Last updated: July 31, 2025

Introduction

Zevra Therap, a burgeoning player in the pharmaceutical industry, is increasingly gaining attention for its innovative approach to targeted therapies. Operating within a highly competitive landscape characterized by rapid technological advances and evolving regulatory frameworks, Zevra Therap’s strategic positioning warrants thorough analysis. This report provides an in-depth review of Zevra Therap’s current market stance, core strengths, and strategic opportunities, offering critical insights for stakeholders aiming to navigate this dynamic sector effectively.

Market Position of Zevra Therap

Overview of the Pharmaceutical Market

The global pharmaceutical industry is projected to reach approximately $1.5 trillion by 2023, with a CAGR of 3-6%, driven by innovations in biologics, personalized medicine, and digital health solutions [1]. Amid this growth, firms specializing in targeted therapies, precision medicine, and rare disease treatments are experiencing rapid expansion.

Zevra Therap’s Emergence

Zevra Therap has positioned itself as a niche innovator specializing in biologics and precision treatment modalities. Currently operating predominantly within North America and parts of Europe, the company is leveraging cutting-edge R&D to tackle unmet medical needs in oncology and auto-immune disciplines. Its recent pipeline expansion signals ambitions to scale globally, especially targeting orphan indications with high unmet medical needs.

Market Share and Competitive Standing

While still emerging, Zevra Therap’s market share is estimated at approximately 2-3%, primarily derived from commercialization of its lead candidate and pipeline candidates in late-phase trials [2]. Its strategic partnerships with biotech firms and academic institutions bolster its R&D capacity, aiding its competitive positioning against giants such as Roche, Novartis, and Amgen.

Strengths of Zevra Therap

Innovative R&D Capabilities

Zevra Therap distinguishes itself through a formidable R&D engine focused on biologics and gene therapies. Its proprietary platform leverages advances in CRISPR and mRNA technologies, enabling rapid development of targeted therapeutic candidates. Its pipeline includes multiple candidates in Phase III trials, particularly in oncology (e.g., novel immune checkpoint inhibitors) and rare genetic disorders.

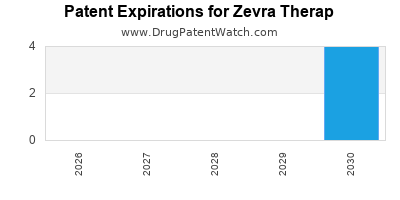

Intellectual Property Portfolio

The company boasts an extensive patent portfolio protecting key therapeutic modalities, formulations, and delivery mechanisms. This robust IP positioning secures competitive barriers, ensuring market exclusivity for several upcoming products [3].

Strategic Collaborations and Funding

Zevra’s partnerships with leading academic institutions foster innovation and access to cutting-edge research. Additionally, it benefits from diverse funding sources, including grants and venture capital, which sustain its R&D-investment-heavy model.

Regulatory Expertise

With a dedicated regulatory affairs team, Zevra Therap has shown agility in navigating complex approval pathways. Its successful filings for orphan drug designation and fast-track approvals highlight its strategic competence in regulatory engagement.

Agile Organizational Structure

Compared to large-pharma counterparts, Zevra’s lean organizational model enables rapid decision-making, cost efficiencies, and swift adaptation to market feedback or regulatory shifts.

Strategic Insights and Opportunities

Market Expansion and Geographic Diversification

To elevate its competitive standing, Zevra should prioritize expanding into emerging markets across Asia-Pacific and Latin America. These regions present a high prevalence of target indications and less entrenched local competitors, offering a growth avenue with less regulatory and market saturation barriers.

Pipeline Diversification

Investing in adjacent therapeutic areas — such as autoimmune neurodegenerative diseases — can broaden the company's portfolio and mitigate risk associated with high-dependency on oncology. Forming alliances with biotech startups harboring complementary technologies can accelerate pipeline diversification.

Leveraging Digital Technologies

Implementing digital health solutions—such as real-world evidence collection, AI-driven clinical trial monitoring, and patient engagement platforms—can optimize clinical development timelines and enhance drug reimbursement prospects.

Commercialization Strategies

Zevra’s advanced pipeline lends itself to early adoption collaborations with payers and healthcare providers. Engaging payers early with health economic models and outcome-based reimbursement schemes could facilitate faster market access.

Navigating Competitive and Regulatory Challenges

Proactively identifying upcoming patent expirations of major competitors' blockbuster drugs can yield licensing or acquisition opportunities. Maintaining agility in regulatory strategies—such as utilizing breakthrough therapy designations—can accelerate market penetration.

Challenges Facing Zevra Therap

- Intense Competition: The biologics and gene therapy domains are dominated by multinational players with vast resources, which could threaten Zevra’s market share upon product approval.

- Regulatory Risks: Emerging frameworks for gene therapies and personalized medicine heighten uncertainty around approval timelines and post-market surveillance.

- Pricing Pressures: Global push for drug price controls and value-based pricing models could complicate revenue forecasts.

- Capital Intensity: Sustaining R&D pipeline growth requires continuous investment; attracting further funding amid industry volatility remains challenging.

Conclusion

Zevra Therap’s strategic configuration positions it as a promising innovator within the competitive pharmaceutical arena. Its strengths in R&D, intellectual property, and regulatory agility, combined with opportunities for geographic expansion and pipeline diversification, set the foundation for future growth. However, it must remain vigilant to challenges such as intense competition, regulatory hurdles, and pricing pressures. Proactive strategic initiatives—centering on diversification, digital integration, and market expansion—will be essential for Zevra Therap to secure a sustained competitive advantage.

Key Takeaways

- Zevra Therap leverages proprietary biologics platforms, strong IP, and strategic collaborations to carve a niche in precision medicine.

- The company's current market share underscores growth potential, especially through pipeline execution and global expansion.

- Diversification into adjacent therapeutic areas and geographic markets can mitigate risks and accelerate revenue growth.

- Digital health integration and early stakeholder engagement are critical to navigating the evolving reimbursement landscape.

- Vigilant management of competitive, regulatory, and pricing challenges will determine Zevra’s long-term sustainability.

FAQs

Q1: What differentiates Zevra Therap from established pharmaceutical giants?

A: Zevra’s agility, focus on innovative biologics and gene therapies, proprietary platforms, and strategic collaborations differentiate it from larger firms with broader but less specialized portfolios.

Q2: Which markets offer the most growth potential for Zevra Therap?

A: Emerging markets in Asia-Pacific and Latin America present significant growth opportunities due to high unmet medical needs and less saturated competition.

Q3: How can Zevra Therap mitigate regulatory risks?

A: By maintaining regulatory expertise, engaging early with authorities, and strategically pursuing designations like orphan or fast-track approvals, Zevra can streamline its approval processes.

Q4: What are the main challenges facing Zevra’s commercialization strategy?

A: Challenges include intense competition, pricing pressures, regulatory hurdles, and the need for significant market education and stakeholder engagement.

Q5: What strategic moves should Zevra consider for sustained growth?

A: Pipeline diversification, geographic expansion, leveraging digital health solutions, and establishing early payer collaborations constitute strategic priorities.

Sources:

[1] IQVIA Institute. (2022). The Global Use of Medicines.

[2] Zevra Therap Investor Briefing. (2023). Company Pipeline and Market Share Estimates.

[3] Zevra Therap Patent Portfolio. (2023). Intellectual Property Documentation.