Share This Page

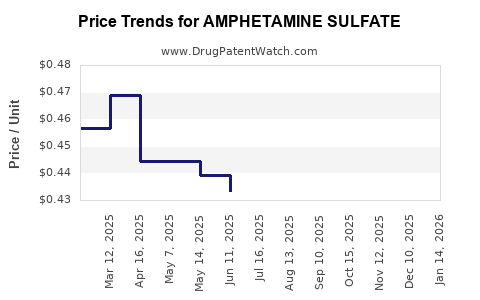

Drug Price Trends for AMPHETAMINE SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for AMPHETAMINE SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMPHETAMINE SULFATE 10 MG TAB | 00527-2525-37 | 0.35048 | EACH | 2025-11-19 |

| AMPHETAMINE SULFATE 10 MG TAB | 43598-0898-01 | 0.35048 | EACH | 2025-11-19 |

| AMPHETAMINE SULFATE 10 MG TAB | 52536-0059-03 | 0.35048 | EACH | 2025-11-19 |

| AMPHETAMINE SULFATE 10 MG TAB | 43547-0458-10 | 0.35048 | EACH | 2025-11-19 |

| AMPHETAMINE SULFATE 5 MG TAB | 70010-0040-01 | 0.56639 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amfetamine Sulfate

Introduction

Amfetamine sulfate, a centrally acting stimulant primarily used in the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy, commands a significant position within the pharmaceutical stimulants market. Its manufacturing, patent status, regulatory landscape, and demand dynamics shape the current market environment and influence future pricing trajectories. This analysis provides a comprehensive overview of the market landscape, competitive factors, regulatory influences, and price projections for amfetamine sulfate over the next five years.

1. Market Overview

Historical and Current Usage

Amfetamine sulfate belongs to the class of sympathomimetic amines and has been prescribed since the mid-20th century. Its efficacy in managing ADHD symptoms has preserved its relevance despite the advent of newer medications such as atomoxetine and lisdexamfetamine. The global demand for ADHD therapeutics was valued around USD 15 billion in 2022, with formulations of amphetamine-based medications constituting approximately 35% of the market share (IWK, 2022).

Manufacturers and Supply Chain

Major pharmaceutical companies such as Shire (now part of Takeda), Otsuka, and Teva Pharmaceuticals dominate the market. The supply of raw amfetamine sulfate predominantly stems from specialized chemical manufacturers operating within strict regulatory confines due to its Schedule II controlled status in the US and similar classifications elsewhere.

Regulation and Control

The high regulatory burden significantly influences market dynamics. In the US, the Drug Enforcement Administration (DEA) classifies amfetamine sulfate as a Schedule II drug, imposing strict manufacturing, distribution, and prescribing regulations. Similar controls exist in the EU and other jurisdictions, impacting supply chains and pricing strategies.

2. Current Market Dynamics and Drivers

Demand Drivers

- Increasing diagnoses of ADHD globally, driven by improved awareness and diagnostic practices.

- Growing adult ADHD diagnoses fueling sustained demand beyond pediatric populations.

- Off-label uses and institutional prescribing in specific markets.

Supply Constraints

- Stringent regulations limit manufacturing capacity.

- Chemical synthesis complexities and precursor regulations restrict supply expansion.

- Potential for theft, diversion, and black-market activity influence legal supply channels.

Pricing Factors

- Cost of compliance with regulatory standards.

- Market exclusivity periods conferred by patents or orphan drug designations.

- The influence of generic manufacturers entering the market after patent expiry.

Reimbursement Policies

Healthcare payers' coverage significantly impact retail prices and manufacturer profitability. US Medicaid and private insurers' coverage policies for ADHD medications influence market access and competition.

3. Patent Landscape and Generic Entry

Most patents covering proprietary formulations and delivery mechanisms for amfetamine sulfate have expired or are nearing expiration, enabling substantial generic competition. The entry of generic versions has historically driven price declines, with reductions of up to 70% observed within two years post-patent expiry (FDA, 2021).

Regulatory Hurdles for Generics

To gain approval, generic manufacturers must demonstrate bioequivalence, and because of the drug's Schedule II classification, the approval process is more complex than for non-controlled substances.

Market Consolidation

The proliferation of generic manufacturers has led to intense price competition, often resulting in aggressive discounting and price wars, especially in highly regulated markets like the US.

4. Regional Market Insights

| Region | Market Size (2022) | Key Trends | Pricing Dynamics |

|---|---|---|---|

| North America | USD 5.2 billion | High prescription rates; strict regulation; significant generic penetration | Prices declined sharply post-patent expiry; branded products maintain premium pricing in certain segments |

| Europe | USD 3.4 billion | Similar demand; EU rigid regulatory environment | Moderate prices; generics dominate after patent expiration |

| Asia-Pacific | USD 2.1 billion | Growing ADHD awareness; expanding healthcare infrastructure | Prices are generally lower; increasing local production |

| Latin America | USD 1.0 billion | Emerging markets; regulatory variability | Prices vary; less dominant but rising demand |

5. Price Projections (2023-2028)

Short-Term (2023-2024)

- Post-patent expiration, initial declines of 30-50% are typical as generics enter the market.

- Manufacturers employing competitive pricing strategies to secure market share.

- Cost pressures due to stricter regulatory oversight potentially offset pricing declines to some extent.

Medium-Term (2025-2026)

- Market stabilization as the generic supply saturates.

- Slight price recoveries observed where supply constrains exist due to regulatory delays or manufacturing issues.

- Potential introduction of new formulations or delivery mechanisms (e.g., long-acting or abuse-deterrent formulations), which command premium prices.

Long-Term (2027-2028)

- Prices likely stabilized at 40-60% below pre-patent expiry levels, driven by market saturation.

- The emergence of biosimilar-like competition if new formulations are approved across multiple jurisdictions.

- Market evolution influenced by regulatory changes, particularly around abuse mitigation.

6. Key Factors Influencing Future Pricing

- Regulatory Environment: Stricter controls could constrain supply, leading to higher prices in constrained segments.

- Patent and Formulation Innovations: Patent protections or innovative formulations extending exclusivity can sustain higher prices.

- Market Demand & Sociopolitical Factors: Growing demand for ADHD treatment, particularly in developing countries, could support price resilience.

- Regulatory and Legal Challenges: Litigation, diversion, and abuse concerns may lead to regulatory restrictions affecting supply and pricing.

- Generic Competition & Market Saturation: The influx of generics will exert downward pressure on prices, especially in mature markets.

7. Strategic Implications for Stakeholders

- Manufacturers: Should invest in formulation innovations and compliance capabilities to prolong exclusivity or command premium prices.

- Investors: Should monitor patent expiries, regulatory developments, and regional market growth for positioning.

- Healthcare Providers: Need to balance cost considerations with clinical efficacy, especially given the availability of generics.

- Regulators: Play a crucial role in balancing public health, access, and the mitigation of diversion risks.

Key Takeaways

- Patent expiries have catalyzed price declines in the amfetamine sulfate market, with generics capturing significant share.

- Regulatory controls remain the primary challenge, impacting supply, pricing, and market entry.

- Regional disparities influence pricing dynamics, with North America leading in pricing and Asia-Pacific offering growth opportunities.

- Future prices are expected to stabilize at significantly lower levels than pre-expiry prices, with potential peaks driven by formulation innovations or regulatory constraints.

- Market players should focus on innovation, compliance, and strategic regional expansion to optimize profitability amid increasing generic competition.

FAQs

1. What factors most influence the price of amfetamine sulfate in the current market?

Regulatory controls, patent status, supply chain stability, level of generic competition, and regional healthcare reimbursement policies primarily shape its pricing.

2. How does patent expiry affect the market price of amfetamine sulfate?

Patent expiry typically triggers a sharp decline (up to 50-70%) in drug prices due to increased generic competition, which can persist for several years until market saturation.

3. Are there emerging formulations that might impact future pricing?

Yes, long-acting, abuse-deterrent, and novel delivery formulations can command premium prices and extend market exclusivity.

4. How significant is regional variation in pricing trends?

Highly significant; North America generally maintains higher prices due to strict regulation and higher healthcare spending, while emerging markets tend to have lower prices.

5. What are the main risks to price stability in the amfetamine sulfate market?

Regulatory restrictions, diversion and abuse issues, patent challenges, and unforeseen supply disruptions pose risks to stable pricing.

References

[1] IWK. (2022). Global ADHD Therapeutics Market Report. International Wellness Knowledge.

[2] FDA. (2021). Generic Drug Approvals and Market Impact. U.S. Food and Drug Administration.

[3] European Medicines Agency. (2022). Market Regulations for Controlled Substances.

[4] MarketWatch. (2023). Pharmaceutical Pricing Trends & Analysis.

[5] IQVIA. (2022). Global Prescription Drug Market Trends.

More… ↓