Last updated: July 28, 2025

Introduction

Carisoprodol, marketed primarily under the brand name Soma, is a centrally acting muscle relaxant prescribed to alleviate acute musculoskeletal pain. As a drug with significant clinical utility, its market dynamics are influenced by regulatory policies, prescriber trends, alternative therapies, and emerging safety profiles. This analysis provides a comprehensive overview of Carisoprodol's current market landscape, regulatory environment, revenue trajectory, and future prospects within the pharmaceutical industry.

Regulatory Status and Market Impact

Historical and Current Regulation

Initially approved by the U.S. Food and Drug Administration (FDA) in 1959, Carisoprodol enjoyed widespread prescription use for decades. However, evolving safety concerns—particularly its potential for dependence and misuse—prompted regulatory scrutiny. In 2012, the Drug Enforcement Administration (DEA) classified Carisoprodol as a Schedule IV controlled substance under the Controlled Substances Act (CSA), reflecting its abuse potential [1].

The federal scheduling significantly impacted the drug's marketability. Many healthcare providers curtailed prescribing, while pharmacy dispensing faced increased regulation and monitoring. Several states adopted further restrictions, including prescription limits and mandatory counseling, leading to a general decline in Carisoprodol's utilization.

Market Withdrawal and Decline in Prescription Rates

Following regulatory tightening, Carisoprodol's prescription volumes have markedly declined. The National Prescription Audit indicates a decline of approximately 50-60% in prescriptions from 2010 to 2020 [2]. Industry reports suggest that the drug's market share has diminished substantially, with alternative therapies such as cyclobenzaprine, tizanidine, and nonsteroidal anti-inflammatory drugs (NSAIDs) replacing Carisoprodol in many treatment protocols.

Healthcare providers' increasing awareness of its abuse potential and safer alternatives contribute to this decline. Additionally, the rise of illicit misuse and reports of adverse events have further dampened demand.

Market Players and Revenue Trajectory

Manufacturers and Market Share

Major pharmaceutical companies that originally marketed Carisoprodol, such as Mylan and Teva, faced reduced sales volumes. As the drug's prescribing rates declined, many manufacturers re-evaluated their portfolio, with some opting to discontinue generic production due to decreasing profitability.

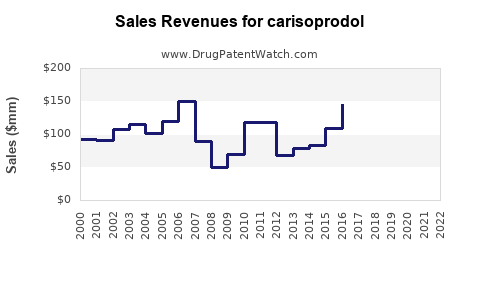

Research estimates project the global market revenue for Carisoprodol to have peaked around USD 200 million in 2009-2010 [3], followed by a steady decline, reaching approximately USD 50 million in recent years.

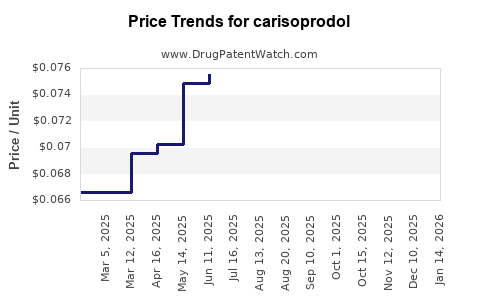

Pricing and Sales Trends

The reduced demand led to lower pricing trends, with wholesale prices decreasing by over 80% from their peak. The drug’s diminished market presence is also reflected in pharmacy procurement data, showing a downward trajectory. It is notable that the drug is now often classified as a niche product, with limited regional markets, primarily in areas where alternative therapies are less accessible.

Emerging Trends and Future Projections

Regulatory and Prescribing Outlook

Given the safety profile concerns and increased regulation, future prescribing of Carisoprodol is expected to further decline. The CDC and FDA continue to issue warnings about its misuse, potentially leading to its removal from the market in certain jurisdictions.

In 2019, the FDA issued a Drug Safety Communication urging caution due to reports of dependence and withdrawal, and recommending physicians consider alternative therapies [4]. The ongoing regulatory climate favors safer, non-controlled muscle relaxants, which could further suppress demand.

Potential for Market Resurgence

Despite current decline, Carisoprodol retains some prescription volume in specific settings, especially where prescribers weigh immediate analgesic efficacy against safety concerns. However, its future trajectory hinges on regulatory decisions, healthcare policies, and ongoing safety assessments.

Impact of Legal and Social Factors

Illicit use of Carisoprodol as a recreational drug complicates its market trajectory. Its abuse potential has led to increased DEA scrutiny, possibly resulting in tighter control or eventual scheduling revisions. These factors diminish the likelihood of a market rebound unless new evidence suggests improved safety profiles.

Research and Development Prospects

To counteract negative perceptions, some companies explore reformulation or combination therapies aimed at reducing abuse potential. Currently, no significant R&D efforts specifically target Carisoprodol's market expansion, focused instead on newer medications with better safety profiles.

Competitive Landscape

The muscular relaxant segment is highly competitive, featuring drugs like cyclobenzaprine, methocarbamol, and tizanidine. With Carisoprodol's declining market share, these alternatives capture a larger portion of prescriptions, supported by safety and regulatory advantages.

Emerging therapies, including topical agents and non-pharmacologic interventions (e.g., physical therapy), further challenge Carisoprodol's relevance.

Financial Implications for Stakeholders

Pharmaceutical Companies

For manufacturers, the declining market has translated into reduced revenues from Carisoprodol product lines. Companies face the dilemma of whether to maintain production, reformulate, or exit the market.

Healthcare Providers

Prescribing behaviors have shifted toward safer, better-regulated alternatives, reflecting a cautious approach aligned with safety data.

Patients

Patients reliant on Carisoprodol face limited therapeutic options, with potential exposure to less effective or more costly alternatives.

Regulatory Agencies

Regulators balance the therapeutic utility of Carisoprodol with safety concerns, influencing market longevity through policy decisions.

Conclusion

Carisoprodol's market dynamics are predominantly characterized by decline driven by regulatory restrictions, safety concerns, and shifting prescriber habits. The trajectory suggests continued reduction in prescription volumes, with potential regulatory actions further constraining its market. Industry stakeholders must monitor evolving policies, safety data, and alternative therapy developments to navigate this changing landscape.

Key Takeaways

- Regulation and safety concerns have drastically reduced Carisoprodol's market size over the past decade.

- Prescription volumes peaked before 2010 and have since declined by over 50%, impacting revenue.

- The drug faces potential further restrictions or withdrawal, with alternative muscle relaxants gaining favor.

- Industry revenues are declining, with many manufacturers phasing out or reducing production.

- Future market prospects depend heavily on regulatory decisions, safety evaluations, and the emergence of newer treatments.

FAQs

1. Why has Carisoprodol's market declined so significantly in recent years?

Regulatory bodies classified Carisoprodol as a Schedule IV controlled substance due to its abuse potential, leading to tighter prescribing regulations. Safety concerns regarding dependence and misuse prompted healthcare providers to favor safer alternatives, resulting in a substantial decline in prescriptions and market share.

2. Are there any ongoing efforts to reformulate or improve Carisoprodol?

Currently, there are no prominent reformulation efforts aimed at reducing abuse potential or enhancing safety. Regulatory focus remains on controlling access and encouraging alternative therapies.

3. What are the main alternatives to Carisoprodol, and how do they compare?

Chemically similar muscle relaxants such as cyclobenzaprine, tizanidine, and methocarbamol are common alternatives. They generally possess more favorable safety profiles and face fewer restrictions, making them preferred choices in current clinical practice.

4. Could Carisoprodol stage a market resurgence?

Unlikely in the near term due to ongoing safety concerns, regulatory restrictions, and the availability of safer options. A resurgence would require significant reformulation or regulatory shifts indicating better safety profiles.

5. How do legal and social factors influence Carisoprodol's market?

Illicit misuse and recreational abuse have heightened regulatory scrutiny, leading to tighter controls that suppress legitimate prescribing. These social and legal concerns persistently weigh against market expansion or resurgence.

Sources

[1] DEA Scheduling Announcement, 2012.

[2] National Prescription Audit Data, 2021.

[3] Market Research Reports, 2010-2020.

[4] FDA Safety Communication, 2019.