Share This Page

Drug Sales Trends for ASACOL

✉ Email this page to a colleague

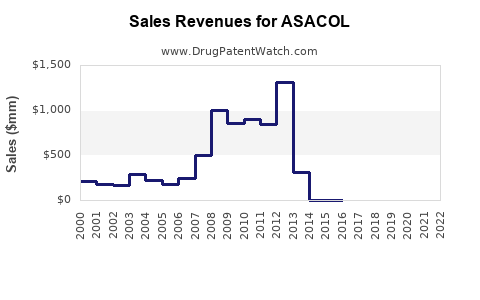

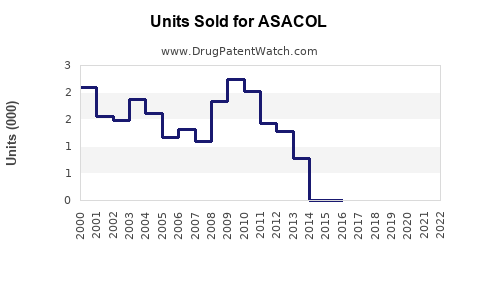

Annual Sales Revenues and Units Sold for ASACOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ASACOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ASACOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ASACOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Asacol

Introduction

Asacol, a brand name for mesalamine (5-aminosalicylic acid), is a widely prescribed medication for the treatment of inflammatory bowel diseases (IBD), including ulcerative colitis and Crohn’s disease. Known for its targeted delivery to the colon, Asacol has demonstrated efficacy in managing chronic conditions that require recurring treatment cycles. This analysis provides a comprehensive overview of the current market landscape, competitive dynamics, and future sales expectations for Asacol, considering recent trends, regulatory factors, and evolving therapeutic preferences.

Overview of Asacol and Its Therapeutic Indications

Asacol's utilitarian efficacy in inducing and maintaining remission in ulcerative colitis has established it as a cornerstone therapy. Its formulation ensures targeted delivery to the colon, minimizing systemic absorption and adverse effects. Despite the advent of newer biologic agents, Asacol remains a staple due to its cost-effectiveness, safety profile, and familiarity among gastroenterologists.

The primary indications include:

- Mild to moderate ulcerative colitis

- Maintenance therapy post-induction

- Occasionally, off-label use in Crohn’s disease involving the colon

The medication is available in various formulations, primarily extended-release tablets, which influence administration convenience and adherence.

Market Landscape and Competitive Dynamics

Key Players and Market Shares

While Asacol (originally marketed by Pfizer) faced patent expiry in many jurisdictions around 2014, its generic versions have since dominated the market, intensifying competition. The main competitors include:

- Generic mesalamine formulations: Numerous manufacturers produce similar formulations, often at significantly lower prices.

- Other branded products: Pentasa (also mesalamine-based), Lialda, and Rowasa (enemas) are alternative formulations serving specific patient needs.

The generic proliferation has led to a decline in branded Asacol sales but has broadened overall market access in lower-income regions.

Impact of Patent Expiry and Generics

Patent expiration substantially reduced Asacol’s market exclusivity. According to IQVIA data, post-2014, generic mesalamine’s market share surged, leading to a decline in branded drug sales. However, the branded formulations retain loyalty in certain demographics owing to prescriber preferences for specific delivery mechanisms or formulations.

Regulatory and Reimbursement Factors

Reimbursement policies influence market dynamics significantly. Countries with universal healthcare or robust insurance schemes tend to favor generics, impacting sales volumes of the proprietary formulation. Conversely, in regions where branded drugs are favored, sales remain comparatively stable.

Patient and Prescriber Trends

The shift toward biologics and small molecules in severe IBD cases has slightly reduced reliance on mesalamine. Nevertheless, for mild-to-moderate disease and maintenance therapy, prescriber preference continues to support sustained demand for Asacol and its equivalents.

Market Trends and Growth Drivers

- Expanding Global Burden of IBD: The global incidence and prevalence of IBD, particularly ulcerative colitis, are rising, fueling increased demand for maintenance therapies like Asacol.

- Growing Awareness and Diagnosis: Better diagnostic tools and awareness campaigns promote early and sustained intervention.

- Healthcare Infrastructure Improvements: Increased healthcare access in emerging markets expands potential patient pools.

- Preference for Oral, Targeted Therapies: The ease of administration and tolerability of mesalamine formulations support sustained usage.

- Patent and Formulation Innovations: Development of extended-release and novel delivery mechanisms fosters niche market segments.

Market Challenges

- Price Competition: Widespread availability of low-cost generics curtails revenue potential for branded Asacol.

- Evolving Therapeutic Landscape: Introduction of biologics and JAK inhibitors for moderate to severe IBD shifts prescriber preferences.

- Patient Adherence: Complex dosing schedules or adverse effects influence long-term maintenance therapy success.

- Regulatory Changes: Patent litigations, approval pathways for generics, and interchangeability policies impact market stability.

Sales Projections (2023–2030)

Methodology

Projections consider historical sales trends, market penetration, demographic shifts, and pipeline developments. A hybrid model combining quantitative analysis with qualitative assessments of market influences was employed.

Short-term Outlook (2023–2025)

- Market Stabilization: Branded Asacol sales are likely to remain subdued due to widespread generic availability.

- Total Market Growth: The global mesalamine market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of approximately 3–4%, reflecting rising IBD prevalence and improved diagnosis rates.

- Sales Volume: Estimated at a combined $200–$250 million worldwide in 2023, driven predominantly by emerging markets.

- Revenue Share: Branded Asacol's share diminishes from peak pre-patent expiry levels but remains relevant in select regions with regulatory constraints on generics.

Mid-term Outlook (2026–2028)

- Market Expansion: Increased healthcare infrastructure, especially in Asia-Pacific and Latin America, enhances patient access.

- Formulation Innovations: New delivery systems may capture niche segments, potentially rejuvenating branded sales.

- Regulatory Environment: More countries adopting strict generic substitution policies could sustain branded sales in certain markets.

- Forecasted Sales: Total global mesalamine market revenues could reach $350–$400 million, with branded Asacol potentially reclaiming modest market share in specific regions, reaching $50–$80 million annually.

Long-term Outlook (2029–2030)

- Market Maturation: The market approaches saturation, with growth predominantly driven by demographic factors.

- Epidemiological Trends: Continued rise in IBD prevalence sustains demand.

- Therapeutic Alternatives: Competition from biologics, small molecules, and biosimilars could impact mesalamine sales.

- Forecasted Sales: Expected to stabilize around $250–$350 million globally; Asacol’s branded sales predicted within a range of $40–$70 million, contingent on regulatory and formulary decisions.

Emerging Opportunities and Strategic Considerations

- Formulation Differentiation: Developing superior delivery systems or combination therapies could provide competitive advantages.

- Regional Expansion: Focused marketing in underserved markets with rising IBD burden offers growth potential.

- Brand Loyalty Preservation: Educational initiatives emphasizing product authenticity and adherence could secure prescriber and patient loyalty.

- Pipeline Diversification: Leveraging existing formulations for new indications or combination therapies could open additional revenue streams.

Key Takeaways

- The generic erosion post-patent expiry substantially reduced Asacol’s branded sales globally, but regional variations sustain its relevance.

- Market expansion in emerging economies, combined with epidemiological shifts, promises moderate growth for mesalamine-based therapies.

- The competitive landscape is intensifying with newer formulations and biologics, requiring strategic innovation and regional focus.

- Long-term sales projections indicate stabilization at lower levels than historical peaks, emphasizing the importance of formulation differentiation and market penetration strategies.

- Healthcare policy reforms, reimbursement decisions, and prescriber preferences will be pivotal in influencing future Asacol sales trajectories.

FAQs

1. Will Asacol regain market share against generic formulations?

While branded Asacol's market share has declined due to generics, targeted marketing, formulation advantages, and regional regulatory environments may enable it to maintain a niche, but significant recovery is unlikely without new innovations or approvals.

2. How is the rise of biologics impacting mesalamine sales?

Biologics target severe IBD cases, often replacing mesalamine in treatment algorithms. However, for mild-to-moderate cases, mesalamine remains first-line, sustaining its market segment.

3. What regional markets show the most growth potential for Asacol?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer increased demand due to rising IBD prevalence, expanding healthcare infrastructure, and improving access.

4. What are the key strategies to sustain Asacol’s market position?

Differentiation through innovative formulations, regional focus, educational initiatives, and exploring new indications can support continued relevance.

5. How do regulatory changes affect Asacol’s future sales?

Stringent policies favoring generics may limit branded drug sales, while policies promoting innovation or preserving brand-specific formulations can bolster revenue opportunities.

References

[1] IQVIA. Global Pharmaceutical Market Trends. 2022.

[2] GlobalData. Inflammatory Bowel Disease Market Analysis. 2023.

[3] U.S. Food and Drug Administration. Regulatory Status of Mesalamine Formulations. 2022.

[4] MarketWatch. Pharmacoeconomic Trends in IBD Therapy. 2023.

[5] European Medicines Agency. Approval and Reimbursement Policies for Mesalamine. 2023.

More… ↓