APADAZ Drug Patent Profile

✉ Email this page to a colleague

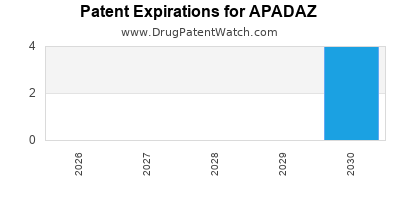

When do Apadaz patents expire, and what generic alternatives are available?

Apadaz is a drug marketed by Zevra Therap and is included in one NDA. There are five patents protecting this drug.

This drug has thirty-five patent family members in twenty countries.

The generic ingredient in APADAZ is acetaminophen; benzhydrocodone hydrochloride. There are sixty-six drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the acetaminophen; benzhydrocodone hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Apadaz

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be February 22, 2031. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for APADAZ?

- What are the global sales for APADAZ?

- What is Average Wholesale Price for APADAZ?

Summary for APADAZ

| International Patents: | 35 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Drug Prices: | Drug price information for APADAZ |

| What excipients (inactive ingredients) are in APADAZ? | APADAZ excipients list |

| DailyMed Link: | APADAZ at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for APADAZ

Generic Entry Date for APADAZ*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

US Patents and Regulatory Information for APADAZ

APADAZ is protected by five US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of APADAZ is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,461,137.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Zevra Therap | APADAZ | acetaminophen; benzhydrocodone hydrochloride | TABLET;ORAL | 208653-002 | Jan 4, 2019 | DISCN | Yes | No | 9,132,125 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Zevra Therap | APADAZ | acetaminophen; benzhydrocodone hydrochloride | TABLET;ORAL | 208653-001 | Feb 23, 2018 | DISCN | Yes | No | 9,549,923 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Zevra Therap | APADAZ | acetaminophen; benzhydrocodone hydrochloride | TABLET;ORAL | 208653-002 | Jan 4, 2019 | DISCN | Yes | No | 9,549,923 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Zevra Therap | APADAZ | acetaminophen; benzhydrocodone hydrochloride | TABLET;ORAL | 208653-003 | Jan 4, 2019 | DISCN | Yes | No | 8,828,978 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for APADAZ

When does loss-of-exclusivity occur for APADAZ?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 10266205

Patent: Benzoic acid, benzoic acid derivatives and heteroaryl carboxylic acid conjugates of hydrocodone, prodrugs, methods of making and use thereof

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012000569

Patent: ácido benzóico, derivados de ácido benzóico e conjugados de ácido heteroaril carboxílico de hidrocodona, pró-farmacos, métodos de produção e uso destes

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 66388

Patent: ACIDE BENZOIQUE, DERIVES D'ACIDE BENZOIQUE ET CONJUGUES D'ACIDEHETEROARYLCARBOXYLIQUEE D'HYDROCODONE, PROMEDICAMENTS, LEURS PROCEDES DE FABRICATION ET D'UTILISATION (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 11003347

Patent: Composicion farmaceutica que comprende un conjugado, correspondiente a benzoato de hidrocodona ; y uso en el tratamiento de una enfermedad, trastorno o afeccion mediada por la union de un opioide a receptores opioides.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2480959

Patent: Benzoic acid, benzoic acid derivatives and heteroaryl carboxylic acid conjugates of hydrocodone, prodrugs, methods of making and use thereof

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 80991

Patent: ACIDO BENZOICO, DERIVADOS DE ACIDO BENZOICO Y CONJUGADOS DE ACIDO HETEROARIL CARBOXILICO DE HIDROCODONA, PROFARMACOS, METODOS PARA ELABORAR Y UTILIZAR LOS MISMOS

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 110688

Patent: CONJUGADOS DE HIDROCODONA CON ÁCIDO BENZOICO, DERIVADOS DE ÁCIDO BENZOICO Y ÁCIDO CARBOXÍLICO HETEROARÍLICO, PROFÁRCOS, MÉTODOS DE PREPARACIÓN Y USO DE LOS MISMOS

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 128

Patent: COMPUESTO DE BENZOATO CONJUGADO A LA HIDROCODONA (BZ-HC)

Estimated Expiration: ⤷ Get Started Free

Patent: 110246

Patent: ÁCIDO BENZOICO, DERIVADOS DE ÁCIDO BENZOICO Y CONJUGADOS DE ÁCIDO HETEROARIL CARBOXÍLICO DE HIDROCODONA, PROFÁRMACOS, MÉTODOS PARA ELABORAR Y UTILIZAR LOS MISMOS

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 48407

Patent: ACIDE BENZOÏQUE, DÉRIVÉS D'ACIDE BENZOÏQUE ET CONJUGUÉS D'ACIDEHÉTÉROARYLCARBOXYLIQUEE D'HYDROCODONE, PROMÉDICAMENTS, LEURS PROCÉDÉS DE FABRICATION ET D'UTILISATION (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 60336

Patent: ACIDE BENZOÏQUE, DÉRIVÉS D'ACIDE BENZOÏQUE ET CONJUGUÉS D'ACIDE CARBOXYLIQUE HÉTÉROARYLE D'HYDROCODONE, PROMÉDICAMENTS, PROCÉDÉS DE FABRICATION ET D'UTILISATION (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7096

Patent: תכשירים הכוללים תצמידים של בנזואט הידרוקודון ושימושים בהם (Compositions comprising conjugates of benzoate hydrocodone and use thereof)

Estimated Expiration: ⤷ Get Started Free

Patent: 9889

Patent: תצמידי חומצה בנזואית, תולדות חומצה בנזואית וחומצה קרבוקסילית הטרוארילית של הידרוקודון, מטרימי תרופות, שיטות להכנתם ושימוש בהם (Benzoic acid, benzoic acid derivatives and heteroaryl carboxylic acid conjugates of hydrocodone, prodrugs, methods of making and use thereof)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 42862

Estimated Expiration: ⤷ Get Started Free

Patent: 12532142

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3046

Patent: BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 12000128

Patent: ACIDO BENZOICO, DERIVADOS DE ACIDO BENZOICO Y CONJUGADOS DE ACIDO HETEROARIL CARBOXILICO DE HIDROCODONA, PROFARMACOS METODOS PARA ELABORALOS Y SUS USOS. (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7235

Patent: BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 05541

Patent: КОНЪЮГАТЫ ГИДРОКОДОНА С БЕНЗОЙНОЙ КИСЛОТОЙ, ПРОИЗВОДНЫМИ БЕНЗОЙНОЙ КИСЛОТЫ И ГЕТЕРОАРИЛКАРБОНОВОЙ КИСЛОТОЙ, ПРОЛЕКАРСТВА, СПОСОБЫ ИХ ПОЛУЧЕНИЯ И ИХ ПРИМЕНЕНИЕ (CONJUGATES OF HYDROCODONE WITH BENZOIC ACID, DERIVATIVES OF BENZOIC ACID AND HETERO-ACRYL-CARBON ACID, PRODRUGS, METHODS FOR THEIR OBTAINING AND APPLICATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 12103476

Patent: КОНЪЮГАТЫ ГИДРОКОДОНА С БЕНЗОЙНОЙ КИСЛОТОЙ, ПРОИЗВОДНЫМИ БЕНЗОЙНОЙ КИСЛОТЫ И ГЕТЕРОАРИЛКАРБОНОВОЙ КИСЛОТОЙ, ПРОЛЕКАРСТВА, СПОСОБЫ ИХ ПОЛУЧЕНИЯ И ИХ ПРИМЕНЕНИЕ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 7445

Patent: BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1109438

Patent: BENZOIC ACID,BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE,PRODRUGS,METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Patent: 1300747

Patent: BENZOIC ACID,BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE,PRODRUGS,METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1655972

Estimated Expiration: ⤷ Get Started Free

Patent: 1795330

Estimated Expiration: ⤷ Get Started Free

Patent: 1877467

Estimated Expiration: ⤷ Get Started Free

Patent: 1971223

Estimated Expiration: ⤷ Get Started Free

Patent: 2038260

Estimated Expiration: ⤷ Get Started Free

Patent: 120048589

Patent: BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Patent: 160106781

Patent: 히드로코돈의 벤조산, 벤조산 유도체 및 헤테로아릴 카르복실산 콘쥬게이트, 이의 전구약물, 제조 방법 및 용도 (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 170124638

Patent: 히드로코돈의 벤조산, 벤조산 유도체 및 헤테로아릴 카르복실산 콘쥬게이트, 이의 전구약물, 제조 방법 및 용도 (BENZOIC ACID BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE PRODRUGS METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 180081176

Patent: 히드로코돈의 벤조산, 벤조산 유도체 및 헤테로아릴 카르복실산 콘쥬게이트, 이의 전구약물, 제조 방법 및 용도 (BENZOIC ACID BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE PRODRUGS METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 190042115

Patent: 히드로코돈의 벤조산, 벤조산 유도체 및 헤테로아릴 카르복실산 콘쥬게이트, 이의 전구약물, 제조 방법 및 용도 (BENZOIC ACID BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE PRODRUGS METHODS OF MAKING AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 2916

Patent: КОМПОЗИЦИЯ НА ОСНОВЕ КОНЬЮГАТА ГИДРОКОДОНА С БЕНЗОЛЬНОЙ КИСЛОТОЙ, ПРОИЗВОДНЫМИ БЕНЗОЙНОЙ КИСЛОТ ИЛИ ГЕТЕРОАРИЛКАРБОНОВОЙ КИСЛОТОЙ, ПРОЛЕКАРСТВА, СПОСОБ ЛЕЧЕНИЯ ОТ ЗЛОУПОТРЕБЛЕНИЙ;КОМПОЗИЦІЯ НА ОСНОВІ КОН'ЮГАТУ ГІДРОКОДОНУ З БЕНЗОЙНОЮ КИСЛОТОЮ, ПОХІДНИМИ БЕНЗОЙНОЇ КИСЛОТИ АБО ГЕТЕРОАРИЛКАРБОНОВОЮ КИСЛОТОЮ, ПРОЛІКИ, СПОСІБ ЛІКУВАННЯ ВІД ЗЛОВЖИВАНЬ (COMPOSITION BASED ON CONJUGATES OF HYDROCODONE WITH BENZOIC ACID, BENZOIC ACID OR HETEROARYL CARBOXYLIC ACID DERIVATIVES, PRODRUGS AND METHOD FOR TREATMENT OF ABUSES)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering APADAZ around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 20160106781 | 히드로코돈의 벤조산, 벤조산 유도체 및 헤테로아릴 카르복실산 콘쥬게이트, 이의 전구약물, 제조 방법 및 용도 (BENZOIC ACID, BENZOIC ACID DERIVATIVES AND HETEROARYL CARBOXYLIC ACID CONJUGATES OF HYDROCODONE, PRODRUGS, METHODS OF MAKING AND USE THEREOF) | ⤷ Get Started Free |

| Cuba | 20110246 | ⤷ Get Started Free | |

| European Patent Office | 2448407 | ⤷ Get Started Free | |

| South Korea | 101795330 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for APADAZ

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.