Last updated: July 27, 2025

Introduction

Amphetamine sulfate, a central nervous system stimulant, primarily used in the treatment of attention deficit hyperactivity disorder (ADHD) and narcolepsy, has traversed a complex market landscape marked by regulatory scrutiny, evolving therapeutic needs, and shifting societal perceptions. Its influence on the pharmaceutical industry extends beyond its clinical applications, impacting market strategies, supply chains, and investment considerations.

Regulatory Framework and Market Control

Amphetamine sulfate’s status as a Schedule II controlled substance significantly constrains its production, distribution, and research activities. Regulatory agencies such as the U.S. Drug Enforcement Administration (DEA) impose strict controls due to its high potential for abuse and dependence [1]. These regulatory hurdles restrict market entries and innovation, often elevating the costs associated with research and development (R&D) and licensing. Moreover, regulatory pathways for generic and biosimilar products are complex, impacting market competition and pricing strategies.

Market Size and Growth Drivers

The global ADHD therapeutic market, where amphetamine-based medications constitute a significant segment, is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.2% between 2022 and 2028 [2]. Factors fueling this growth include increased diagnosis rates, rising awareness, and expanding healthcare infrastructure in emerging markets. Additionally, demographic shifts such as rising adolescent populations and geriatric mental health needs contribute to sustained demand.

In the United States, amphetamine-based drugs like Adderall (a formulation of amphetamine mixed salts) dominate the prescription landscape. The U.S. accounted for over 90% of the global ADHD drug sales in 2021, underscoring regional market dominance [3].

Market Dynamics

Supply Chain Constraints and Raw Material Dependence

The manufacturing of amphetamine sulfate depends heavily on precursor chemicals like pseudoephedrine and ephedrine, which are subject to strict regulation under the Combat Methamphetamine Epidemic Act (CMEA) in the U.S. [4]. These regulations impose limitations on production volumes and complicate supply chain logistics. Consequently, supply disruptions can lead to price volatility and product shortages, affecting both manufacturers and consumers.

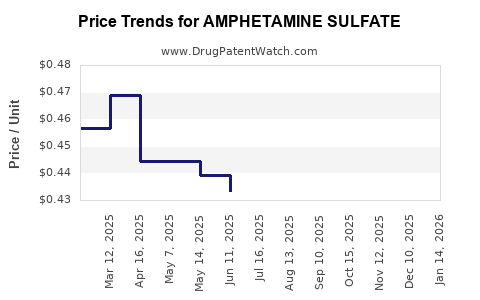

Generic Competition and Price Trends

Patent expirations of major amphetamine formulations have introduced robust generic competition, leading to reduced prices and increased accessibility. However, price pressures are counterbalanced by regulatory compliance costs and the need for secure supply chains, which can sustain premium pricing for branded formulations.

Reformulation and Abuse Deterrence

To mitigate diversion and abuse, pharmaceutical companies have developed reformulated products with abuse-deterrent properties. These innovations increase manufacturing costs but are critical for maintaining market access and complying with regulatory expectations [5].

Financial Trajectory and Investment Outlook

Revenue Streams and Market Valuation

In 2021, the global market for ADHD medications was valued at approximately $20 billion, with amphetamine-based drugs accounting for nearly half of this value [6]. The steady rise in demand yields predictable revenue streams for established firms like Teva Pharmaceuticals, Pfizer, and generic manufacturers.

Impact of Patent and Regulatory Trends on Revenue

Patent expirations and regulatory approvals for generics have historically precipitated revenue declines for branded products. However, companies investing in reformulated or branded versions with abuse-deterrent features have managed to sustain higher margins and revenue footprints.

Emerging Markets and Future Growth

Investments in markets such as China, India, and Latin America present significant growth opportunities due to expanding healthcare access and increasing diagnostic rates. These regions typically have less mature regulatory environments but offer lower manufacturing costs, enabling competitive pricing strategies [7].

Research and Development Investment

Innovative research targeting novel delivery mechanisms, such as extended-release formulations, or alternative compounds with similar efficacy but reduced abuse potential, represents a key area of investment. Companies focusing on R&D aim to extend their product lifecycle and capture unmet needs, contributing to long-term financial growth.

Competitive Landscape

The market is characterized by a mix of large pharmaceutical corporations, generic manufacturers, and specialty biotech firms. The high barriers to entry due to regulatory and manufacturing complexities reinforce existing oligopolies, while patent protections and formulations innovations serve as competitive differentiators.

Market Challenges and Opportunities

- Challenges: Regulatory constraints, abuse potential, supply chain disruptions, and pricing pressures threaten profitability.

- Opportunities: Emerging markets, formulations innovation (abuse-deterrent technologies), and ongoing research for alternative therapies augment growth prospects.

Conclusion

The market dynamics for amphetamine sulfate are shaped by regulatory oversight, patent landscapes, societal trends, and supply chain realities. Financial trajectories suggest a cautiously optimistic outlook, supported by demographic trends and therapeutic demands. However, companies must navigate regulatory complexities and societal concerns around abuse to sustain profitability and growth in this highly controlled yet lucrative segment of the pharmaceutical industry.

Key Takeaways

- Regulatory control significantly constrains amphetamine sulfate’s manufacturing, distribution, and R&D, impacting market supply and innovation.

- The global ADHD drug market is expanding, with amphetamine-based products maintaining dominant market share, especially in North America.

- Supply chain dependencies on precursor chemicals and abuse-deterrent formulations influence manufacturing costs and market pricing.

- Patent expirations have introduced generic competition, driving prices downward but allowing continued revenue through differentiated formulations.

- Investment in emerging markets, novel drug delivery systems, and abuse-deterrent technologies represent strategic avenues for future growth.

FAQs

1. How does regulation impact the production and distribution of amphetamine sulfate?

Regulatory agencies classify amphetamine sulfate as a Schedule II substance, imposing stringent controls on manufacturing, prescribing, and dispensing. These regulations limit production volumes, require secure logistics, and entail compliance costs that hinder market entry and expansion.

2. What are the primary factors driving demand for amphetamine-based medications?

Demand is driven by rising diagnosis rates of ADHD and narcolepsy, increased awareness, and expanding healthcare access in various regions. Societal acceptance and insurance coverage for these medications also bolster demand.

3. How do patent expirations influence the financial trajectory of companies involved with amphetamine sulfate?

Patent expirations allow generics to enter the market, often leading to reduced drug prices and shrinkage of branded drug revenues. However, firms that innovate with abuse-deterrent formulations or move into emerging markets can offset revenue declines.

4. What is the outlook for supply chain stability regarding precursor chemicals?

Strict regulations on chemicals like pseudoephedrine constrain supply, increasing costs and causing occasional shortages. Companies are exploring alternative sourcing and synthetic pathways to mitigate these risks.

5. Can new formulations or delivery mechanisms enhance market competitiveness for amphetamine sulfate products?

Yes. Extended-release, abuse-deterrent, and non-invasive formulations can differentiate products, meet regulatory requirements, and sustain market share amid generic competition.

References

[1] DEA Controlled Substances Scheduling. United States Drug Enforcement Administration.

[2] MarketWatch. ADHD Therapeutics Market Size and Forecast 2022–2028.

[3] IQVIA. U.S. Prescription Data and Market Share Analysis.

[4] Combat Methamphetamine Epidemic Act of 2005. U.S. Congress.

[5] FDA. Abuse-Deterrent Opioids. Regulatory Guidelines.

[6] Grand View Research. Global ADHD Drugs Market Overview.

[7] WHO. Access to Essential Medicines and Regional Market Dynamics.