Share This Page

Drug Price Trends for oxaprozin

✉ Email this page to a colleague

Average Pharmacy Cost for oxaprozin

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXAPROZIN 600 MG TABLET | 69238-1120-01 | 0.55721 | EACH | 2025-11-19 |

| OXAPROZIN 600 MG CAPLET | 59762-6002-01 | 0.55721 | EACH | 2025-11-19 |

| OXAPROZIN 600 MG TABLET | 55111-0170-01 | 0.55721 | EACH | 2025-11-19 |

| OXAPROZIN 600 MG TABLET | 62135-0176-60 | 0.55721 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Oxaprozin

Introduction

Oxaprozin, a non-steroidal anti-inflammatory drug (NSAID), is primarily prescribed for the treatment of rheumatoid arthritis and osteoarthritis. Since its approval, oxaprozin has carved a niche within the NSAID segment, characterized by its long half-life and once-daily dosing. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory environment, and prospects for price evolution over the coming years.

Regulatory Status and Manufacturing Landscape

Oxaprozin was approved by the FDA in 1982 and is marketed under the brand name Daypro by Warner Chilcott. Its regulatory status remains largely stable, with no recent major reforms impacting its distribution. The manufacturing landscape is consolidated, with a few key players holding patent rights or manufacturing licenses, contributing to a relatively controlled supply chain.

Market Dynamics

Current Market Size

The global NSAID market was valued at approximately USD 13 billion in 2022, with oxaprozin occupying a modest subset of this. In the United States, where the drug’s use is most prevalent, annual prescriptions are estimated to be in the hundreds of thousands, indicating steady but niche demand.

Demand Drivers

- Chronic Disease Prevalence: Rising incidences of rheumatoid arthritis and osteoarthritis underpin consistent demand.

- Dosing Convenience: Oxaprozin's once-daily regimen increases patient compliance compared to shorter-acting NSAIDs.

- Prescriber Preferences: Physicians increasingly favor drugs with established efficacy profiles and manageable safety concerns, favoring oxaprozin in selected cases.

Market Trends

- Shift Toward Biologics: The growth of biologic therapies in rheumatoid arthritis presents competitive challenges, though NSAIDs like oxaprozin remain foundational in initial management.

- Generic Penetration: Patent expirations have historically enabled generic entry, exerting downward pressure on prices.

- Emerging Markets: Growing healthcare infrastructure fuels demand in regions like Asia-Pacific, although market penetration remains limited compared to the US and Europe.

Competitive Landscape

Oxaprozin competes mainly with other long-acting NSAIDs such as nabumetone, meloxicam, and etodolac, as well as with analgesics and biologic agents. While patent protections have long expired, brand loyalty and prescriber familiarity bolster its competitive position. Generic formulations contribute to a competitive price environment, with wholesale prices approximately 20-30% lower than branded versions.

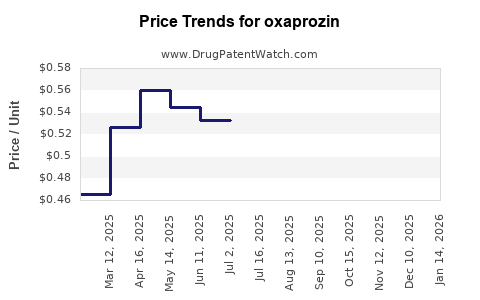

Pricing Analysis and Trends

Historical Price Trends

- Pre-Generic Era: Branded oxaprozin prices ranged from USD 2.00 to USD 4.00 per tablet.

- Post-Generic Entry: Prices declined by approximately 30-50%, with generics driving competition.

- Current Prices: Wholesale prices generally hover around USD 0.50 to USD 1.50 per tablet, with significant discounts available through pharmacy benefit managers and bulk purchasing.

Pricing Influences

- Regulatory and Patent Status: Stable regulatory status maintains pricing stability; patent expiry facilitates generics.

- Market Penetration: Saturation in primary markets limits further price reductions but sustains volume.

- Reimbursement Policies: Insurance and healthcare reimbursement significantly influence patient access and ultimately impact retail pricing.

Price Projection Outlook

Short-term (1-2 years)

Given the mature market status, prices are unlikely to decline further significantly due to saturation of generic sales. Slight fluctuations are expected driven by supply chain dynamics and inflation adjustments.

Medium-term (3-5 years)

- Introduction of New Formulations or Delivery Methods: If innovator companies develop extended-release or combination formulations, initial high pricing might occur, but likely deflation upon generic competition.

- Price Stability: In the absence of new patent protections or significant market disruptions, prices will likely remain within the current range.

Long-term (5+ years)

- Market Contraction or Expansion: A shift toward biologics or combination therapies could further diminish NSAID market share, pressuring prices downward.

- Regulatory or Market Access Changes: Policies favoring biosimilars or emerging therapies could further impact pricing.

Impact of Emerging Therapies and Policies

The ongoing development of biologic and biosimilar agents for inflammatory diseases might marginalize traditional NSAIDs like oxaprozin. Additionally, initiatives promoting cost-effective prescribing and stricter safety regulations (particularly cardiovascular safety concerns associated with NSAIDs) may influence volume and pricing dynamics.

Regional Market Considerations

- United States: Mature market with established prescription patterns; price stability expected.

- Europe: Similar trends to the US, with regional formulary preferences influencing pricing.

- Asia-Pacific: Growing demand, but pricing remains lower due to less pervasive reimbursement systems and higher generic penetration.

Key Market Challenges

- Safety Profile Concerns: NSAID-related gastrointestinal and cardiovascular adverse effects may restrict utilization.

- Competition from Newer Agents: As newer NSAIDs and biologics enter the market, oxaprozin’s share may decline.

- Regulatory Pressures: Policies favoring cost-effective therapies could constrain pricing potential.

Opportunities for Growth and Price Optimization

- Niche Positioning: Focused marketing for specific patient populations with contraindications to newer therapies.

- Formulation Innovations: Development of extended-release or combination drugs with tailored dosing could command premium pricing.

- Market Expansion: Penetration into emerging markets remains a potential growth avenue, albeit with lower pricing norms.

Conclusion

The market for oxaprozin remains stable but mature. Its price trajectory over the next five years will likely reflect modest declines driven by generic competition, with minimal volatility absent of new formulation innovations or regulatory shifts. Strategic positioning within niche markets and geographic expansion can provide opportunities for value retention amidst competitive pressures.

Key Takeaways

- Oxaprozin's demand sustains due to its efficacy and dosing convenience, but market growth is constrained by competition and therapeutic shifts.

- Generic entry has significantly lowered prices, making it a cost-effective option for many prescribers.

- Future pricing will remain relatively stable, with slight downward trends, unless innovative formulations or new regulatory policies emerge.

- Regional differences—particularly in emerging markets—may offer incremental growth opportunities, though at lower price points.

- Stakeholders should monitor biopharmaceutical innovations and policy developments that could reshape the NSAID landscape and influence oxaprozin’s market positioning.

FAQs

1. What factors have contributed most to recent price declines in oxaprozin?

The primary factor is generic entry following patent expirations, increasing competition and reducing wholesale and retail prices.

2. How does oxaprozin compare price-wise to other NSAIDs?

Oxaprozin prices are relatively comparable to long-acting NSAIDs like nabumetone and meloxicam in the generic market, generally making it a cost-effective choice.

3. What is the outlook for oxaprozin's market share amid emerging biologics?

While biologics primarily target more severe inflammatory diseases, their rising use could marginalize NSAIDs, including oxaprozin, especially as safety concerns increase.

4. Are there any patent protections or exclusivity periods left for oxaprozin?

No; patent protections have expired for oxaprozin, allowing generic manufacturers to produce and sell the drug.

5. What regional markets hold the most potential for oxaprozin growth?

Emerging markets in Asia-Pacific present growth opportunities owing to expanding healthcare infrastructure and increasing prescription rates, albeit at lower price points.

Sources:

[1] MarketResearch.com. "NSAID Market Overview," 2022.

[2] IQVIA. "Global Prescription Trends," 2022.

[3] FDA Database, Drug Approval Archives, 1982.

[4] Warner Chilcott Annual Reports, 2022.

[5] Industry Consultancy Reports, 2023.

More… ↓