Last updated: July 28, 2025

Introduction

Benztropine mesylate, a centrally acting anticholinergic agent primarily used to treat Parkinson's disease and extrapyramidal symptoms associated with antipsychotic medications, operates within a specialized pharmaceutical niche. While its patent status and market presence are less prominent compared to blockbuster drugs, understanding its evolving market dynamics and financial trajectory offers valuable insight into its role amidst broader neurological therapies.

Pharmaceutical Profile of Benztropine Mesylate

Originally approved by the U.S. Food and Drug Administration (FDA) in 1956, benztropine mesylate's primary indication remains Parkinson’s disease management and drug-induced movement disorders (e.g., tardive dyskinesia). Its mechanism involves central anticholinergic activity, reducing involuntary movements. Although it has a long-standing history, there has been limited introduction of novel formulations or indications, constraining growth prospects.

Market Dynamics Overview

1. Market Demand and Therapeutic Area Outlook

The demand for benztropine mesylate persists primarily within the realm of movement disorder treatments. However, innovations in Parkinson's therapy—such as dopamine agonists, MAO-B inhibitors, and novel neuroprotective agents—have affected its positioning. The global Parkinson’s disease market is projected to reach approximately $8–10 billion by 2027, with anticholinergic drugs like benztropine constituting a smaller segment owing to their side effect profile and vertical specialization [1].

Furthermore, the off-label and adjunct uses contribute minimally to overall demand. The aging population globally, especially in North America and Europe, sustains a baseline demand for traditional treatments. Yet, the emergence of advanced therapeutics has lowered reliance on older drugs like benztropine mesylate among clinicians.

2. Patent and Regulatory Landscape

Benztropine mesylate’s patent protections largely expired decades ago, classifying it as a generic drug. Generic availability substantially influences market pricing and profitability, leading to price competition and downward pressure on revenue. The lack of new regulatory indications further limits growth incentives for branded formulations.

3. Competition and Market Share

Major pharmaceutical companies predominantly produce generic benztropine, with a few specialty firms maintaining production. Its market share is concentrated in legacy and bundled treatment protocols rather than as a standalone growth driver. The competition from newer, dopamine-based therapies or non-pharmacological interventions creates an environment where market share for benztropine continues to dwindle.

4. Manufacturing and Supply Chain Considerations

As a generic, benztropine’s manufacturing is largely commoditized, with economies of scale ensuring low production costs. Supply chain resilience, particularly during global disruptions like the COVID-19 pandemic, remains essential for continuous availability in healthcare settings. Significant supply constraints could marginally influence regional markets but are unlikely to alter overall market dynamics substantially.

Financial Trajectory Analysis

1. Revenue Trends and Market Potential

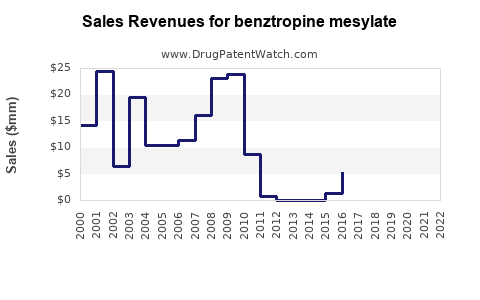

Due to its status as a generic drug and its limited expansion prospects, the financial trajectory of benztropine mesylate indicates Stabilization rather than growth. Revenue estimates across U.S. markets suggest annual sales ranging from $10 million to $50 million, depending on the manufacturer and regional market penetration [2]. The absence of recent patents or novel formulations constrains significant revenue increases.

2. Impact of Market Penetration and Pricing

Price erosion due to generic proliferation diminishes profit margins over time. As newer therapies gain prominence, hospitals and clinics favor medications with improved efficacy profiles and fewer side effects, further compounding the financial stagnation. Market penetration remains steady among long-term Parkinson’s disease patients, but growth is limited.

3. Investment and R&D Perspectives

Research and development efforts targeting benztropine mesylate are sparse, as the focus shifts toward disease-modifying therapies and neuroprotective strategies. Investment in this specific drug segment is unlikely, with most pharmaceutical R&D channels geared toward innovative treatments like gene therapy and novel dopaminergic agents.

4. Regulatory and Pricing Pressures

Pricing pressures from payers and formulary constraints further depress revenues. Reimbursement policies favor newer, branded drugs with demonstrable benefits, diminishing the financial attractiveness of older generics like benztropine mesylate.

5. Future Outlook and Strategic Considerations

The future financial trajectory points toward continued marginal revenues dominated by generic competition. Companies focusing on niche markets may maintain minimal revenues, but substantial income growth is improbable absent new indications or formulations. Strategic stakeholders might consider repositioning benztropine in research for investigational uses, such as in neuroinflammation or as a research tool for cholinergic pathways, although these are not mainstream pathways for commercial development.

Market Trends and External Factors Influencing Financial Trajectory

- Emergence of Disease-Modifying Therapies: The development pipeline for Parkinson’s includes disease-modifying drugs like gene therapies, which could further displace symptomatic treatments such as benztropine.

- Healthcare Policy Shifts: Payer emphasis on cost-effective therapies discourages use of older, off-label drugs with side effect profiles, constraining financial upside.

- Global Demographics: An aging population sustains baseline demand but does not catalyze significant growth.

Conclusion

Benztropine mesylate’s market dynamics reflect its entrenched position within a mature, highly competitive segment characterized by generic drugs. The financial trajectory is predominantly flat, constrained by patent expiration, competitive pricing, and evolving therapeutic standards. Stakeholders should view benztropine primarily as a legacy medication with limited growth potential, emphasizing cost-efficiency and supply stability over revenue expansion.

Key Takeaways

- The global Parkinson’s market’s growth favors newer, disease-modifying therapies, reducing the relative market share for benztropine mesylate.

- Patent expiration and generic competition have exerted downward pressure on revenues, capping profitability.

- Limited innovations or new indications continue to keep the financial outlook stable but stagnant.

- Supply chain resilience remains critical amid low-margin, high-volume generic production.

- Strategic shifts toward niche applications or research-centric roles could unlock marginal revenue streams but are unlikely to generate significant growth.

FAQs

Q1: Is benztropine mesylate likely to experience any significant market growth in the next decade?

A1: Unlikely. Market growth prospects are minimal due to patent expiry, high competition from newer therapies, and limited emerging indications.

Q2: What are the main drivers affecting the profitability of benztropine mesylate?

A2: Key drivers include generic competition, pricing pressures, healthcare policy shifts favoring newer drugs, and patent expiration.

Q3: Are there ongoing research efforts to develop new formulations or indications for benztropine?

A3: Research is limited; most efforts are directed toward innovative neurotherapeutic agents rather than reformulating or repurposing benztropine.

Q4: How does the global demographic trend impact benztropine mesylate’s market?

A4: The aging global population sustains some demand but does not significantly alter the drug’s limited market share or financial trajectory.

Q5: Could regulatory changes influence the market dynamics of benztropine mesylate?

A5: Yes, policies promoting off-patent drug efficiency and cost reduction could further depress revenues, while approval of new therapeutic indications might offer marginal opportunities.

References

[1] Global Parkinson’s Disease Market, Market Research Future, 2022.

[2] IQVIA National Sales Perspectives, 2022.