Last updated: December 15, 2025

Executive Summary

ASACOL (mesalamine) is a pivotal drug used in the management of ulcerative colitis (UC), a chronic inflammatory bowel disease. Its market landscape is shaped by factors such as rising prevalence of UC, competitive product profiles, patent status, manufacturing complexities, and evolving treatment paradigms. The drug’s financial trajectory indicates sustained revenue streams, driven by patent protections, generic competition, and healthcare policies influencing reimbursement and prescribing patterns. This comprehensive analysis examines current market dynamics, forecasted growth, competitive landscape, regulatory influences, and strategic considerations pertinent to ASACOL, providing stakeholders with actionable insights.

What Are the Current Market Dynamics for ASACOL?

1. Disease Epidemiology and Patient Population

-

Ulcerative Colitis Prevalence: UC affects approximately 1.3 million Americans, with similar rates globally. The incidence rate is estimated at 10-20 cases per 100,000 annually, with rising trends due to environmental and lifestyle factors [1].

-

Market Segmentation: Patients are classified into mild, moderate, and severe UC. ASACOL is primarily prescribed for mild to moderate cases, with a focus on maintaining remission.

2. Therapeutic Positioning and Treatment Paradigm

-

Mechanism: ASACOL contains mesalamine, an anti-inflammatory agent inhibiting cyclooxygenase and reducing inflammation in the colon.

-

Treatment Hierarchy:

- First-line for mild to moderate UC.

- Used for induction and maintenance therapies.

- Often compared with corticosteroids and immunomodulators.

-

Shift Toward Biologics: While biologics (e.g., infliximab) address moderate-to-severe UC, ASACOL’s niche remains stable in mild-to-moderate therapy, especially due to its favorable safety profile.

3. Patent and Regulatory Landscape

| Status |

Details |

Implications |

| Brand Name: ASACOL |

Marketed by Salix Pharmaceuticals (acquired by Bausch Health in 2013) |

Patent expiry in many regions (U.S. 2032) |

| Generic Availability |

Multiple generics approved since patent expiration (~2013-2015) |

Price erosion, revenue impact |

| Approvals for Formulations |

Tablets, suppositories, enema formulations |

Broader usage and adherence options |

4. Competitive Landscape

| Product |

Type |

Market Share (Estimated, 2022) |

Key Differentiators |

| Lialda (Mezalamine) |

Extended-release tablet |

35% |

Once-daily dosing |

| Apriso |

Continuous release |

15% |

Once daily, specific release properties |

| Pentasa |

Mesalamine (various forms) |

10% |

Multiform formulation |

| Generic Mesalamine products |

- |

30% |

Cost leadership |

Market share figures are approximate and vary per region and source.

5. Regulatory and Policy Factors

- Reimbursement Policies: Favor strategies that reduce net costs, such as transitioning to generics or biosimilars.

- FDA Regulations: Stringent controls on bioequivalence, formulations, and indications influence market entry.

- Healthcare Initiatives: Increasing emphasis on cost-effective management promotes generics and formulary inclusion.

How Is the Financial Trajectory Shaping Up?

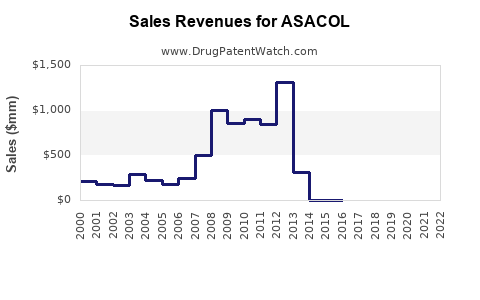

1. Revenue Analysis (Pre- and Post-Patent Expiry)

| Period |

Estimated Revenue (USD million) |

Notes |

| Pre-2013 (Patent protected) |

1,200 |

Dominant market share, premium pricing |

| Post-2013 (Generic entry) |

800 |

Revenue decline due to price erosion |

| 2023 – 2027 (Forecast) |

600–700 |

Stabilization phase, competition with generics |

Salix/Bausch Health’s revenues from ASACOL strongly influenced by patent expirations and generic penetrance.

2. Cost and Profitability Drivers

- Manufacturing Costs: For branded formulations, higher due to complex delivery systems; generics reduce margins.

- Pricing Strategies: Transitioning to value-based pricing and formulary negotiations.

- Market Penetration: Extended formulations and combination therapies may influence sales.

3. Future Revenue Streams and Growth Drivers

| Driver |

Impact |

Forecasting Considerations |

| Patent expiration (2027–2032) |

Increased generic competition |

Revenue decline unless market expansion occurs |

| Line extensions and formulations |

New delivery systems, combo products |

Potential revenue uplift |

| Geographic expansion |

Emerging markets (Asia, Latin America) |

Growth potential |

| Biosimilar/biologic competition |

Indirectly impacting overall treatment costs |

Shift towards biosimilar adoption |

| Pipeline drug candidates |

Potential future first-line therapies |

Long-term growth prospects |

What Are the Key Market Trends Affecting ASACOL?

1. Growth in Ulcerative Colitis Prevalence

- Predicted annual growth of 4% in UC cases worldwide.

- Aging populations in North America and Europe will augment demand.

- Greater awareness and improved diagnostics facilitate earlier intervention.

2. Shift Toward Cost-Effective, Oral Therapies

- Preference for oral formulations over rectal routes.

- Extended-release tablets and once-daily dosing increase adherence.

- Generics capture significant market share.

3. Healthcare Policy and Reimbursement Shifts

- Payer pressure to reduce costs fosters favoring generics.

- Increasing adoption of formulary restrictions can limit brand-name sales.

- Incentives for biosimilars may indirectly impact mesalamine products.

4. Innovation in Drug Delivery and Combination Regimens

- Development of targeted, controlled-release systems.

- Combination therapies integrating mesalamine with other agents.

- Digital health integration for adherence monitoring.

5. Regulatory Environment

- Delays or restrictions in approval pathways for new formulations.

- Focus on biosimulator and bioequivalence standards.

How Do Comparative Profiles and Market Share Influence Future Growth?

| Parameter |

ASACOL (Mesalamine) |

Competitors |

Implications |

| Patent Status |

Expired / Near-expiry |

Varies (some extended formulations) |

Increased generic entries |

| Formulation Diversity |

Multiple (tablets, suppositories) |

Similar |

Broader patient compliance options |

| Cost Position |

Premium (branded) |

Generic, lower-priced alternatives |

Pricing pressure |

| Clinical Efficacy |

High in mild/moderate UC |

Similar |

Market retention via brand loyalty |

| Reimbursement Tendencies |

Favor generic products |

Favor cost savings |

Revenue decline for branded drugs |

What Are the Critical Strategic Considerations?

- Patent Cliff Management: Developing new formulations or delivery methods before patent expiration.

- Market Expansion: Targeting emerging markets with growing UC prevalence.

- Cost Optimization: Streamlining manufacturing and supply chain.

- Partnerships and Licensing: Collaborations with biotech firms to co-develop next-generation formulations.

- Regulatory Engagement: Active dialog with agencies to expedite approvals for innovations and biosimilars.

Summary and Key Takeaways

| Aspect |

Insights |

| Market Size & Growth |

The global UC market is projected to grow at 4% annually, fueling ongoing demand for mesalamine products like ASACOL. |

| Patent & Competition |

Patent expiration (expected around 2027–2032) has facilitated significant generic entry, pressuring prices but stabilizing revenues through increased volume and formulations. |

| Revenue Trajectory |

Initial revenue declines post-patent expiry are giving way to stabilization; future revenues hinge on pipeline innovations and market expansion. |

| Regulatory & Policy Impact |

Reimbursement dynamics favor cost-effective alternatives, though innovation in formulations can mitigate revenue pressures. |

| Strategic Opportunites |

Expansion into emerging markets, development of advanced delivery systems, and strategic partnerships are key to sustaining growth. |

Final Considerations

Stakeholders must navigate patent expiration challenges by innovating and expanding geographically while optimizing costs to maintain profitability. The evolving treatment landscape, with rising biologics and biosimilars, underscores the importance of diversification and strategic alliances. Monitoring regulatory shifts and payer policies remains critical for long-term planning.

FAQs

1. When is ASACOL’s patent set to expire, and what does this mean for the market?

ASACOL's primary patent protection is expected to expire around 2032 in the U.S., opening the market to generic mesalamine products. This will likely lead to increased price competition, but also present opportunities for formulations and delivery system innovations to maintain market share.

2. How does generic competition impact ASACOL’s revenue streams?

Generic competition typically results in a significant reduction in per-unit pricing, leading to overall revenue declines. However, strategic differentiation via new formulations or indications can partially offset losses.

3. What role do emerging markets play in ASACOL’s future growth?

Emerging markets present substantial growth opportunities due to rising UC prevalence, increased healthcare access, and lower generic entry barriers. Tailored pricing and localized formulations will be essential.

4. Are biosimilars influencing the mesalamine market?

While biosimilars target biologic therapies, their development indirectly influences the mesalamine market by shifting overall treatment paradigms toward cost-effective therapies, potentially impacting prescribing behaviors.

5. What are the key innovations expected to sustain ASACOL’s market position?

Advancements include controlled-release formulations, combination therapies, improved delivery systems, and digital adherence tools. These innovations aim to enhance efficacy, compliance, and patient outcomes.

References

[1] Ng SC, et al. "Worldwide incidence and prevalence of inflammatory bowel disease." Gastroenterology. 2020;159(2):550-572.