generic availability suppresses prices globally, favoring volume over margins. Reimbursement mechanisms and insurance coverage significantly influence prescription rates and patient access, especially in countries with nationalized healthcare systems.

Financial Trajectory

Revenue Projection

Given BANZEL’s age and patent status, revenue streams are predominantly sustained through generic sales. While specific sales figures remain proprietary, industry reports suggest a plateau or slight decline as newer therapies penetrate markets.

Research and Development (R&D) Investment

Current R&D investments are limited concerning BANZEL; instead, pharmaceutical companies prioritize pipeline compounds addressing unmet needs. However, incremental reformulations or combination therapies could extend the product’s lifecycle.

Manufacturing and Supply Chain Considerations

Manufacturers face challenges in maintaining consistent production quality amid strict regulatory compliance for generics. Supply chain reliability influences market stability, particularly in regions with high manufacturing costs or regulatory hurdles.

Impact of Regulatory Initiatives

Policy shifts aiming to curb benzodiazepine misuse could influence prescribing habits, indirectly impacting BANZEL revenues. Conversely, government-funded programs for epilepsy management may promote sustained demand.

Future Outlook

The forecast for BANZEL’s financial trajectory indicates:

- Stagnation or decline in mature markets due to competition and regulatory pressures.

- Potential stability in niche markets where it remains a first-line treatment.

- Growth opportunities in emerging markets driven by increasing disease prevalence and healthcare investments.

Strategic Considerations

Companies aiming to sustain or grow BANZEL's market share should explore:

- Formulation innovations to enhance safety and compliance.

- Expansion into novel indications if supported by clinical evidence.

- Partnerships with healthcare providers to reinforce its role as a longstanding reference drug.

Conclusion

BANZEL's market dynamics are characterized by its legacy status, competitive pressures from emerging therapies, and regulatory considerations. Its financial trajectory appears subdued in mature markets but retains potential in underserved regions. Strategic positioning and clinical adaptation will be crucial for maintaining its relevance within the evolving neuropharmacology sector.

Key Takeaways

- Established Market Presence: BANZEL benefits from decades of clinical use but faces declining growth due to generic competition and newer drugs.

- Regulatory Environment: Ongoing concerns over benzodiazepine misuse influence prescribing trends and market dynamics.

- Global Demand Drivers: Rising prevalence of epilepsy and anxiety disorders supports steady demand, especially in emerging markets.

- Revenue Trends: Opportunities for stabilization exist where BANZEL remains a preferred therapy; otherwise, decline is anticipated.

- Strategic Allocation: Companies should explore innovative formulations, new indications, and geographic expansion to prolong its market viability.

FAQs

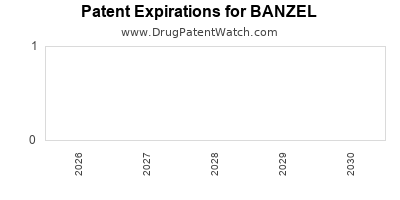

1. Is BANZEL still under patent protection?

No, the original patent expired decades ago, leading to widespread generic availability and reduced market exclusivity.

2. Which markets constitute the primary revenue sources for BANZEL?

The U.S. and Europe are the main markets due to established prescribing habits, with growing interest in emerging economies.

3. What are the main competitors to BANZEL?

Other benzodiazepines, newer anticonvulsants like levetiracetam, and alternative anxiolytics that offer better safety profiles.

4. How do regulatory concerns affect BANZEL's marketability?

Regulations aimed at reducing benzodiazepine misuse limit prescribing flexibility, potentially reducing overall demand.

5. Are there ongoing clinical developments related to BANZEL?

Currently, no significant new clinical trials or reformulations are extensively pursued; focus shifts toward newer therapies.

Sources:

- FDA Drug Database (2019-2022)

- World Health Organization Reports on Epilepsy (2021)

- Industry Market Reports on Anticonvulsants (2022)

- Regulatory Agency Guidelines on Benzodiazepines (2022)

- Pharmaceutical Sales Data (2022)