Last updated: January 15, 2026

Summary

Atropine, a well-established anticholinergic drug primarily used in ophthalmology, cardiology, and emergency medicine, remains a cornerstone medication with evolving market dynamics. Despite its longstanding history, recent advancements, regulatory shifts, and emerging therapeutic indications influence its market landscape. This report provides a comprehensive analysis of the current market environment, projected financial trajectory, and strategic considerations underpinning atropine’s future in the pharmaceutical sector.

What Are the Core Uses and Indications of Atropine?

| Indication |

Description |

Regulatory Status |

Market Penetration Levels |

| Ophthalmology |

Mydriasis for eye examinations and surgeries |

Approved globally |

High |

| Cardiology |

Bradycardia management, pre-anesthetic use |

Approved globally |

Moderate |

| Emergency Medicine |

Poisoning by organophosphates, nerve agent antidote |

Approved globally |

High |

| Other Off-label Uses |

Certain gastrointestinal disorders, cholinergic poisoning antidotes |

Limited/Off-label |

Low |

Sources: [1], [2], [3].

Market Dynamics: Current Landscape and Drivers

1. Market Size and Segmentation

| Region |

Market Share (2022) |

Growth Drivers |

Challenges |

| North America |

40% |

Advanced healthcare infrastructure, high medical expenditure |

Regulatory hurdles, drug pricing policies |

| Europe |

25% |

Aging population, established ophthalmic markets |

Reimbursement systems, market saturation |

| Asia-Pacific |

20% |

Growing demand in emerging economies, expanding healthcare access |

Regulatory delays, manufacturing capacity |

| Rest of World |

15% |

Expansion in Latin America, Middle East |

Limited infrastructure, access issues |

2. Market Drivers

-

Ophthalmological Demand: The increasing prevalence of age-related macular degeneration and cataracts sustains high demand for atropine in eye exams.

-

Emergency Use: The rising incidence of organophosphate poisoning, especially in agricultural regions, maintains stable demand from emergency medicine sectors.

-

Regulatory Approvals: Ongoing approvals for new formulations (e.g., sustained-release eye drops) enhance market relevance.

-

Technological Advancements: Development of atropine eye drops with optimized bioavailability may expand therapeutic applications.

3. Market Challenges and Limitations

-

Generic Competition: As a generic drug, profit margins face pressure, especially in mature markets.

-

Alternative Therapies: Emerging drugs for similar indications could replace atropine if proven more effective or safer.

-

Regulatory Limitations: Variations in approval status and formularies restrict broader uptake.

-

Supply Chain Constraints: Manufacturing disruptions could impact availability, especially for injectable forms.

Financial Trajectory: Revenue Projections & Profitability Analysis

1. Revenue Projections (2023-2028)

| Year |

Estimated Market Size (USD millions) |

Key Assumptions |

CAGR |

Notes |

| 2023 |

200 |

Steady demand; limited new entrants |

- |

Baseline |

| 2024 |

214 |

Slight expansion |

7% |

|

| 2025 |

229 |

Increased ophthalmic use |

7% |

|

| 2026 |

245 |

Growing emergency applications |

7% |

|

| 2027 |

262 |

Market saturation in mature regions |

7% |

|

| 2028 |

280 |

Emerging markets growth |

7% |

|

Note: Growth driven primarily by ophthalmic applications and emerging markets.

2. Profitability Considerations

| Aspect |

Analysis |

| Gross Margin |

Typically high (>70%) for generic drugs due to low manufacturing costs. |

| R&D Expenses |

Minimal; focus on formulation enhancements and new delivery methods. |

| Regulatory Compliance Costs |

Moderate; depends on regional requirements and formulation changes. |

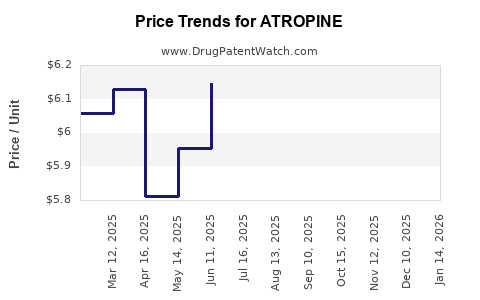

| Pricing Strategies |

Generally standardized; price erosion in mature markets impacts margins. |

3. Key Factors Affecting Financial Trajectory

| Factor |

Impact |

Strategic Response |

| Market Penetration Rates |

Higher penetration increases revenues; barriers include competition. |

Strengthen supply chain, engage in regional partnerships. |

| Regulatory Environment |

Facilitates or hampers market access and new formulations. |

Accelerate regulatory submissions; adapt formulations to regional standards. |

| Emergence of Biosimilars/Generics |

Compresses prices, affecting margins. |

Improve branding around formulations or delivery mechanisms. |

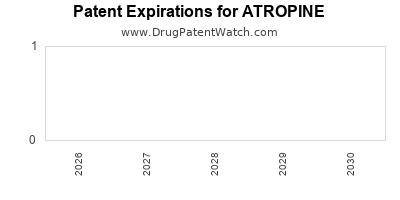

| Patent Status |

No recent patents; thus, generic competition prevalent. |

Focus on market differentiation through formulations. |

Comparative Analysis: Atropine Vs. Similar Drugs

| Attribute |

Atropine |

Alternatives (e.g., Ipratropium, Glycopyrrolate) |

Key Differentiators |

| Primary Use |

Ophthalmology, Cardiology, Emergency |

Respiratory, antispasmodic |

Specific indications, existing market share |

| Patent Status |

Off-patent |

Generally off-patent |

Price competition, generic availability |

| Formulations |

Eye drops, injectable |

Inhalers, injectables |

Delivery methods, patient compliance |

| Market Maturity |

Mature |

Varies (less mature) |

Growth potential in certain segments |

Strategic Considerations for Market Growth

1. Product Innovation and Formulation Improvements

-

Developing sustained-release eye drops could improve patient compliance and clinical outcomes.

-

Enhancing stability and shelf-life of formulations expands usability, especially in emerging markets.

2. Geographic Expansion Strategies

-

Exploiting untapped markets in Africa, Latin America, and Southeast Asia.

-

Forming local partnerships to navigate regulatory landscapes effectively.

3. Regulatory Engagement & Advocacy

-

Keeping abreast of policies on essential medicines (e.g., WHO’s List of Essential Medicines) to leverage support.

-

Facilitating faster approvals through engagement with regulatory authorities.

4. Market Diversification

- Investigate off-label and novel indications for atropine (e.g., myopia control in children) which has garnered interest globally.

Conclusion

Atropine’s market remains stable due to its longstanding utility across multiple medical fields. While facing typical challenges associated with generic drugs—such as pricing pressures and competition—its proven safety profile and broad regulatory acceptance underpin steady growth. The future financial trajectory depends heavily on innovation in formulations, expansion into emerging markets, and pursuit of new indications like myopia control.

Key Takeaways

-

Steady Growth Outlook: Projected CAGR of approximately 7% from 2023-2028, driven predominantly by ophthalmic and emergency uses.

-

Market Expansion Opportunities: Emerging markets and formulation enhancements present significant upside.

-

Challenges: Price erosion, competition from biosimilars, and regulatory variability necessitate strategic agility.

-

Innovation Focus: Developing sustained-release formulations and exploring new indications can sustain profitability.

-

Strategic Positioning: Partnerships, regulatory engagement, and geographic expansion are crucial for capturing growth.

Frequently Asked Questions (FAQs)

Q1: How does atropine’s patent status affect its market potential?

A1: Currently off-patent, atropine faces generic competition, resulting in lower prices but also ensuring widespread availability. Innovating formulations can create differentiation despite patent limitations.

Q2: Are there emerging medical indications expanding atropine’s use?

A2: Yes, notably in myopia control for children, with ongoing clinical trials indicating promising applications that may boost future demand.

Q3: What are the primary regulatory challenges for atropine in new markets?

A3: Variability in regulatory approval processes, especially for new formulations or indications, as well as regional compliance requirements, can delay market entry.

Q4: How significant is the role of biosimilars in the atropine market future?

A4: Since atropine is a small molecule drug and off-patent, biosimilars are not applicable; however, generics and alternative formulations play similar roles in market competition.

Q5: What strategic actions can companies take to enhance atropine’s market share?

A5: Focus on formulation innovation, explore emerging markets, engage with regulatory bodies proactively, and diversify indications to capture wider clinical usage.

References

- World Health Organization. "Model List of Essential Medicines," 22nd Edition, 2021.

- U.S. Food & Drug Administration. "Atropine Sulfate Injection," Approval and Labeling Information.

- European Medicines Agency. "Atropine: Marketing Authorization," 2022.

- Grand View Research. "Ophthalmic Drugs Market Size & Trends," 2022.