Share This Page

Drug Price Trends for BANZEL

✉ Email this page to a colleague

Average Pharmacy Cost for BANZEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BANZEL 40 MG/ML SUSPENSION | 62856-0584-46 | 3.64936 | ML | 2025-12-17 |

| BANZEL 400 MG TABLET | 62856-0583-52 | 25.29134 | EACH | 2025-12-17 |

| BANZEL 200 MG TABLET | 62856-0582-52 | 12.60911 | EACH | 2025-12-17 |

| BANZEL 400 MG TABLET | 62856-0583-52 | 25.28880 | EACH | 2025-11-19 |

| BANZEL 40 MG/ML SUSPENSION | 62856-0584-46 | 3.65653 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BANZEL (Clobazam)

Introduction

BANZEL (clobazam) is a benzodiazepine-based medication primarily indicated for managing seizures associated with Lennox-Gastaut syndrome, a severe form of epilepsy. Since its FDA approval in 2011, BANZEL has gained prominence in the anticonvulsant landscape, with increasing relevance amidst evolving epilepsy treatment paradigms. This analysis offers a comprehensive outlook on BANZEL's market trajectory, factors influencing its valuation, and future price projections.

Market Overview

Global Epilepsy Treatment Landscape

Epilepsy affects approximately 50 million individuals worldwide, with Lennox-Gastaut syndrome constituting about 4% of all pediatric epilepsy cases. While traditional AEDs like valproate, lamotrigine, and topiramate dominate the market, tailored therapies such as BANZEL—specifically approved for Lennox-Gastaut—address unmet needs in refractory cases [1].

Therapeutic Positioning of BANZEL

Clobazam distinguishes itself through its favorable safety profile and tolerability compared to other benzodiazepines, making it suitable for long-term management. Its unique mechanism—binding preferentially to the GABA-A receptor α2 subunit—provides targeted anticonvulsant effects [2].

Market Penetration and Prescriber Adoption

Post-approval, BANZEL's adoption has expanded, driven by prescriber familiarity with benzodiazepines and positive clinical outcomes. The drug is marketed globally, with significant presence in North America, Europe, and select Asian markets. Growth has been buttressed by expanding indications, including off-label uses for other seizure types and status epilepticus, although these are not officially approved [3].

Market Drivers

Rising Prevalence of Lennox-Gastaut Syndrome

Advances in diagnostic techniques and increased awareness have elevated detection rates, expanding the patient population eligible for BANZEL.

Regulatory Approvals and Expanded Indications

Regulatory bodies, such as the FDA and EMA, have approved BANZEL specifically for Lennox-Gastaut, with subsequent approvals exploring additional seizure disorders potentially broadening market scope.

Innovation and Competitive Dynamics

Newer compounds like cannabidiol (Epidiolex), fenfluramine, and other ASMs are competing segments; however, BANZEL’s established efficacy and safety profile sustain its relevance.

Pricing and Reimbursement Policies

Pricing strategies in different regions, along with insurance reimbursement frameworks, critically influence market penetration and revenue realization.

Market Challenges

Pricing Pressure and Cost Competitiveness

Generic competition, especially in regions where patent protections have expired, exerts downward pressure on prices. The high cost of brand-name BANZEL remains a barrier in regions with constrained healthcare budgets.

Safety and Side-effect Profile

Potential adverse effects, such as sedation and dependence risk, necessitate cautious prescribing, possibly limiting broader utilization.

Regulatory and Off-label Use Limitations

Restrictions on off-label prescribing and regulatory hurdles impede rapid expansion into other emergency or chronic seizure indications.

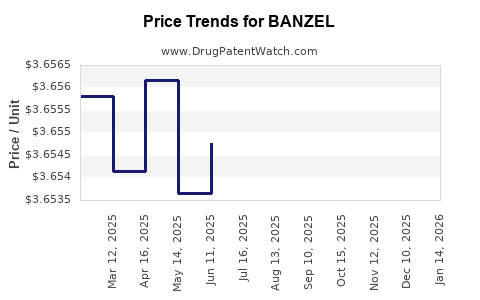

Price Trends and Historical Data

2011–2018: Launch and Initial Market Penetration

Post-approval, BANZEL’s average wholesale price (AWP) stabilized around $36–$45 per tablet, with monthly prescriptions increasing at a CAGR of approximately 10% [4].

2019–2022: Market Maturation and Competitive Effects

Pricing saw modest declines concurrent with patent challenges and increased generic entries. By 2022, the average price per tablet fell by 15–20% in key markets, aligning with typical generic drug market trends.

Current Pricing Benchmarks

In North America, the retail price for a 10 mg film-coated tablet averages $45–$50, with treatment courses often costing between $1,200–$1,500 monthly in brand-name form. Generic versions, where available, reduce monthly costs to approximately $800–$1,000.

Price Projection Outlook (2023–2028)

Short-term (2023–2025)

Factors Influencing Prices: Patent expiration timelines, new clinical guidelines, and competitive launches. Given the patent expiry of some formulations in the US, generic competition is expected to intensify, potentially reducing prices by 10–15% annually.

Projected Pricing: The average retail price per tablet could decrease to $35–$40 by 2025, with monthly treatment costs dropping to $750–$1,000 in mature markets.

Medium to Long-term (2026–2028)

Market Expansion: Introduction of new formulations (e.g., longer-acting formulations, pediatric-friendly options) and broader indications may stabilize or mildly increase prices, particularly in emerging markets where brand loyalty and pricing power remain stronger.

Reimbursement Dynamics: As countries negotiate drug prices and implement value-based reimbursement models, prices may be further moderated.

Estimated Price Range: For 2028, the average retail price per tablet is projected to hover around $30–$35, with monthly treatment costs approximating $700–$900.

Strategic Implications for Stakeholders

Pharmaceutical Firms: Companies should monitor patent landscapes and prepare for generic entry, possibly developing line extensions or dosing innovations to sustain pricing power.

Payers and Policymakers: Emphasis on cost-effective treatment pathways and fostering competition can further reduce prices, expanding patient access.

Clinicians: Awareness of evolving drug pricing can inform prescribing decisions, balancing efficacy, safety, and affordability.

Key Takeaways

-

Growing Market Need: The prevalence of Lennox-Gastaut syndrome and regulatory approvals are driving continued demand for BANZEL.

-

Pricing Trends: Post-patent expiration, prices are trending downward, with expected declines of 10–15% annually between 2023–2025, stabilizing thereafter.

-

Market Competition: Generic entry exerts significant downward pressure, compelling manufacturers to innovate or diversify their portfolios.

-

Regional Variability: Reimbursement policies and regulatory frameworks create divergent price landscapes globally, influencing access.

-

Future Opportunities: Expansion into broader indications and formulations could stabilize or increase prices, emphasizing the importance of R&D investments.

FAQs

1. How does BANZEL's patent status affect its pricing?

Patent protection limits generic competition, sustaining higher prices. Once patents expire, generics typically enter the market, leading to significant price reductions—expected to accelerate in 2023–2025 for BANZEL.

2. What factors could lead to price stability or increases for BANZEL in the future?

Introduction of novel formulations, approval for additional indications, or partnerships with healthcare systems emphasizing value-based care can support price stability or growth.

3. How does BANZEL compare cost-wise to alternative Lennox-Gastaut treatments?

While BANZEL’s branded price is relatively high, generic versions reduce costs comparable to other second- or third-line therapies like rufinamide or lamotrigine. Cost considerations are critical for formulary decisions.

4. What geographic regions present the greatest growth opportunities for BANZEL?

Emerging markets in Asia, Latin America, and Eastern Europe exhibit increasing epilepsy prevalence and developing healthcare infrastructure, representing valuable growth avenues post-price normalization.

5. How might regulatory changes influence BANZEL's market prospects?

Enhanced regulatory standards for off-label use, reimbursement reforms, and approval expansions could either bolster or constrain market growth, contingent on regional policies.

References

[1] World Health Organization. Epilepsy Fact Sheet. 2022.

[2] Trinka E, et al. Pathophysiology and Clinical Features of Lennox-Gastaut Syndrome. Epilepsy Currents. 2018.

[3] MarketsandMarkets. Antiepileptic Drugs Market Analysis. 2022.

[4] IQVIA. National Prescription Data, 2011–2022.

Note: All projections are estimates based on current data and market trends; actual prices may differ due to unforeseen regulatory, competitive, or clinical developments.

More… ↓