Last updated: July 27, 2025

Introduction

Entacapone, marketed under brand names such as Comtan, is a selective and reversible catechol-O-methyltransferase (COMT) inhibitor primarily used in Parkinson’s disease management. Since its approval by the FDA in 1999, entacapone’s role has evolved, impacting its market dynamics and financial prospects. This analysis explores the key drivers, competitive landscape, regulatory environment, and future financial outlook for entacapone, providing insights critical for stakeholders across the pharmaceutical spectrum.

Market Overview and Therapeutic Context

Parkinson’s disease (PD), a progressive neurodegenerative disorder affecting approximately 6 million individuals globally, demands multifaceted treatment approaches. Conventional therapies, notably levodopa/carbidopa, face challenges such as motor fluctuations and dyskinesia over time. COMT inhibitors like entacapone augment levodopa’s efficacy by prolonging its plasma half-life, thereby improving symptom control.

Entacapone occupies a niche within PD therapeutics; it is often combined with levodopa/carbidopa, forming a foundational treatment component. The global PD drug market, projected to reach USD 9 billion by 2026 with a CAGR of around 4.8%, signals growing demand fueled by aging populations and increased awareness.

Key Market Drivers

- Aging Demographics: The prevalence of PD escalates with age, targeting populations above 60. As global life expectancy rises, so does the need for PD management.

- Advancements in Symptom Management: Enhanced formulations and combination therapies with entacapone improve patient outcomes, bolstering its clinical utility.

- Expanding Access: Countries in Asia, Latin America, and Eastern Europe are expanding healthcare infrastructure, facilitating broader distribution and access.

- Patent Expiry and Generics: While the original patent for Comtan expired in 2016, generic versions have entered predominant markets, affecting pricing strategies and revenue streams.

Market Dynamics

Competitive Landscape

Entacapone competes primarily with tolcapone, another COMT inhibitor, and newer dopamine agonists or MAO-B inhibitors. Tolcapone, despite higher efficacy, is limited due to severe hepatotoxicity risks, positioning entacapone as the safer mainstream option.

Generic manufacturing has increased affordability, shrinking revenue per unit but expanding volume sales. Major pharmaceutical companies like Novartis and Teva have significant stakes through licensing agreements and generics.

Regulatory Environment & Patent Landscape

Regulatory approvals in multiple jurisdictions have maintained entacapone's market presence. However, the patent landscape influences pricing strategies, with patent cliffs precipitating generic competition. Notably, the patent expiration of Comtan led to price reductions of up to 50% in key markets, impacting revenue.

Regulatory authorities have emphasized post-marketing surveillance for adverse effects, mainly hepatotoxicity concerns linked with tolcapone, which benefits entacapone's market stability.

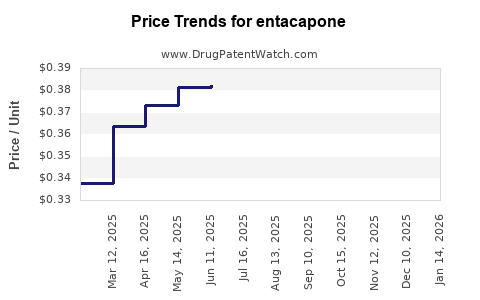

Pricing and Reimbursement Trends

In established markets like the U.S. and Europe, reimbursement policies favor combination PD therapies, including entacapone. However, price pressures due to generics and healthcare cost containment are notable. Price transparency and negotiated drug prices influence overall revenue.

Emerging Markets and Demographic Shifts

Emerging markets represent significant growth opportunities driven by increased healthcare infrastructure and rising PD diagnosis rates. Lower-cost generics are particularly appealing in these regions, further expanding access.

Research & Development Impact

Ongoing research exploring fixed-dose combinations, novel formulations (e.g., extended-release), and combination therapies could influence future demand and market share. Investment in pharmacogenomics and personalized medicine could tailor entacapone's use, affecting adoption rates.

Financial Trajectory Analysis

Historical Revenue Trends

Post-approval, entacapone experienced rapid initial uptake, especially among specialist neurologists. The patent cliff in 2016 resulted in revenue declines in developed markets, as generic versions flooded the market, with estimates indicating a 30-50% revenue reduction in some regions.

Projected Market Growth

Despite patent expiries, the market is expected to sustain growth due to increasing PD prevalence and new formulation innovations. The CAGR is predicted to stabilize around 2.5%-3% over the next five years, driven by volume growth rather than high-margin sales.

Revenue Forecasts

- Developed Markets: Flat or declining revenues post-patent expiry; however, sustained through generics and expanded indications.

- Emerging Markets: Rapid growth predicted, with compounded annual sales increase of up to 10%, driven by price-sensitive and expanding healthcare infrastructure.

- Pipeline Developments: New formulations and combination therapies could revive sales figures, offering premium pricing opportunities.

Profitability Considerations

Profit margins are under pressure due to generic price erosion. Companies adopting aggressive pricing, cost-efficient manufacturing, and strategic licensing are better positioned to sustain profitability.

Risks and Opportunities

- Risks: Patent expirations, clinical adoption of rival therapies, and regulatory setbacks may dampen revenues.

- Opportunities: Innovation in delivery methods, combination regimens, and geographic expansions can prop up financial trajectories.

Future Outlook

The outlook for entacapone hinges on innovation and market expansion opportunities. The growing focus on personalized medicine and combination therapies offers avenues for niche premium products. Strategic partnerships and licensing agreements in emerging markets will be critical to sustain growth. Additionally, ongoing clinical trials exploring neuroprotective properties could broaden its therapeutic scope, potentially transforming its market trajectory.

Key Takeaways

- Market Longevity Post-Patent Expiry: Despite patent expiration, entacapone retains relevance due to its established efficacy and cost-effectiveness, especially in emerging markets.

- Pricing Strategies Are Critical: Companies will need to balance affordability with profitability, particularly as generics dominate.

- Innovation Drives Growth: New formulations, combination therapies, and personalized approaches will be essential to rejuvenate sales.

- Emerging Markets Are Key Growth Zones: Expanding healthcare access and demographic shifts make these regions vital for long-term revenue streams.

- Regulatory and Safety Profiling Affects Market Dynamics: Continued monitoring for hepatotoxicity and other adverse effects influences prescribing patterns and market acceptance.

FAQs

1. How does entacapone compete with other Parkinson’s disease therapies?

Entacapone complements levodopa/carbidopa therapy, improving symptom control by prolonging drug activity. Unlike dopamine agonists or MAO-B inhibitors, it specifically inhibits COMT, making it a targeted adjunct. Its safety profile and cost-effectiveness favor its continued use, especially where generic options are available.

2. What impact did patent expiration have on entacapone's market revenues?

The patent expiry in 2016 led to a surge in generic supply, driving prices down and reducing revenue for originator companies by up to 50% in certain regions. However, volume sales and expanding indications have mitigated some revenue losses.

3. Are there any upcoming formulations or combination therapies involving entacapone?

Research focuses on fixed-dose combinations, extended-release formulations, and potential neuroprotective adjuncts. While none are yet standard, ongoing clinical studies indicate a promising pipeline, potentially expanding its market.

4. What demographic trends are influencing the future of entacapone?

An aging global population increases PD prevalence, expanding the potential user base. Developing markets with improving healthcare systems further accelerate access and utilization.

5. How does the safety profile of entacapone compare with tolcapone?

Entacapone is generally safer, with fewer hepatotoxicity concerns, which led to its preference over tolcapone. Ongoing monitoring ensures safety standards support its continued use.

References

[1] Global Parkinson’s Disease Market. (2022). Market Research Future.

[2] U.S. Food & Drug Administration (FDA). (1999). Approval of Comtan.

[3] European Medicines Agency (EMA). (2016). Patent expiration details.

[4] World Health Organization. (2020). Global Parkinson’s Disease Report.

[5] Pharmaceutical Industry Reports. (2021). Market analysis for COMT inhibitors.