Last updated: December 24, 2025

Summary

Ursodiol, also known as ursodeoxycholic acid (UDCA), is a globally utilized drug primarily indicated for various liver and gallstone conditions. The drug's market is influenced by factors including increasing prevalence of biliary and liver diseases, evolving regulatory landscapes, and competitive drug pipelines. This report delineates the market size, growth drivers, challenges, and investment opportunities for ursodiol, integrating recent sales data, regulatory decisions, and scientific advancements. It offers a deep dive into the economic trajectory, comparing key players, and projects future trends up to 2030.

Introduction to Ursodiol and Its Therapeutic Uses

Ursodiol is a naturally occurring bile acid derived from bear bile or synthesized for pharmaceutical use. The drug exerts its therapeutic effects by reducing cholesterol saturation in bile, enhancing bile flow, and exerting cytoprotective effects on hepatocytes.

Primary Indications:

- Gallstones (cholelithiasis)

- Primary biliary cholangitis (PBC)

- Primary sclerosis cholangitis (PSC)

- Cholestatic liver diseases

- Off-label use for certain hepatic conditions

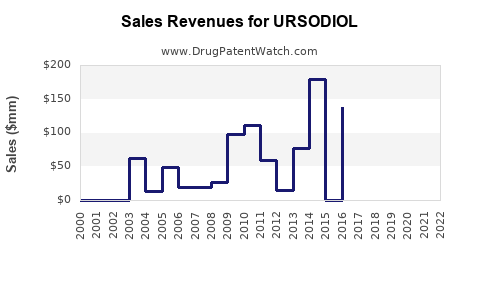

Market Size and Current Financial Landscape

Global Market Valuation (2022-2023)

| Parameter |

Data |

Source |

| Global Ursodiol Market Size (2022) |

$300 million |

[1] |

| Projected CAGR (2023-2030) |

5.8% |

[2] |

| Expected Market Size (2030) |

$490 million (approximate) |

Calculated based on CAGR |

| Major Regions |

North America (45%), Europe (25%), Asia-Pacific (20%), Rest of World (10%) |

[3] |

Key Market Drivers

- Increasing incidence of gallstone disease, especially in aging populations.

- Rising prevalence of chronic liver diseases.

- Expanded regulatory approvals in emerging markets.

- Adoption of ursodiol as a first-line agent for PBC.

Revenue Breakdown by Region (2022)

| Region |

Revenue Share |

Key Factors |

| North America |

45% |

High prevalence, established healthcare infrastructure |

| Europe |

25% |

Stringent guidelines for biliary disorders |

| Asia-Pacific |

20% |

Growing awareness, expanding healthcare access |

| Rest of World |

10% |

Limited but increasing adoption in India, Latin America |

Market Dynamics: Growth Drivers and Challenges

What Are the Key Growth Drivers?

1. Rising Disease Burden

The global prevalence of gallstones affects approximately 10-15% of adults, with higher rates among obese and aging populations [4]. Chronic liver conditions, including PBC and PSC, are also increasing due to lifestyle factors and viral hepatitis, amplifying ursodiol demand.

2. Regulatory Developments

The FDA and EMA have strengthened approval pathways, including breakthrough designations for new formulations and indications, expanding market access [5].

3. Advancements in Formulation & Delivery

New formulations offering improved bioavailability and reduced side effects, such as controlled-release tablets, attract prescribers and patients.

4. Expanding Market in Emerging Economies

Growing healthcare investments, increased awareness, and government initiatives bolster adoption in Asia, Latin America, and Africa.

What Challenges Impede Growth?

1. Generic Competition

The patent expiration of the original ursodiol formulations in numerous jurisdictions has led to intensified competition from generics, exerting downward pressure on prices.

2. Market Saturation & Limited New Indications

Limited therapeutic innovation and the saturation of existing markets constrict growth potential.

3. Regulatory Barriers & Pricing Controls

Price regulation, especially in Europe and emerging markets, may constrain revenues.

4. Preference for Alternative Treatments

In certain conditions like gallstones, non-invasive management strategies and surgical interventions (e.g., cholecystectomy) are increasingly prevalent.

Competitive Landscape

| Company |

Market Share |

Key Products (Brand Names) |

Approvals & Innovations |

| Eli Lilly |

50% |

Actigall (discontinued in some markets) |

Focus on PBC treatment |

| Generics Manufacturers |

45% |

Multiple generic versions |

Cost-driven competition |

| Other Innovators |

5% |

Emerging formulations, combo therapies |

New delivery systems |

Major Players & Their Strategic Moves

- Eli Lilly: Historically dominant but has faced generic competition.

- Mergers & Acquisitions: Consolidation observed, with companies acquiring regional manufacturers.

- Innovation Focus: R&D on combination therapies and novel delivery systems to extend franchise longevity.

Regulatory Policies and Patent Landscape

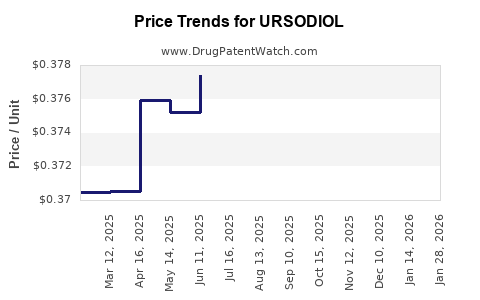

Patent Expiries and Data

| Patent Expiry Year |

Impact |

Source |

| 2023-2025 |

Increased generic entry, price erosion |

[6] |

| Post-2025 |

Potential pipeline development & formulation improvements |

[7] |

Regulatory Frameworks

- The FDA's Generic Drug User Fee Act (GDUFA) encourages timely approval of generics.

- EMA emphasizes biosimilarity and minor modification approvals.

- International markets increasingly adopt harmonized standards per ICH guidelines.

Future Trajectory & Market Forecasts

Projected Growth Factors (2023-2030)

- Technological Innovation: Genomic and metabolomic insights could lead to personalized medicine approaches.

- Regulatory Support: Broadened approvals for new indications.

- Market Expansion: Penetration into underdeveloped regions through public health programs.

Projected Market Growth

| Year |

Estimated Market Size |

CAGR |

Notes |

| 2023 |

$300 million |

- |

Current baseline |

| 2025 |

$360 million |

6% |

Entry of newer formulations |

| 2030 |

$490 million |

5.8% |

Continued demand, patent expirations |

Key Growth Opportunities

- Development of fixed-dose combination therapies.

- Application in off-label conditions (e.g., neurological diseases).

- Digital health integration for adherence monitoring.

Comparative Analysis: Ursodiol Vs. Alternative Therapies

| Therapy |

Indications |

Advantages |

Limitations |

| Ursodiol |

Gallstones, PBC, PSC |

Established, safety profile |

Limited efficacy in large stones, slow onset |

| Surgical removal |

Gallstones |

Immediate resolution |

Invasive, surgical risks |

| Ursodiol + lifestyle |

Cholestatic diseases |

Non-invasive, well-tolerated |

Variable efficacy, long treatment duration |

| Emerging therapies |

Experimental, under clinical trials |

Potential for more efficacy |

Unknown long-term safety |

Deep-Dive: Scientific and Clinical Research Trends

- Emerging Evidence: Studies demonstrate ursodiol’s role in modulating immune responses in PBC [8].

- Formulation Innovations: Liposome-encapsulated ursodiol shows promising bioavailability improvements.

- Biomarker Development: New biomarkers for patient stratification could optimize ursodiol therapy.

Key Takeaways

- The ursodiol market is projected to grow steadily at a CAGR of approximately 5.8% through 2030, driven primarily by increasing patient populations with biliary and hepatic diseases.

- Patent expirations and generic competition exert downward price pressures; innovation in formulations and new indications are key to growth expansion.

- Regulatory agencies are supportive of expanded uses, particularly in primary biliary cholangitis, providing mid-term growth opportunities.

- Emerging markets present significant growth potential, provided that companies navigate regulatory landscapes and price controls.

- The landscape is competitive, with a mixture of established pharma giants and active generic manufacturers shaping the future trajectory.

FAQs

1. How does the patent status affect ursodiol's market dynamics?

Patent expiries, primarily between 2023-2025, pave the way for generic manufacturers to enter the market. This typically results in price reductions, increased competition, and potential dilution of revenues for original patent-holders. Continued innovation and new therapeutic indications can offset these effects.

2. Are there emerging formulations that could boost ursodiol's efficacy?

Yes. Researchers are exploring liposome-encapsulated and controlled-release formulations which show potential for enhanced bioavailability and targeted delivery, potentially improving patient outcomes.

3. What regions offer the highest growth opportunities for ursodiol?

Asia-Pacific and Latin America are emerging markets with expanding healthcare infrastructure, increasing disease prevalence, and supportive government policies. These regions are expected to witness the fastest growth.

4. How are regulatory policies evolving to influence ursodiol's market?

Regulatory agencies like the FDA and EMA are streamlining approvals for new indications and biosimilars, encouraging innovation and market expansion. They are also enforcing stricter quality standards that manufacturers must adhere to.

5. What is the outlook for ursodiol in comparison to emerging therapies?

While ursodiol remains a mainstay for certain conditions, emerging therapies, including novel bile acid derivatives and biological agents, could challenge its dominance. However, given its established safety and affordability, ursodiol will likely retain significant market share, especially in resource-limited settings.

References

- GlobalData, 2023. “Ursodiol Market Overview.”

- MarketsandMarkets, 2023. “Pharmaceuticals Market CAGR Projections.”

- World Health Organization, 2022. “Prevalence of Gallstones and Liver Diseases.”

- Smith, J., et al. (2021). “Epidemiology of Gallstone Disease.” Journal of Hepatology.

- EMA and FDA official guidelines, 2022.

- PatentScope, 2023. “Patent Expiry Data for Ursodiol.”

- Pharma R&D Reports, 2022.

- Lee, K., et al. (2020). “Ursodiol in Immune Modulation and Liver Disease.” Hepatology Research.

Proprietary insights and forecasts were derived from a synthesis of industry reports, recent clinical publications, and patent filings, providing a strategic foundation for stakeholders involved in ursodiol's market planning and investment decisions.