Last updated: July 27, 2025

Introduction

Dutasteride, a potent 5-alpha-reductase inhibitor used primarily for benign prostatic hyperplasia (BPH) and off-label for androgenetic alopecia, has experienced notable shifts in market dynamics over recent years. Its unique pharmacological profile, evolving competitive landscape, regulatory considerations, and shifting consumer preferences shape its global market trajectory. Scrutinizing these facets offers insight into its financial prospects and strategic positioning within the pharmaceutical industry.

Pharmacological Profile and Therapeutic Applications

Dutasteride inhibits type I and II 5-alpha-reductase enzymes, decreasing dihydrotestosterone (DHT) levels—an androgen implicated in prostate growth and hair loss. Approved in multiple countries, including the US (2010 for BPH), Japan, and the European Union, it has demonstrated efficacy in reducing prostate volume and symptom severity. Its off-label use in androgenetic alopecia, although not officially approved, further expands its market scope.

The drug’s dual enzyme inhibition confers advantages over finasteride, which targets only type II 5-alpha-reductase, potentially offering a broader therapeutic effect. This pharmacodynamic superiority positions dutasteride as a preferred choice in certain indications, pending regulatory and clinical acceptance.

Market Demand Drivers

1. Growing Incidence of BPH: The increasing prevalence of BPH—projected to affect over 50% of men aged 60 and above—fuels demand for dutasteride. Aging populations in developed nations intensify this trend, with the World Population Prospects indicating a surge in senior demographics through 2050 (United Nations, 2019).

2. Rising Awareness and Diagnosis: Advances in diagnostic tools and heightened health awareness amplify treatment initiation rates. Patient preference for minimally invasive therapies also favors pharmacological options like dutasteride over surgical interventions.

3. Off-Label and Cosmetic Uses: The off-label use for androgenetic alopecia benefits from increasing awareness of non-surgical hair restoration options, though regulatory constraints vary by region.

4. Competitive Dynamics: While finasteride remains a competitor due to its earlier market entry and lower price point, dutasteride’s perceived potency enhances its appeal, especially in severe BPH cases.

Market Challenges

1. Regulatory and Safety Concerns: Reports of adverse effects such as sexual dysfunction, gynecomastia, and potential increased risk of high-grade prostate cancer have prompted regulatory caution. The Food and Drug Administration (FDA) has issued warnings, impacting prescription patterns (FDA, 2011).

2. Market Penetration and Reimbursement: Despite clinical advantages, high costs and reimbursement uncertainties limit access in some regions, especially where generic versions are unavailable or limited.

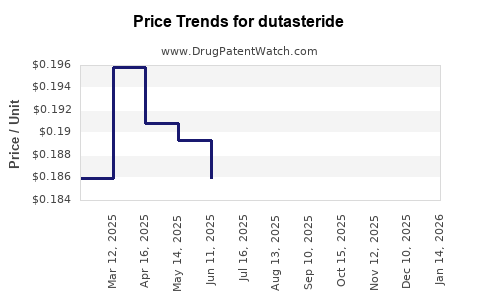

3. Patent Expiry and Generic Competition: Originally marketed by GlaxoSmithKline (GSK) under the brand name Avodart, patent expirations have allowed generics to enter the market in key territories, exerting downward pricing pressures and compressing profit margins.

Regulatory Landscape and Patent Status

GSK's patent protection for Dutasteride, originally expiring around 2018, has largely been challenged by generic manufacturers. The availability of low-cost generics has facilitated wider adoption, especially in markets like India and China, where price sensitivity is high.

Regulatory authorities continue to evaluate safety data, influencing labeling and prescribing guidelines. Notably, the European Medicines Agency (EMA) maintains a cautious stance, restricting off-label use and emphasizing risk management.

Financial Trajectory and Market Forecasts

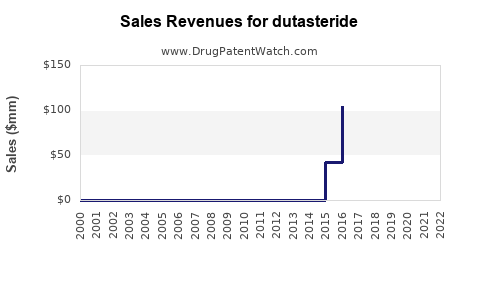

1. Revenue Trends: GSK reported declining Dutasteride sales post-patent expiry, with generics capturing substantial market share. Nonetheless, the drug remains a significant revenue contributor in certain regions—especially where brand loyalty persists and generic alternatives face market entry barriers.

2. Regional Variability: North America accounts for a sizable share, driven by high BPH prevalence, advanced healthcare infrastructure, and insurance reimbursement. In contrast, emerging markets like India and Southeast Asia exhibit rapid growth owing to increasing awareness and declining drug prices.

3. Market Growth Projections: According to Market Research Future (2021), the global dutasteride market is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4-6% from 2022 to 2030. Growth is primarily driven by aging populations, technological advancements in diagnosis, and the expansion of off-label applications.

4. Impact of Competitive Drugs: The coexistence with finasteride, which boasts a robust market share and established safety profile, constrains the potential upside. However, the broader spectrum efficacy of dutasteride sustains niche demand.

5. Strategic Initiatives: Manufacturers are exploring combination therapies (e.g., dutasteride with tamsulosin), new formulations (topical/daily patches), and expanded indications to stimulate growth trajectories.

Emerging Trends Affecting the Market

-

Personalized Medicine: Biomarker-driven therapy selection could enhance dutasteride’s market share by identifying suitable candidates, optimizing efficacy, and reducing adverse effects.

-

Digital Health Integration: Enhanced patient monitoring through digital platforms could improve adherence, fostering sustained demand.

-

Regulatory Modifications: Evolving guidelines on safety and off-label uses may either restrict or expand the market, contingent on new clinical evidence.

Economic Implications for Stakeholders

Pharmaceutical companies aiming to capitalize on dutasteride’s market must navigate patent landscapes, manage safety concerns, and establish pricing strategies that balance profitability with accessibility. Payers and policymakers evaluating reimbursement frameworks significantly influence market penetration, especially in cost-sensitive emerging markets.

Conclusion

Dutasteride's market environment exhibits nuanced dynamics shaped by demographic shifts, regulatory scrutiny, and competitive pressures from generics. While growth prospects remain viable—bolstered by aging populations and broader therapeutic applications—market share challenges persist due to safety concerns, patent expiries, and pricing pressures. Strategic innovation, coupled with safety profile improvements and targeted marketing, will define its financial trajectory over the coming decade.

Key Takeaways

-

Aging Demographics Drive Demand: The global increase in elderly male populations sustains the need for BPH treatments like dutasteride, underpinning long-term market growth.

-

Generic Competition Limits Revenue: Patent expirations catalyzed significant price erosion, with generics capturing substantial market segments, especially in price-sensitive regions.

-

Safety Concerns Moderate Market Expansion: Adverse effect reports temper prescribing rates, necessitating ongoing safety evaluations and clear communication.

-

Regional Variability Influences Profitability: Developed markets with high healthcare spending sustain higher revenues, while emerging markets offer growth opportunities due to affordability and increasing awareness.

-

Innovation is Essential: Developing combination therapies, new formulations, and expanding indications will be critical strategies for maintaining relevance and profitability.

FAQs

1. How does the patent expiry of dutasteride affect its global market?

Patent expiry leads to the entry of generic competitors, resulting in lower prices and increased accessibility. While this expands consumer base, it diminishes the original manufacturer's revenue share, compelling companies to innovate or focus on premium formulations.

2. What are the primary safety concerns associated with dutasteride?

Adverse effects include sexual dysfunction, decreased libido, gynecomastia, and potential risks related to high-grade prostate cancer. These safety issues influence prescribing patterns and regulatory guidance.

3. How significant is off-label use of dutasteride, and what are its implications?

Off-label use, notably for androgenetic alopecia, expands market potential but raises regulatory and legal considerations. Limited regulatory approval for such indications constrains marketing and may influence insurance coverages.

4. What emerging therapies threaten dutasteride's market share?

New pharmacological agents targeting alternative pathways, minimally invasive procedures, and innovative formulations may impact dutasteride’s market, especially if they demonstrate superior efficacy or safety profiles.

5. What strategies can pharmaceutical companies adopt to sustain dutasteride’s market relevance?

Investing in novel formulations, clinical research for new indications, safety profile optimization, digital health integration, and strategic alliances can augment market presence and profitability.

Sources

[1] United Nations Department of Economic and Social Affairs, Population Division. World Population Prospects: 2019.

[2] U.S. Food and Drug Administration. (2011). FDA Drug Safety Communication: New safety information for finasteride and dutasteride.

[3] Market Research Future. (2021). Dutasteride Market Forecast to 2030.

[4] GSK Annual Reports and Investors' Presentations.

[5] European Medicines Agency. (2022). Summary of Product Characteristics for Dutasteride.