Last updated: July 27, 2025

Introduction

Oxaprozin is a non-steroidal anti-inflammatory drug (NSAID) primarily used for managing pain and inflammation associated with arthritis. Since its patent expiration, the drug’s market landscape has experienced notable shifts influenced by regulatory, competitive, and clinical factors. Analyzing its ongoing market dynamics and financial trajectory provides insight into its current positioning and future prospects within the pharmaceutical industry.

Pharmacological Profile and Clinical Usage

Oxaprozin, marketed under brand names such as Daypro, belongs to the arylpropionic acid class of NSAIDs. It exerts its effect by inhibiting cyclooxygenase enzymes (COX-1 and COX-2), thus reducing prostaglandin synthesis involved in pain and inflammation [1]. Approved in the late 1970s, oxaprozin’s primary indication remains rheumatoid arthritis, osteoarthritis, and other musculoskeletal disorders.

Clinically, the drug is valued for its once-daily dosing due to its long half-life, improving patient compliance. However, concerns over gastrointestinal (GI) bleeding, cardiovascular risks, and renal toxicity have constrained its utilization relative to newer NSAIDs with more favorable safety profiles.

Market Dynamics

Patent Expiry and Generic Competition

The expiration of oxaprozin’s patent rights in the late 1990s led to the proliferation of generic formulations, markedly reducing drug prices and limiting brand-name sales [2]. Generic entrants have dominated the market, lowering barriers for access but also constraining profit margins for the original manufacturer.

Regulatory and Safety Considerations

Regulatory agencies, including the FDA, have imposed warnings for NSAIDs regarding cardiovascular and GI side effects, influencing prescriber preferences. The increased adoption of selective COX-2 inhibitors, such as celecoxib, which offer a lower GI risk profile, has impacted oxaprozin’s market share.

Competitive Landscape and Therapeutic Alternatives

The NSAID market is saturated with both traditional and selective agents. The emergence of biologic therapies for inflammatory arthritic conditions, while mainly applicable to severe cases, further diminishes NSAID reliance. Additionally, the availability of analgesics with safer profiles encourages physicians to prescribe alternatives over oxaprozin, especially in high-risk patients.

Market Penetration and Patient Demographics

Oxaprozin remains prescribed primarily in regions with established generic distribution channels. Its use is often limited to chronic arthritis management in middle-aged and elderly populations, who are also vulnerable to NSAID-associated adverse effects. These safety concerns limit its broader adoption, especially where newer agents are preferred.

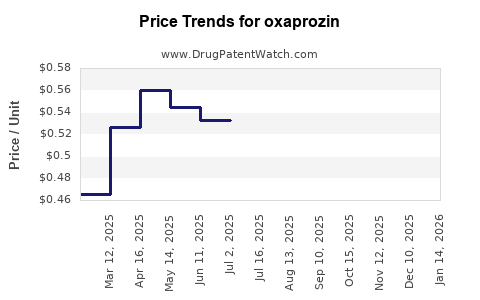

Pricing and Reimbursement Policies

Pricing strategies have moved toward aggressive discounting in response to generic competition, shrinking profit margins. Reimbursement policies favor more recent, evidence-supported NSAIDs with improved safety, further constricting oxaprozin’s market segment.

Financial Trajectory

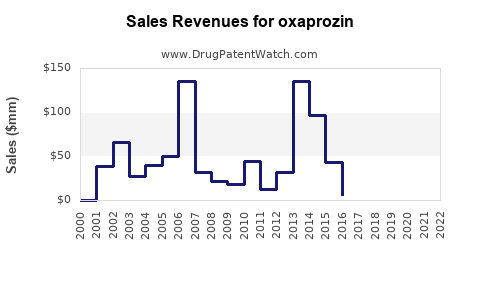

Revenue Trends

Historical revenue data for oxaprozin reflects a decline post-generic entry, consistent with patterns observed for many off-patent drugs [3]. The branded product’s sales have relatively stabilized in niche segments but are unlikely to recover pre-patent levels barring new clinical indications or formulations.

Profitability and Market Share

Profit margins for manufacturers have diminished owing to commoditization, with volume-based sales substituting for high-margin revenue streams. Market share remains thin in comparison to dominant NSAIDs like ibuprofen and naproxen, augmented by newer, targeted therapies for inflammatory diseases.

Research and Development Investment

Limited R&D investment is directed toward oxaprozin owing to its age, established safety profile, and declining market relevance. However, some manufacturers explore novel formulation strategies and combination therapies to extend its lifecycle or improve tolerability.

Regulatory and Legal Risks

Litigation related to NSAID-associated adverse events persists, with some manufacturers facing substantial liabilities. Regulatory bodies maintain vigilant oversight, which could impose new restrictions, further impacting financial prospects.

Emerging Trends and Future Outlook

Potential Repositioning and New Indications

The future of oxaprozin hinges on identifying novel clinical applications or repositioning strategies. For example, exploring its role in managing rare inflammatory conditions or utilizing new delivery systems might carve niche markets.

Generic Market Saturation and Biosimilars

Given the extensive presence of generics, profit margins are unlikely to normalize unless significant innovation or patent-related exclusivity periods recur. Biosenting pathways are less applicable due to oxaprozin’s chemical nature.

Market Consolidation and Strategic Alliances

Large pharmaceutical firms may incentivize licensing, manufacturing, or distribution agreements to optimize supply chains and market penetration, albeit limited by its diminished prominence.

Impact of Healthcare Policy

Policy shifts favoring personalized medicine and safer NSAID alternatives will influence drug prescribing patterns, challenging oxaprozin’s relevance in its current form.

Conclusion

Oxaprozin’s market dynamics revolve around generic competition, safety profile considerations, and competition from newer NSAIDs and biologics. Its financial trajectory is characterized by declining revenues and margins, with limited prospects for significant resurgence absent strategic repositioning or new clinical indications. The drug exemplifies the broader lifecycle challenges faced by mature pharmaceutical assets in a highly competitive, safety-conscious landscape.

Key Takeaways

- Patent expiration and generic competition have substantially eroded oxaprozin’s profitability.

- Safety concerns and the emergence of alternative NSAIDs constrain its market share.

- Limited R&D investment points to declining strategic importance within the pharmaceutical pipeline.

- Future growth may depend on niche applications or innovative formulations.

- Industry trends favor targeted therapies and safer anti-inflammatory agents, diminishing oxaprozin's market relevance.

FAQs

1. Why did the market share of oxaprozin decline after patent expiry?

Patent expiry facilitated the entry of generic competitors, drastically reducing drug prices and market exclusivity, which diminished revenue for original patent holders. Clinicians also shifted toward NSAIDs with better safety profiles, further limiting oxaprozin’s use.

2. How do adverse safety profiles impact oxaprozin’s market?

Safety concerns, particularly cardiovascular and gastrointestinal risks, reduce prescriber confidence. The development and marketing of selective COX-2 inhibitors with improved safety profiles have offered alternative options, challenging oxaprozin’s market position.

3. Are there any ongoing efforts to revitalize oxaprozin’s market presence?

Currently, R&D efforts are minimal. Potential strategies include reformulation, exploring new indications, or targeted use in specific patient populations. However, such initiatives remain limited due to the drug’s mature status.

4. How does the competitive landscape influence the future of oxaprozin?

The dominance of newer NSAIDs, biologic agents, and alternative therapies limits oxaprozin’s utility. Market consolidation and shifting reimbursement policies favor advanced treatments, further restricting its growth.

5. What are the key factors determining Oxford prozin’s financial future?

Market saturation by generics, safety concerns, evolving clinical guidelines, and the rise of personalized medicine are primary determinants. Strategic repositioning and innovation could alter its financial trajectory, but opportunities remain limited.

Sources:

[1] U.S. Food and Drug Administration. (1979). Summary of Pharmacology and Clinical Data for Oxaprozin.

[2] IMS Health. (2000). Impact of Patent Expirations on NSAID Market Revenues.

[3] EvaluatePharma. (2022). Analysis of Older NSAIDs in Post-Patent Market.