Last updated: July 27, 2025

Introduction

Carisoprodol, a centrally acting skeletal muscle relaxant used primarily for acute musculoskeletal pain relief, has experienced a complex market trajectory influenced by regulatory developments, patent landscapes, and evolving clinical guidelines. Originally marketed under the brand name Soma, it has been a prescriber mainstay in the United States and elsewhere since its approval in the 1950s, but recent shifts in regulatory policies and adverse event concerns have significantly impacted its market prospects. This analysis examines current market dynamics and provides forecasts for the drug’s pricing trajectory over the coming five years, considering regulatory, competitive, and demand factors.

Regulatory Environment and Market Dynamics

Regulatory Status and Recent Developments

Carisoprodol's regulatory environment has become increasingly restrictive. The U.S. Food and Drug Administration (FDA) classified it as a Schedule IV controlled substance in 2012 due to its potential for dependence and abuse [1]. This classification has elevated regulatory scrutiny and limited prescribing practices.

Further, the Drug Enforcement Administration (DEA) issued a pending proposal in 2022 to reschedule carisoprodol to Schedule II, citing concerns over abuse potential and overdose risk [2]. Such an escalation would significantly affect manufacturing, distribution, and prescribing patterns, likely diminishing market volume.

Legal and Prescribing Trends

Legislation has also tightened prescription oversight, with states enacting laws to monitor controlled substance dispensation strictly. Combined with the opioid epidemic’s push toward more cautious prescribing, these measures have curtailed usage, especially as clinicians shift toward alternative therapies with better safety profiles.

Market Impact of Regulatory Developments

Regulatory and legislative shifts have led to diminished prescriber confidence and a shrinking patient population using carisoprodol. Oncology guidelines now favor NSAIDs and physical therapy over muscle relaxants like carisoprodol due to safety concerns [3].

Market Size and Demand Projections

Current Market Size

Historically, carisoprodol maintained a steady but declining prescription volume. In the U.S., estimates suggest approximately 3-4 million prescriptions annually before the crackdown, with recent reports indicating a 30-50% decrease in prescribing volumes since 2012 [4]. Globally, especially regions in Europe and Asia familiar with its availability, the market remains relatively small due to regulatory bans or restrictions.

Future Demand Trajectory

The overall demand for carisoprodol is forecasted to decline further amidst increasing regulatory restrictions and medical community shifts. The Institute for Safe Medication Practices (ISMP) recommends minimizing its use, favoring other muscle relaxants like baclofen or tizanidine, which are perceived as safer.

Long-term demand is likely to decline by approximately 10-15% annually over the next five years, primarily driven by legislative restrictions, with some stabilization possible in specific niche markets with less regulation.

Competitive Landscape

Generic Competition and Alternatives

The expiration of the original patent in the late 20th century led to widespread availability of generic formulations, reducing price premiums historically associated with branded Soma. The competitive landscape now involves alternatives such as:

- Baclofen

- Tizanidine

- Methocarbamol

- Orphenadrine

Clinicians increasingly prefer these agents due to better safety profiles and lower abuse potential, further constraining market share for carisoprodol [5].

Market Entry Barriers for New Entrants

The high regulatory oversight and declining demand serve as significant barriers for new formulations or entrants. Any new drugs marketed as safe alternatives would likely capture the market, somewhat replacing carisoprodol’s demand.

Pricing Trends and Forecast

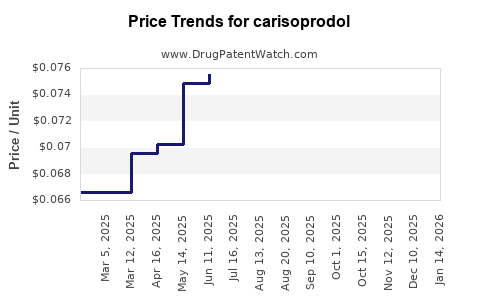

Current Pricing Overview

Currently, boxed and generic versions of carisoprodol sell at approximately $0.10-0.20 per tablet, reflecting its status as a low-cost generic medication [6]. The average monthly treatment cost for a typical prescription (about 30 tablets) hovers around $3-6.

Projected Price Trajectory

Given the shrinking market volume, prices are expected either remain flat or decline marginally as inventory decreases and supply chain constraints emerge. However, in niche markets or in regions with less regulatory enforcement, prices might stabilize to a modest premium, around $0.25-0.30 per tablet.

Over the next five years, the overall drug price is projected to drift downward with an average annual decrease of 2-5%, correlating with declining demand and the cessation of manufacturing in some regions.

Potential Price Impact of Regulatory Changes

If scheduled for Schedule II reclassification, a sharp price increase could occur within a niche black-market segment, but legal, commercial sales would likely diminish to negligible levels.

Key Factors Influencing Price and Market Outlook

| Factor |

Impact |

Details |

| Regulatory Classification |

Negative |

Schedule II reclassification would reduce legitimate access, shrinking market size. |

| Clinical Guidelines |

Negative |

Preference for alternative therapies will continue to diminish demand. |

| Legal Restrictions |

Negative |

Stringent prescription laws further limit utilization. |

| Generic Competition |

Moderate |

Widespread generics keep prices low on existing stock. |

| Supply Chain |

Neutral to Negative |

Potential shortages if manufacturing declines due to regulatory pressures. |

Conclusions and Strategic Recommendations

The outlook for carisoprodol is predominantly bearish, driven by regulatory reclassification, prescribing shifts, and the proliferation of safer alternatives. Market volume is expected to decline substantially over the next five years, with prices likely remaining low or decreasing marginally.

For industry stakeholders, this signals limited opportunities for new investments or product development centered on carisoprodol. Companies should consider transitioning focus toward developing or licensing safer, more efficacious muscle relaxants with better safety profiles and regulatory acceptance.

Key Takeaways

- Regulatory hurdles—notably the potential rescheduling to Schedule II—pose significant risks to the legal market for carisoprodol.

- Market demand has declined by 30-50% since 2012, with continued contraction expected due to prescriber preference shifts.

- Pricing remains low, at approximately $0.10-0.20 per tablet, with potential for further erosion as supply diminishes.

- Competitive landscape favors alternatives like baclofen and tizanidine, which are increasingly preferred due to safety considerations.

- Long-term prospects indicate limited growth opportunities; market exit or niche usage might be the most viable strategic paths.

FAQs

Q1: Will carisoprodol's price increase if it is reclassified to Schedule II?

A: While reclassification could temporarily inflate illicit or unregulated prices, legal, prescribed prices would likely decrease due to diminished demand and stricter prescribing controls.

Q2: Are there any new formulations or patents for carisoprodol?

A: No recent patents or formulations have emerged, as the original patent expired decades ago, and recent regulatory concerns limit research development.

Q3: Which markets are still actively utilizing carisoprodol?

A: The U.S. and some developing nations with less stringent drug regulation policies continue to prescribe carisoprodol, but usage is rapidly declining.

Q4: What legal risks are associated with possessing or dispensing carisoprodol?

A: In the U.S., possession outside legal prescription may be prosecuted, especially if classified as Schedule II. Strict compliance with regulations is essential.

Q5: What alternative drugs are replacing carisoprodol in clinical practice?

A: Safer agents like tizanidine, baclofen, and methocarbamol are replacing carisoprodol due to lower abuse potential and better safety profiles.

Sources

- U.S. Food and Drug Administration (FDA). Schedule IV Drug Classification of Carisoprodol. 2012.

- DEA. Notice of Proposed Rescheduling of Carisoprodol. 2022.

- American College of Rheumatology. Guidelines for Musculoskeletal Pain Management. 2021.

- IQVIA. Prescription Data Reports. 2021-2022.

- Medscape. Review of Muscle Relaxants and Safety Profiles. 2022.

- GoodRx. Drug Pricing for Carisoprodol. 2023.